HIGHLIGHTS

GHL 9M2022

- Earnings: EPS increased 131.0% from $1.97 to $4.55

- Performance Drivers:

- Higher Net Income from Insurance Activities

- Decline in Net Income from Investing Activities

- Increased Fee and Commission Income

- Outlook:

- Volatile Financial Markets

- Rating: Maintained at MARKETWEIGHT.

NCBFG FY2022

- Earnings: EPS increased 90.2% from TT$0.28 from TT$0.53

- Performance Drivers:

- Increased Income from Banking and Insurance Activities

- Higher Operating Expenses

- Outlook:

- Volatile Financial Markets

- Rating: Maintained at MARKETWEIGHT.

This week, we at Bourse review the performance of Guardian Holdings Limited (GHL) for the nine-month period (9M2022) ended September 30th, 2022 and NCB Financial Group Limited (NCBFG) for the financial year ended September 30th, 2022 (FY2022). Both Groups benefitted from increased Net Premium Income, but were adversely affected by heightened volatility in financial markets. Can both Groups continue to navigate the still uncertain operating environment? We discuss below.

Guardian Holdings Limited (GHL)

Guardian Holdings Limited (GHL) reported Earnings per Share of $4.55 for its nine-month period ended September 30th 2022 (9M2022), a 131.0% increase relative to $1.97 reported in the prior comparable period. Net Income from Investing Activities declined 18.3% to $942M. Fees and Commission Income from Brokerage Activities increased 2.5% ($2.8M) to $109.4M. Net Income from All Activities increased 26.2%, as the reduction in Investing Activities was offset by a 111.5% increase in Net Result from Insurance Activities from $630.4M in 9M2021 to $1.3B in 9M2022. GHL recorded Net Impairment gains on Financial Assets of $93.5M, relative to a loss of $76.5M in 9M2021. Operating Expenses grew 6.8%, with the Group noting continued costs associated with the implementation of IFRS 17 as well as Group-wide transformation initiatives. Finance charges amounted to $155.1M in 9M2022 – (9M2021: $150.0M). Consequently, the Group reported an Operating Profit of $1.2B in 9M2022, 99.0% higher relative to a prior $592.3M in 9M2021. Profit Before Tax rose 95.8% to $1.2B in the period under review from $608.8M in 9M2021. Resultantly, Profit Attributable to Equity Holders of the Company advanced 131.0% from $457.1M in 9M2021 to $1.05B in 9M2022.

Insurance Income Boosts Performance

Net Income from All Activities increased 26.2% during the nine-month period with two of the three segments experiencing growth. Net Income from Investment Activities (39.5% of Net Income) declined from $1.15B to $942M in 9M2022, due to increased volatility in global financial markets caused by inflation, increasing interest rates and economic spill-overs from geopolitical tensions.

Net Income from Insurance Activities (55.8% of Net Income) expanded 111.5% from $630M to $1.3B in 9M2022. Gross Written Premiums advanced 3.7% ($197.0M) while Net Written Premiums climbed 5.4% ($181.6M). GHL’s Life, Health and Pensions segment rose 37.3% year-on-year in Net Income driven by increased premiums, favourable reserve movements and lower underwriting expenses. Net Income from Brokerage Activities (4.7% of Net Income) increased modestly from $109M to $112M.

GHL’s posted an EPS of $4.55, up 131.0% from $1.97 in the prior comparable period bringing its trailing 12-month EPS to $5.95. Following a strong recovery in earnings and a 13.3% decrease in share price year-to-date, the Group’s Price-to-Earnings (P/E) multiple fell from an elevated 10.2 times in 9M 2021 to 4.4 times in 9M 2022.

The Bourse View

GHL is currently priced at $26.01 and trades at a price to earnings ratio of 4.4 times, above the Non-Banking Financial Sector average of 4.2 times. The stock currently offers investors a trailing dividend yield of 2.8% relative to a sector average of 4.2%. The Group made the decision to not declare an interim dividend payment in its latest earnings release.

While volatile financial markets may continue to generate weaker performance in its Investment Activities segment, the Group’s Insurance segment appears to be gaining momentum. This could be tempered by erratic weather and associated claim events (flooding etc.) in the near-term. On the basis of improving profitability and fair valuations, but tempered by heightened volatility in financial markets, Bourse maintains a MARKETWEIGHT rating on GHL.

