HIGHLIGHTS

RFHL 9M 2022

- Earnings: Diluted Earnings Per Share improved 10.4% to $7.01 from $6.35

- Performance Drivers:

- Increased Revenues

- Lower Credit Loss Expense

- Outlook:

- Normalization of economic activity

- Rating: Maintained at MARKETWEIGHT

FCGFH 9M 2022

- Earnings: Earnings Per Share increased 6.2% from $1.93 to $2.05

- Performance Drivers:

- Lower Total Net Income

- Write Back in Impairment Expenses

- Modest Loan Growth

- Outlook:

- Further Moderation in Credit Impairment Expenses

- Rating: Maintained at MARKETWEIGHT

This week, we at Bourse review the performance of local Banking Sector stalwarts Republic Financial Holdings Limited (RFHL) and First Citizens Group Financial Holdings Limited (FCGFH) for their nine months (9M 2022) ended 30th June, 2022. RFHL was able to deliver earnings growth driven by increased Operating Income. FCGFH, meanwhile, reported lower Operating Income which was offset by a reversal of Credit Impairment Losses. What might investors expect in the months ahead? We discuss below.

Republic Financial Holdings Limited (RFHL)

RFHL reported a Diluted Earnings Per Share (EPS) of $7.01 for the nine months ended 30th June 2022(9M 2022), up 10.4% relative to the $6.35 reported in the prior comparable period.

Net Interest Income increased 3.9% to $3.1B from $2.9B in 9M 2021. Similarly, Other Income ticked up 5.6% to $1.5B in 9M 2022, relative to $1.4B in 9M 2021. Operating Income improved by 4.5% to $4.5B. Operating Expenses increased 2.0% from $2.5B in 9M 2021 to $2.6B in 9M 2022. Operating Profit for the period stood at $1.9B relative to $1.7B in 9M 2021, up 8.1%. Credit Loss Expense contracted 37.4% from $242.5M in 9M 2021 to $151.9M in 9M 2022. Profit Before Taxation (PBT) stood at $1.7B in 9M 2022, 15.4% higher than $1.5B in the prior comparable period. Taxation Expense increased 28.7%, with the effective taxation rate moving from 25.2% in 9M 2021 to 28.1% in 9M 2022. Overall, Profit Attributable to Equity Holders of the parent rose by $109.7M or 10.6%.

Revenues Higher

RFHL’s Operating Income continued its upward momentum with a 4.5% increase in 9M 2022. Net Interest Income (67.4% of Operating Income) advanced 3.9% from $2.9B to $3.1B, reflecting increasing demand for loans by consumers and supported by a 1.4% ($1.3B) increase in customer deposits. Similarly, Other Income (32.6% of Operating Income) climbed 5.7%, likely driven by increased fees and commissions as transaction volumes continue to normalize.

PBT Expands

RFHL recorded an expansion in its operations in six out of its eight major operating jurisdictions in 9M 2022, with Profit Before Tax (PBT) advancing to $1.75B. PBT from Trinidad and Tobago, the Group’s largest operating jurisdiction (49.7% of PBT) advanced 17.7% YoY to $869.8M from a previous $738.7M. The Eastern Caribbean replaced Barbados as the second largest contributor of PBT (11.5%), advancing 38.2% in the period under review from $145.1M to $200.4M.

Suriname expanded 188.9% year-on-year, with PBT moving from $16.6M to $48.1M in the current period. Guyana (9.0% of PBT) recorded an increased PBT from $123.9M to $157.0M for the period, up 26.8%. British Virgin Islands (BVI) expanded 87.4% YoY to $53.8M.

Despite growth in these territories, PBT from Barbados declined 19.0% from $178.4M to $144.6M in 9M 2022 and PBT from Ghana fell 9.8% to $106.7M from $118.3M in the prior comparable period.

The Group’s total assets amounted to $112.9B, an increase of $4.7B in 9M 2022, fuelled by growth in customer deposits across the subsidiaries in the Eastern Caribbean, Cayman Islands, Guyana and Barbados.

The Bourse View

At a current price of $141.01 RFHL trades at a trailing P/E of 16.2 times, above the Banking Sector average of 15.0 times. The stock offers investors a trailing dividend yield of 2.9%, below the sector average of 3.2%.

