HIGHLIGHTS

Local Markets

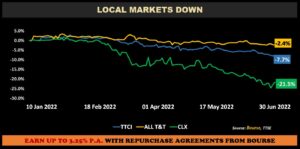

- HY2022 Performance:

- TTCI ↓ 7.7%

- All T&T ↓2.4%

- CLX ↓ 21.5%

- Performance Drivers:

- Inflationary Pressures

- Volatile Financial Markets

- Outlook:

- Economic Uncertainty

International Markets

- HY2022 Performance:

- US Markets – S&P 500 ↓ 20.6%

- European Markets- Euro Stoxx 50 ↓16.7%

- Asian Markets – MXASJ ↓16.8%

- Latin American Markets – MSCI EM ↓ 4.2%

- Performance Drivers:

- Elevated Inflation

- Geopolitical Tensions

- Outlook:

- Economic Uncertainty

This week, we at Bourse recap the performance of local and international stock markets for the first half of 2022 in a very challenging period for equity investors. Global markets were sharply lower as a result of surging inflation, hawkish central bank policies, ongoing geopolitical tensions and increasing concerns of slower global growth. Could the sell-off in equities carry into the second half of 2022, or will an improvement in conditions bring about a recovery across stock markets? We discuss below.

Local Markets Decline

The Cross Listed Index (CLX), comprising some of the largest publicly-listed regional companies, led losses among the three major indices, slipping 21.5%, as movements of index heavyweight NCBFG (down 31.5%) and its subsidiary GHL (down 9.0%) dragged market performance down. The All Trinidad and Tobago Index (All T&T), while faring better, declined 2.4% for HY 2022. Resultantly, the Trinidad and Tobago Composite Index (TTCI) fell 7.7% to close at 1,378.42. MASSY Holdings Limited (MASSY) and JMMB Group Limited were the volume leaders on the First Tier Market for HY 2022, with 18.3M and 10.4M shares being traded respectively.

Major Movers

Agostini’s Limited (AGL) advanced 42.3%, boosted by positive earnings momentum, improving margins and diversification activity. On April 6, 2022, Agostini’s Ltd gave notice that it signed a sale and purchase agreement with the shareholders of Barbadian-based Collins Ltd and its subsidiary Carlisle Laboratories Limited, extending its regional acquisition strategy. Angostura Holdings Limited (AHL) increased 27.2% for HY 2022, supported by strong demand for its branded products both locally and internationally. Canadian-owned Banking giant, Scotiabank Trinidad and Tobago Limited (SBTT), was up 12.2% for HY 2022 on account of higher Revenues, lower Non-Interest Expenses and healthy dividends. The Bank continues to reward investors with consistent dividend payments. Rounding out the top 5 major advancers were Point Lisas Industrial Port Development Corporation (PLD) and Trinidad Cement Limited (TCL) which increased 7.9% and 3.4% respectively.

Major decliners for HY 2022 included NCB Financial Group Limited (NCBFG down 31.5%), First Citizens Group Financial Holdings (FCGFH down 19.7%), FirstCaribbean International Bank Limited (FCI down 18.6%) and West Indian Tobacco Company Limited (WCO, down 18.1%) and Unilever Caribbean Limited (UCL down 14.3%).

US Markets Lower

The S&P 500 closed in bear market territory at the end of HY 2022, defined as a 20% decline from a recent peak. This comes against a backdrop of aggressive rate hikes by the Federal Reserve, looming recession fears and unsettling inflation readings. The Energy Select Sector SPDR Fund (XLE) was the sole sector Exchange Traded Fund (ETF) in positive territory during HY 2022, up 28.8% on account of (i) elevated energy prices (ii) supply constraints and (iii) geopolitical tensions in Eastern Europe. The Consumer Discretionary Select Sector SPDR Fund (XLY) rounded out the first half of 2022 as the worst performing sector, down 32.8% as high inflation continues to erode household income, lowering demand for discretionary spending.

