Local Markets

- 2022 Performance:

- TTCI ↓ 11.0%

- All T&T ↓ 3.7%

- CLX ↓ 29.9%

- Performance Drivers:

- Inflationary Pressures

- Volatile Financial Markets

- Outlook:

- Economic Normalization

International Markets

- 2022 Performance:

- US Markets – S&P 500 ↓ 19.4 %

- European Markets- Euro Stoxx 50 ↓ 10.0%

- Asian Markets – MXASJ ↓ 19.2%

- Latin American Markets – MSCI EM ↓ -0.1%

- Performance Drivers:

- Inflationary Pressures

- Geopolitical Tensions

- Outlook:

- Economic NormalizationWe take this opportunity to wish you a very Happy New Year from the team at Bourse! This week, we recap the performance of local and international stock markets in a turbulent 2022. With asset prices weakening across markets, could the sell-off in equities carry into 2023, or could an improvement in conditions trigger a recovery across stock markets? We discuss below.

Local Markets Regress

After a strong performance in 2021, local/regional equities notably declined in 2022. The Trinidad and Tobago Composite Index (TTCI) fell 11.0% with 17 of the 30 first tier equities’ declining. The All Trinidad and Tobago Index (All T&T) contracted a relatively modest 3.7% during the period, with investor sentiment muted. The Cross Listed Index (CLX) declined 29.9% as a result of downward movements of index heavyweights with a 26.4% drop in GKC, 43.1% decrease in NCBFG and 16.6% fall in JMMBGL.

Major Movers

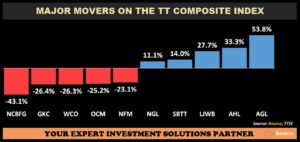

Agostini’s Limited (AGL) was the best performing stock on the TTSE during 2022, advancing 53.8% supported by positive revenue and margin growth and acquisition activity. Angostura Holdings Limited (AHL) appreciated 33.3%, driven by improved top line performance from increased international demand, as well as through product innovation and heightened brand promotion. Scotiabank Trinidad and Tobago Limited (SBTT) climbed 14.0% primarily due to higher revenues. Trinidad and Tobago NGL Limited (NGL) reported significantly improved earnings on account of robust energy markets.

Agostini’s Limited (AGL) was the best performing stock on the TTSE during 2022, advancing 53.8% supported by positive revenue and margin growth and acquisition activity. Angostura Holdings Limited (AHL) appreciated 33.3%, driven by improved top line performance from increased international demand, as well as through product innovation and heightened brand promotion. Scotiabank Trinidad and Tobago Limited (SBTT) climbed 14.0% primarily due to higher revenues. Trinidad and Tobago NGL Limited (NGL) reported significantly improved earnings on account of robust energy markets.Major decliners for 2022 included, NCB Financial Group Limited (NCB â 43.1%), GraceKennedy Group (GKC â 26.4%), West Indian Tobacco Company Limited (WCO â 26.3%), One Caribbean Media Limited (OCM â 25.2%) and National Flour Mills (NFM â 23.1%).

Some notable transactions by publicly listed companies in 2022 include:

- TTNGL’s sole investee company Phoenix Park Gas Processors Limited (PPGPL) made several key acquisitions, including (i) the acquisition of an NGL terminal located in Hull, Texas USA (January 2022) and (ii) the acquisition of a propane terminal in Rush City, Minnesota USA (December 2022).

- On August 30, 2022 – GraceKennedy Limited (GKC) came to an agreement with The Bank of Nova Scotia to acquire 100% of Scotia Insurance Caribbean Limited (SICL), with the associated transaction being subject to regulatory approvals.

- Ansa Merchant Bank Limited (AMBL) advised in November 2022 advised that all regulatory approvals for the transaction to acquire 94.2% of Colonial Fire & General Insurance Company Limited (Colfire) had been received.

- Massy Holdings Ltd. (MASSY) announced acquisitions of Air Liquide, Trinidad and Tobago Limited (November 2022), Rowe’s IGA Supermarkets (“Rowe’s IGA”) in the USA (December 2022) and the acquisition of I.G.L. (St. Lucia) IBC Limited (December 2022).

- Agostini’s Limited (AGL) announced the completion of the acquisition of Collins Limited and Carlisle Laboratories Limited (December 2022).

