HIGHLIGHTS

Local Markets

- HY 2022 Performance:

- Repo Rate maintained at 3.50%

- Inflation climbs

- Food inflation: 8.7%

- Headline inflation: 5.1%

- Core inflation: 4.1%

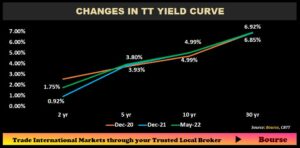

- TT Yield Curve

- 2 Year: 1.75% (↑ 83 bps YTD)

- 10 Year: 4.99% ( 0 bps YTD)

- 30 Year: 6.92% (↑ 7 bps YTD)

International Markets

- HY 2022 Performance:

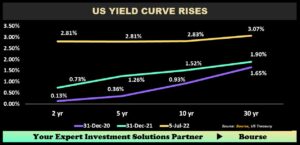

- US Yield Curve rising

- 2 Year: 2.81% (↑ 208 bps YTD)

- 10 Year: 2.83% (↑ 131 bps YTD)

- 30 Year: 3.07% (↑ 117 bpsYTD)

- Inflation climbs

- CPI: 8.6% YoY (May 2022)

- PCE: 6.3% YoY (May 2022)

- US Yield Curve rising

Investor Considerations:

- Rising Inflation

- Interest rate environment

- Credit Quality and Availability of Assets

- Economic Recovery

- Sensitivity of USD Portfolio to Interest Rate Hikes

This week, we at Bourse review the local and international bond markets at the halfway point of 2022. While changes were relatively sparse across the local fixed income landscape, international geopolitical tensions, supply chain disruptions and aggressive global interest rate hikes – by the US Federal Reserve (Fed) and others – have dramatically changed the landscape for USD bond investors. With further rate hikes scheduled and no resolutions in sight for factors stoking inflationary pressures, how can investors adapt in the months ahead? We discuss below.

Local Market

Short term yields increase

In perhaps a nod to increased inflationary pressures within the domestic economy, short-term yields on the Government of the Republic of Trinidad & Tobago (GORTT) TT-dollar bond yield have climbed to 1.75% on a year-to-date basis, up 83 basis points (0.83%) from their December 2021 level of 0.92%. Medium and long-term yields, meanwhile, remained relatively stable. The 5-year yield increased from 3.80% to 3.93%. Longer-term yields marginally increased, with the 10-year yield remaining flat and the 30-year rate going up to 6.92% from 6.85% in December 2021. This could potentially be an indicator of (i) resilient demand for longer-term GORTT securities and (ii) muted concern of increasing credit risk of GORTT.

Domestic Inflation Increases

Domestic inflation has accelerated, exacerbated by the ongoing geopolitical tensions between Russia and Ukraine. The prices of agro and energy commodities have contributed to increased prices faced by consumers, with meat, eggs, flour, fuel and transportation among the major price changes encountered in HY1 2022. National Flour Mills Limited (NFM) would have had little choice but to increase wholesale prices of flour locally by 33% in June 2022. This follows increases in fuel prices in April 2022, where premium gasoline went up by TT$1 per litre to TT$6.75; super by TT$1 from TT$4.97 per litre to TT$5.97; diesel by TT$0.50 to TT$3.91 per litre and kerosene to TT$3.50.

Local Outlook‘

Inflation is anticipated to continue well into the second half of 2022, propelled by imported inflation. Even with a moderation in the inflation rate, prices are likely to remain elevated, with consumers likely to endure reduced buying power.

In the June 2022 Monetary Policy Announcement, the Central Bank of Trinidad & Tobago (CBTT) assessed the global and domestic financial environment and opted to maintain the repo rate at 3.50%. Liquidity remains elevated, as commercial banks’ excess reserves at the Central Bank averaged TT$5.3 billion in early June 2022.

While at a global level central banks have been raising rates to control inflation, the situation in T&T may be somewhat different given (i) the high import content contributing to inflationary pressures and (ii) the need to maintain accommodative lending conditions to support economic growth. With current inflationary pressures largely a supply-side phenomenon, sharp increases in domestic rates are likely to stall credit demand without necessarily arresting the increase in domestic prices. Against this backdrop, maintaining a stable benchmark interest rate (Repo rate) is likely to be the most appropriate policy.

International Markets

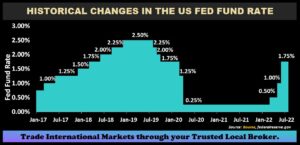

Fed Fund Rate Hikes Expected to Continue

The US Federal Reserve (Fed) hiked interest rates in March 2022 by 0.25 basis points (bps), its first hike since 2018 and a major shift in tone since its COVID-induced emergency cut in rates in early 2020. The Fed followed with a 50 bps hike in May, followed shortly after by a 75 bps hike in June, its most aggressive hike since 1994. The aim of the Fed’s aggressive rate hikes is squarely focused on curbing US inflation, which has exceeded a four-decade high. With four Federal Open Market Committee Meetings (FOMC) remaining for the year, markets are anticipating that the federal fund rate could approach 3.50% by the end of 2022.

