Energy Prices Update

- Year to Date Price Performance:

- WTI Crude ↓ 11.1%

- Brent Crude ↓ 10.8%

- Henry Hub Natural Gas ↓ 52.8%

Commodities Outlook:

- Lower energy prices

- Peaking Interest Rates?

- Inflation Cooling

This week, we at Bourse review the performance of commodity markets, with particular focus on energy and energy commodity prices. Growth concerns across major economies, energy supply normalization following Russia’s invasion of Ukraine and the debottlenecking of global supply chains have all contributed to a drastic change across the commodities landscape. What can investors expect in the months ahead? Could these changes affect T&T’s Fiscal 2023 Budget? We discuss below.

Oil, Natural Gas Prices Retreat

Russia’s invasion of Ukraine on February 24th, 2022 had a profound effect on global commodities trade, which inevitably led to major price dislocations across energy (as well as agricultural and metal) commodities markets. The invasion prompted a global response in the form of severe financial and trade sanctions by the U.S., British and other countries, which banned imports of Russian oil, fuel and other energy-related products which sent energy prices soaring.

Amidst the pronounced uncertainty, Crude oil prices trended up with U.S. West Texas Intermediate (WTI) crude oil reaching as high as US$123.64/barrel and Brent crude oil spiking to US$139.86/barrel in March 2022. Henry Hub Natural Gas price rose to a high of US$9.68/MMBtu in August 2022.

Since then, energy prices have moderated, with physical commodity markets having adjusted to the initial shock caused by Russian supply disruptions. Forecasts of weaker global growth, including the likelihood of recession in some major economies, have also dented the outlook for energy prices. As of May 5th, 2023, WTI crude oil and Brent crude oil stood at US$71.38/barrel (down 42.3%) and US$74.49/barrel (down 46.7%) from highs experienced in March 2022. Henry Hub Natural Gas traded down to US$2.11/MMBtu (down 78.2%).

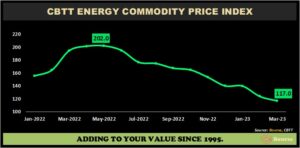

ECPI Declines

The Energy Commodity Price Index (ECPI), calculated and published by the Central Bank of Trinidad & Tobago (CBTT), is a measure of the average energy prices based on T&T’s top ten energy-based commodity exports.

With international energy prices pulling back from record highs, the ECPI followed a similar trajectory. The ECPI peaked at 202.0 in May 2022. From June 2022 onwards, the index experienced a steady downward international price trend falling to a current level of 117.0 as at March 2023, down from 123.9 in the prior month. Despite the fall, the ECPI remains elevated relative to prior comparable periods.

In addition to oil and natural gas, energy commodity prices such as ammonia fell to US$502.0/Tonne in March 2023, down 27.0% MoM from US$688.3/Tonne in February 2023 and 47.4% lower year-to-date (YTD). Methanol also contracted to US$509.0/Tonne in March 2023 and down 5.4% YTD.

Agricultural Commodities Correct

Ukraine and Russia were among the world’s top producers of commodities such as wheat and barley before the war in February 2022. The conflict saw the price of U.S. wheat and corn futures hit multi-decade highs, and significant volatility in global wheat prices throughout the year. Like energy markets, wheat and corn have corrected in 2023, dropping to US$6.47 per bushel and US$6.53/bushel (down 18.3% and 3.7% year-to-date respectively). The Food and Agriculture Organization of the UN (FAO) Food Price Index, which measures the monthly change in international prices of a basket of food commodities fell 2.1% in March 2023 to 126.9 points from 129.7 points in February 2023. Locally, the Index for Prices of Food and Non-Alcoholic Beverages declined from 147.8 in February to 146.1 in March 2023. According to the Central Statistical Office (CSO), this decrease could be attributed to the downward direction of prices of essential goods like parboiled rice, tomatoes, pumpkin, and carrots offset by general increases of meat items.

Commodities Outlook

The outlook for energy prices has softened underpinned by weaker global economic growth and its effect on demand for energy related commodities. The US Energy Information Administration (EIA) in its April 11th, 2023, short-term energy report, forecast the spot price of WTI crude oil to average US$79.24 per barrel in 2023, with Brent crude oil to average US$85.01/ barrel in 2023. Henry Hub natural gas prices are forecast to average US$2.94/MMBtu in 2023.

The IMF in its April 2023 World Economic Outlook (WEO) projected global growth to slow from 3.4% in 2022 to 2.8% in 2023 before rising modestly to 3.0% in 2024. According to the IMF, the unexpected failures last month of Silicon Valley Bank and Signature Bank and the collapse of Credit Suisse Group AG roiled markets and ignited financial-stability concerns, complicating central banks’ quest to tame inflation while maintaining growth and the health of the banking system.

Investor Considerations

With a reversion in energy and other commodity prices, the investment landscape and expectations would evolve. Food and energy disruptions led to overall price increases, which ultimately contributed to higher interest rates and put pressure on non-discretionary spending of individuals and households.

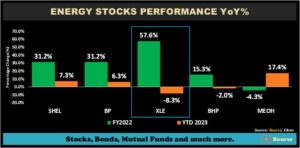

With recent developments, investors should keep an eye on energy-related investments portfolios. Major energy stocks thrived in 2022 thanks to the spike in oil and gas prices, which resulted in robust profits. Energy market corrections will likely lead to more modest performance in 2023, with stock prices likely to come under some pressure. Shell Plc (SHEL) currently has a less outstanding return YTD, up 7.3% relative to 31.2% in FY2022. BHP Group Limited (BHP) is down 2.0% YTD relative to a positive return of 15.3% in FY2022. At the broader sector level, the Energy Select Sector SPDR Fund (XLE) was the sole sector Exchange Traded Fund (ETF) in positive territory for US markets, ending the year up 57.6% in FY2022. Year-to-date the XLE is down 8.3% in 2023. In the domestic market, Trinidad and Tobago NGL Limited (TTNGL) and National Enterprises Limited (NEL) benefitted from robust international energy prices throughout 2022. However, despite the forecast for modestly higher domestic energy production volumes, the lower energy commodity prices could weigh on NEL and TTNGL’s earnings in 2023. NEL and TTNGL share prices have moved up 10.0% and down 18.1% year-to-date respectively.

At the macro level the drop in energy prices could have implications for T&T’s fiscal 2023 budget. The budget, with forecast revenues of TT$56.2B, was premised on average natural gas prices of US$6.00/MMBtu and average crude oil prices of US$92.50/barrel. Energy revenues were initially budgeted to contribute 44.5% of Total Revenue in FY2023.

With the sharp decline in energy prices, it remains increasingly likely that Total Revenue will be short of initial estimates and could contribute to a widening fiscal gap. The widening deficit, combined with economic activity, could adversely impact investor sentiment in the coming months.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”