- US Markets Fall

Fortunes for US equity markets, as measured by the S&P 500 index, faded in 2022 with the S&P closing near bear market territory, down 19.4% (falling as steeply as 27.5% in October 2022). Rising yields put pressure on growth stocks which underperformed their value peers, reversing a trend that has lasted for much of the past decade.

The Energy Select Sector SPDR Fund (XLE) was the sole sector Exchange Traded Fund (ETF) in positive territory for US markets, up 57.6% as energy prices remained robust. On the contrary, the communications sector, represented by the Communication Services Select Sector SPDR Fund (XLC), rounded out 2022 as the worst performing sector, down 38.2%.

Wall Street analysts have begun rolling out predictions for US equity markets in 2023, with some degree of variation. Barclays for example, projects an S&P 500 target of 3,725 representing a drop of 3.0%, whereas Deutsche Bank predicted a year of double-digit gains with a target of 4,500 (+17.2%). The market closed at 3,808.10 on Thursday.

European Stocks Falter

Investor optimism surrounding Europe quickly dissipated in 2022 as the continent faced a number of challenges which took a toll on its economies. European markets, as gauged by the Euro Stoxx 50, fell 10.0% in a rough year marked by geopolitical tensions, an energy crisis, inflationary pressures and fears of a recession as central banks hiked rates to keep prices in check. England was the region’s least-worst performing market, down 9.8% as losses were offset by gains in the energy (↑41.8%) and mining (↑23.0%) sectors. Germany and Italy were among the worst performing markets in the region, declining 20.1% and 18.4% respectively following a squeeze on energy supplies.

Asia in the Red

Asian equities had a turbulent year, starting with the Russian invasion of Ukraine, rising inflation and interest rate hikes, declining demand, and most recently the resurgence of Covid-19 in China.

Asian equities had a turbulent year, starting with the Russian invasion of Ukraine, rising inflation and interest rate hikes, declining demand, and most recently the resurgence of Covid-19 in China.Taiwan equities led the losses among the region, declining 29.8%, clouded by inflation and interest rate rises globally reflected by its 13-year low Consumer Confidence Index in December 2022. South Korea equities slumped 29.2% to a 14-year low hit by declining chip demand and exports. Asian equity markets (excluding Japan) declined 19.2% in 2022. China’s market dropped 21.1%, relative to a gain of 7.6% in 2021, weakened by stringent COVID-related curbs and a property market slump. Hong Kong markets fell 14.5% in 2022. India equities remained relatively more resilient, falling just 5.3% in 2022, compared to a 19.6% gain in the prior period. While unable to offset negative global sentiment, India’s stock market decline has been cushioned by its resilient growth, earnings outperformance and rising domestic equity fund inflows.

- Latin American markets ended the year relatively flat, compared to a drop of 13.1% in 2021. Chile was the best performing market, rebounding 22.9% during the period under review. The outperformance was helped by surging copper prices on optimism over China reopening plans and the Central Bank’s decision to extend its foreign exchange intervention program to June 2023 in order to prop up the weakening national currency.

Brazilian equities advanced 10.3% in 2022, as robust commodity prices outweighed concerns about fiscal spending under the new government of President Luiz Inácio Lula da Silva. Peruvian markets increased 6.1% despite political unrest plaguing the economy. Colombia rounded out 2022 as the worst performing Latin American market, down 23.5%, as consumption and investment remain subdued with high inflation, interest rates and uncertainty about its economic outlook and economic policy.

Investment Outlook

Domestic companies continue to face supply-side challenges, as raw material prices and other input costs remain elevated. According to the Central Bank’s Monetary Policy Announcement, headline inflation fell slightly to 6.2% in September from 6.3% in August. Moreover, stronger consumer lending – evidenced by growth in the loan portfolios of most locally-listed banks – could further signal improving economic activity heading into 2023. With higher input costs, however, operating margins for companies are expected to remain under some degree of pressure.

International Markets are expected to remain volatile. Risks appear tilted towards the downside, as central banks globally affirm their resolve towards reducing inflation at the risk of rising unemployment and slowing economic growth. In its October 2022 World Economic Outlook, the IMF projects global growth of 2.7% in 2023, reflecting significant slowdowns for the largest economies (US, Euro, China).