US Treasury Yields Climb

US Treasury Yields have risen sharply in tandem with realized and expected US interest rate increases. The steepest increase was seen at the short end of the curve, with 2-year and 5-year treasury yields jumping from 0.73% and 1.26% in December 2021 respectively to both around 2.81% as at July 5th 2022. The benchmark 10-year yield has climbed 131 basis points since the beginning of the year, currently hovering at 2.83%.

US Inflation Up

The US Consumer Price Index (CPI) continued its rise that began in 2021, currently at a four-decade high of 8.6%. Personal Consumption Expenditure (PCE), the Fed’s preferred measure of inflation, decreased in May 2022 to 4.70% but still stood well above the Fed’s target 2% level. Despite rate increases from the Federal Reserve (Fed), inflation continues to be on the rise as supply constraints persist. With inflation being driven by supply-side factors, the Fed and other major global Central Banks risk stalling growth in the coming months, with an increasing number of analysts and forecasters pointing to the likelihood of a recession in the US and other major economies.

T&T USD Bonds Yield Trend Higher

With the major move in US interest rates and US Treasury yields, US-dollar bond markets have also experienced a broad repricing. Regional and T&T USD-denominated bond yields have been no exception, with yields climbing by at least 1.2% or 120bps over the past 12 months. For example, the Government of the Republic of Trinidad and Tobago’s 4.50% USD bonds due 2026, which was priced at an annual yield to maturity (return) of 3.0% in September 2021, is now priced at a more attractive 5.0%, some 200 basis points higher in annualized return. Beyond Trinidad & Tobago, regional insurer, Sagicor Financial Company Ltd’s (Sagicor) 5.30% USD bonds 2028 yielded 4.1% average return in the latter half of 2021 while it is now priced to offer a yield close to 6.5%. While bond yields have become much more attractive, investors should note that further anticipated rate hikes could potentially drive yields even higher in the second half of 2022.

International Market Outlook

US and other major global interest rates are expected to increase throughout the remainder of 2022 into early 2023, as attempts are made to rein in inflation. Markets are projecting The Fed and the Bank of England (BoE) to raise rates to approximately 3.5% and 3.0%, respectively, by year-end. Markets price the European Central Bank’s policy rate to be approaching 2.5% by the end of next year.

Higher global interest rates and inflationary pressures will increase the likelihood of stagflation, characterized by climbing prices and weak-to-negative economic growth.

The rising rate cycle, when combined with tepid growth, could potentially flash warnings for investors of companies with weaker credit profiles. With higher borrowing costs and potentially lower business activity, bonds markets could be at the cusp of a broad-based deterioration in credit conditions. Bond investors will be looking for clues of any weakness, with increases in credit rating downgrades and defaults usually the most visible indicators.

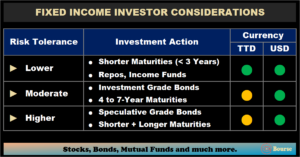

Fixed Income Investor Considerations

At the domestic level, TTD fixed income investors may likely continue to face (i) fairly stable interest rates and (ii) limited new issues. The Honourable Minister of Finance stated during the mid-year review that there were no net new borrowings from December 2021- May 2022. With limited opportunities in the local fixed income space, but cognizant of the need to generate returns to combat the impact of inflation on purchasing power, investors may consider short-to-medium term solutions including (i) income mutual funds (ii) repurchase agreements and (iii) other fixed-return, fixed-term solutions provided by Bourse and other investment services firms.

On the international side, with further rate hikes projected for the second half of 2022 by the Federal Reserve to curb inflation, corporates and individuals will likely continue to face greater investment uncertainty.

Lower risk-tolerant investors, facing more turbulent credit markets, may consider adopting a safer approach by investing in USD income funds and USD repurchase agreements. USD Repurchase agreements are an attractive investment for low risk individual, being fully secured by financial instruments. Investors in international markets might also consider taking positions in shorter-term, high credit quality assets such as US Government Treasury Bonds.

Investors with a moderate risk tolerance, willing and able to hold fixed income positions to maturity, could consider the current environment as an opportunity to add higher-yielding bond positions to their fixed income portfolios. Notwithstanding higher yields, credit risks have also increased. Accordingly, moderately-risk tolerant investors may wish to place particular emphasis on the credit quality of their holdings, focusing on the Investment Grade segment of the bonds market. Investment Grade Bonds carry a credit rating of equal to and greater than “BBB-/Baa3/Baa3” as rated by S&P/Moody’s/Fitch Rating Agencies respectively.

Investors who can tolerate higher risk, with the propensity to hold bonds to maturity, might consider the current environment as very attractive to acquire bonds. With higher risk tolerance, investors could widen their options by considering high/speculative yield bonds in addition to investment grade offerings, to add a greater degree of income generation to their portfolios. It should be noted that higher yields are accompanied by higher risks. With the prospects of recessionary conditions looming, lower-rated bonds could be more susceptible to a weaker economic environment. As always, investors should consult a trusted and experienced advisor, such as Bourse, in order to make better-informed investment decisions.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”