As economic activity continues to improve steadily across its operating jurisdictions, the moderation of Credit Losses could signal improving credit conditions and more resilient loan performance in the near-term. However, further inflationary pressures and the resultant lower disposable income could potentially weigh on demand for loans across the banking sector. On the basis of geographical diversification of operations, improved earnings and fair valuations, Bourse maintains a MARKETWEIGHT rating on RFHL.

First Citizens Group Financial Holdings Limited (FCGFH)

First Citizens Group Financial Holdings Limited (FCGFH) recorded Earnings per Share (EPS) of $2.05 for the nine months ended 30th June, 2022 (9M 2022), up 6.2%, relative to $1.93 reported in the prior comparable period (9M 2021).

Net Interest Income declined 3.9%, moving from $1.13B in 9M 2021 to $1.08M in the current period. Other income marginally declined 0.5%, amounting to $482.7M. Overall, Total Net Income was 2.9% lower, standing at $1.57B, relative to $1.62B in the previous period. The Bank reported a Credit Impairment writeback of $56.6M in 9M 2022, relative to a Credit Impairment Loss in the prior period of $63.7M. Expenses amounted to $926.8M, $40.4M or 4.6% higher year-on-year. Consequently, Operating Profit increased 4.9%, moving from $668.2M to $701.1M in 9M 2022. Share of Profit from Associates and Joint Ventures increased 10.4% to $16.7M in the current period. Profit Before Taxation climbed 5.0% to $717.8M from a prior $683.3M. Taxation expense stood at $199.2M in 9M 2022, with the effective tax rate moving from 28.7% to 27.8% in the current period. Overall, Profit After Taxation advanced 6.4% from $487.4M in the prior period to $518.6M.

Credit Impairment Expenses Decline

FCGFH’s Loans to Customers modestly increased 0.9% during the period from $18.3B to $18.4B in 9M 2022, despite the increasing inflationary pressures. The Group recorded a reversal in its Credit Impairment Losses in the amount of $56.6M, signalling an improvement of their loan portfolio’s estimated credit quality. The stabilization of economic activity both locally and regionally could lead to an improvement in general credit quality conditions and by extension, the credit quality of the Group’s loan portfolio. Increasing economic activity could, however, be partially offset by higher living costs and any adverse impacts on borrowers’ loan servicing capacity.

Segment Performance Mixed

FCGFH grew Profit Before Tax (PBT) by 5.0% YoY. Underpinning this performance was a 22.5% increase in its Retail & Corporate Banking segment, historically the largest contributor to PBT, accounting for 65.0% of PBT before eliminations. Despite a modest increase in loans to customers (á0.9%), Retail & Corporate banking moved from $570M in 9M 2021 to $698M in 9M 2022, likely reflecting the reversal of credit impairment losses. Treasury and Investment Banking, the second largest contributor to PBT (31.1% before eliminations) fell 0.7% while Trustee & Asset Management declined 7.3%.

APO ‘Oversubscribed’

FCGFH closed its Additional Public Offering (APO) of 10,869,565 shares on July 22nd 2022. While no official data has been provided to support the status of the offering, the Honourable Minister of Finance indicated on social media that the APO was oversubscribed.

On Wednesday 3rd August 2022, the Group announced the revision of its dates for the transfer of shares. The notification of allotment of securities was moved from August 18th 2022 to August 29th 2022. The transfer of shares to successful purchasers, electronic transfer of refunds and transfer dates of proceeds from the sale of shares was moved from August 19th 2022 to August 30th 2022.

The Bourse View

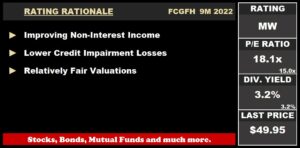

FCGFH is currently priced at $49.95 and trades at a P/E ratio of 18.1 times, above the Banking Sector average of 15.0 times. The Group declared an interim dividend of $0.40 per share to be paid on September 13th 2022 to shareholders on record by August 30th 2022. The stock offers a dividend yield of 3.2%, in line with the sector average. The Group’s reversal of Credit Losses could signal a strengthening of its loan portfolio, which may provide a platform for positive earnings momentum in subsequent periods. On the basis of improving performance and relatively fair valuations, but tempered by a relatively subdued economic environment, Bourse maintains a MARKETWEIGHT rating on FCGFH.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”