The IMF projects economic growth in the United States, for example, to fall to 1.0% in 2023 as higher interest rates and lower disposable income is expected to erode consumer demand. The slowdown in Europe is projected to deepen with economic growth forecasted to stand at 0.5%, reflecting spillover effects from the war in Ukraine, with sharp downward revisions for economies most exposed to Russian gas supply cuts and tighter financial conditions.

The World Bank on Tuesday 6th December revised upwards its GDP growth forecast for India to 6.9% for fiscal 2022-23, from its earlier estimate of 6.5% in October 2022, citing that the economy is demonstrating higher resilience to global shocks.

China’s economic growth outlook was slashed by the World Bank, citing the impact of the abrupt loosening of strict COVID-19 containment measures and persistent property sector weakness. Growth is forecasted to recover to 4.3% in 2023, revised down from 4.5%.

The United Nations Economic Commission for Latin America and the Caribbean (ECLAC) on 15th December reported that the combined region of Latin America is estimated to grow 1.3% in 2023. Brazil, Latin America’s top economy, will likely grow 0.9% in 2023. Mexico is seen advancing 1.1% in 2023, down from 2.9% seen for 2022. ECLAC alluded that the slowing growth in the region comes at a time of restrictive monetary policies, greater limitations on fiscal spending and lower levels of consumption and investment.

Investor Considerations

Elevated monetary policy uncertainty, higher consumer/producer prices and diminishing growth expectations are likely to cause the market volatility of 2022 to spill over into the year ahead. Notwithstanding the tenuous macroeconomic environment, the valuations of local and international stocks appear more attractive than they have been in the past several years. In this context, investors (particularly with a longer-term investment horizon) may find opportunities to add to their local/international stock portfolios.

So, what’s the best approach to gaining equity market exposure? For the relatively passive, ‘hands-off’ investor, equity mutual funds and/or equity index exchange trade funds (ETFs) may be the best approach to gain broader exposure while diversifying risk. For the more active, ‘hands-on’ investor following the markets and news, a selective approach to individual stocks may be preferred, focusing on companies with (i) resilient profitability, (ii) demonstrable competitive advantages and/or market share (iii) attractive valuations and (iv) healthy free cash flow.

Not interested in the risks associated with equity investing, but still looking returns on your savings? Lower-risk solutions like income mutual funds and/or repurchase agreements may be more appealing to you. As always, investors should consult a trusted and experienced advisor, such as Bourse, to make better informed decisions.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”

- Economic NormalizationWe take this opportunity to wish you a very Happy New Year from the team at Bourse! This week, we recap the performance of local and international stock markets in a turbulent 2022. With asset prices weakening across markets, could the sell-off in equities carry into 2023, or could an improvement in conditions trigger a recovery across stock markets? We discuss below.

Agostini’s Limited (AGL) was the best performing stock on the TTSE during 2022, advancing 53.8% supported by positive revenue and margin growth and acquisition activity. Angostura Holdings Limited (AHL) appreciated 33.3%, driven by improved top line performance from increased international demand, as well as through product innovation and heightened brand promotion. Scotiabank Trinidad and Tobago Limited (SBTT) climbed 14.0% primarily due to higher revenues. Trinidad and Tobago NGL Limited (NGL) reported significantly improved earnings on account of robust energy markets.

Agostini’s Limited (AGL) was the best performing stock on the TTSE during 2022, advancing 53.8% supported by positive revenue and margin growth and acquisition activity. Angostura Holdings Limited (AHL) appreciated 33.3%, driven by improved top line performance from increased international demand, as well as through product innovation and heightened brand promotion. Scotiabank Trinidad and Tobago Limited (SBTT) climbed 14.0% primarily due to higher revenues. Trinidad and Tobago NGL Limited (NGL) reported significantly improved earnings on account of robust energy markets.

Asian equities had a turbulent year, starting with the Russian invasion of Ukraine, rising inflation and interest rate hikes, declining demand, and most recently the resurgence of Covid-19 in China.

Asian equities had a turbulent year, starting with the Russian invasion of Ukraine, rising inflation and interest rate hikes, declining demand, and most recently the resurgence of Covid-19 in China.