NCB Financial Group Limited (NCBFG)

NCBFG reported an Earnings Per Share (EPS) of TT$0.53 for the Financial Year ended September 30th 2022 (FY2022), 90.2% more than the EPS of TT$0.28 reported in FY2021.

The Group’s core Revenue driver, Net Interest Income, grew 21.7% YoY to TT$2.6B from a previous TT$2.1B. Net Result from Banking and Investment Activities advanced 9.3% (TT$4.7B) from a prior TT$4.3B. Net Result from Insurance Activities expanded from TT$1.0B in FY2021 to TT$1.9B in the current period (+84.3%). Overall, Net Operating Income improved by 23.5%, to TT$6.6B from a previous TT$5.3B. Operating Expenses increased 10.1% to TT$4.6B, driven by the personnel and infrastructure maintenance costs. Operating Profit advanced 71.9% to roughly TT$2.0B. Share of Profit of Associates moved from TT$15.0M to TT$32.4M in FY2022. Profit Before Tax was $2.0B, 72.5% higher than $1.2B recorded in FY2021. Taxation Expense fell 8.8% with the effective taxation rate moving from 24.8% in FY2021 to 13.0% in FY2022. Net Profit totalled TT$1.8B or an 98.9% increase, while Net Profit Attributable to Shareholders rose to TT$1.2B from TT$628.8M, 92.0% higher.

Operating Income Climbs

NCBFG reported a 23.5% increase to TT$6.6B in Net Operating Income for the financial year ended September 30th, 2022 (FY2022).

Net Interest Income, the largest component of Net Operating Income (39.6%), expanded 21.7% as the Group recorded strong growth in its interest earning portfolios. NCBFG’s loan portfolio and customer deposits increased 11.0% and 10.5% respectively, signalling continued loan demand across its operating jurisdictions. Net Result from Insurance Activities (28.3% of Net Operating Income) advanced 84.3% to TT$1.9B, driven by strong performance in its life and health insurance segment as a result of improved net premium income. Net Fee and Commission Income (17.5% of Net Operating Income) climbed 16.2% to TT$1.1B from TT$990M in FY2021, primarily due to higher transaction volumes. Gains on Foreign Currency and Investment Activities fell 27.4% from TT$1.0B in FY2021 to TT$729M, likely due to volatile financial markets during the period. Other Banking and Investing Income rose 28.0% to TT$237M, led by gains in dividend income and other operating income.

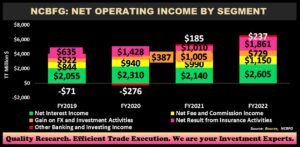

Operating Profit by Activity

Five of NCBFG’s seven operating segments recorded year-on year improvements. Life and Health Insurance & Pension Fund Management which accounts for 38.3% Operating Profit, advanced 54.3% from $1.6B to $2.5B in FY2022. General Insurance expanded (13.0% of Operating Profit) 21.4% from $698M to $847M. Consumer and SME Banking (20.7% of Operating Profit) increased 13.8% from $1.19B to $1.35B, due to improved loan portfolio quality given the improved macro-economic outlook. Conversely, Wealth, Asset Management and Investment Banking (10.8% of Operating Profit) contracted 6.4% from $753M to $704M, as a result of increased interest rates in the local and global markets.

NCBFG posted an EPS of TT$0.53 in FY2022, up 90.2% from TT$0.28 in the prior comparable period. Following a strong recovery in earnings and a 41.3% fall in share price year-to-date, the Group’s Price-to-Earnings (P/E) multiple has adjusted from 30.0 times in FY2021 to 9.1 times in FY2022.

The Bourse View

NCBFG is currently priced at $4.70 and trades at a price to earnings ratio of 9.1 times, below the Banking Sector average of 13.7 times. Despite a significant increase in earnings, the Group made the decision to not declare an interim dividend payment in its latest earnings release.

Future recovery in financial markets could support NCBFG’s Investment Activities segment, as the Group continues to show resilience in its Banking and Insurance segments. However, higher inflationary pressures, tighter financial conditions and the resultant weaker consumer could affect the Group’s loan portfolio growth in the near to medium term. Moreover, widespread economic recovery across its tourism-based operating jurisdictions could serve as a tailwind for growth in the following periods. On the basis of improving performance and valuations but tempered by the noticeable absence of dividends to shareholders, Bourse maintains a MARKETWEIGHT rating on NCBFG.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”