International Markets Contract

European markets, as gauged by the Euro Stoxx 50, fell 16.7% in HY 2022 as investor sentiment shifted to a more negative setting amid uncertainty over the war in Ukraine and surging inflation. England was the region’s ‘least worst’ performer, down 12.7% as better than expected retail data and lower inflation expectations allowed investors to look past mounting political uncertainty. Italy and Germany were among the worst performing markets, declining 28.2% and 28.1% respectively following a squeeze on energy supplies. France contracted 23.7% as slower than expected business activity weighed on the eurozone’s second largest economy. Spain’s Ibex fell 14.3%.

Asian equities declined in HY 2022 as recession fears loomed large, fueled by hawkish signaling from the U.S. Federal Reserve and central banks across Europe, with South Korea leading losses. Negative Asian sentiment was compounded by the threat of regulatory crackdowns on major Chinese companies, which has now settled to some degree.

South Korea equities declined 27.7% in HY 2022, its currency fell below the 1,300-won level against the U.S dollar for the first time in nearly 13 years on Thursday 23rd, June, 2022. The country’s finance minister reiterated the FX authorities’ recent stance that they would take necessary steps to stabilize the currency market in case of excessive volatility. Taiwan markets decelerated 24.1% compared to an appreciation of 21.3% in the year-ago quarter, with US-China cross-strait tensions over Taiwan leading foreign investors to hurriedly exit holdings at a record pace to avoid the market impact of prolonged geopolitical risk. Asian Equity markets (excluding Japan) declined 16.8% in HY 2022 compared to a gain of 5.8% in HY 2021.

China’s market was down 11.4% for HY 2022, affected by a two-month long Covid-19 lockdown, which ended on June 1st, 2022. Hong Kong markets decelerated 7.2% in HY 2022.

India equities dropped 14.1% in the quarter under review relative to an 8.0% gain in HY 2021, as the market sentiment soured on account of an elongated geopolitical conflict between Russia and Ukraine and the consequent rise in key commodity prices. Among sectors, the largest decline was seen in metal and information technology (IT) stocks, while relative outperformance was seen in auto stocks.

Latin American markets served as a respite for global investors during HY2022, with performance sharply determined by whether a country imports or exports energy and other basic materials. Chile was the best performing market in the region, up 7.0% as the world’s largest copper producer benefitted from higher commodity prices and an expansion in its services and retail sectors. Colombian markets contracted 8.1% on account of broad political changes, while Brazil fell 0.4%. Mexico ended HY 2022 as the worst performing Latam market, down 9.0% as the country continues to struggle with two-decade high inflation and sluggish economic activity.

Outlook

On the local horizon, the gradual removal of Covid-19 restrictions, most recently by eliminating the travel pass and the requirement of a negative Covid-19 test upon entering the country, signals continued reopening of T&T and the prospect of increased economic activity. Notwithstanding muted domestic energy production, higher prices for key energy exports like oil, gas, and fertilizers should continue to improve the fiscal position of T&T. The Honourable Minister of Finance stated during the mid-year budget review that (nominal) GDP is now estimated to approach TT$180B in FY 2022 relative to TT$170B in FY 2021. According to the IMF, Real GDP growth in 2022 is expected at 5.5%, reinforced by the continued policy support and the anticipated recovery in oil and gas production.

Inflation has risen to prominence as a key developing theme at both the local and international level. Headline inflation rose to 5.1% year-on-year in April 2022 compared with 4.1% a month earlier. Food inflation picked up to 8.7% in April 2022 from 7.9 %, reflecting higher prices for rice, margarine, edible oils and meat. Many domestic companies are facing headwinds in the form of higher input costs, leading some to pass on increased costs to consumers in an effort to preserve margins. Soaring commodity prices have prompted the National Flour Mills (NFM) to increase wholesale and retail flour prices by 33% and 28% percent respectively, which came into effect on Wednesday, June 22nd, 2022. Other headwinds, including the recent increase in fuel prices, looming increases in water and power tariffs are all likely to result in a weaker consumer demand.

International Markets

With the S&P 500 experiencing its steepest first half decline since 1970, investors remain cautious amid worries that the Fed’s fight against inflation will further weaken risk appetite while potentially throwing the U.S. economy into recession. Economic data, however, points to moderate growth as consumer spending which accounts for more than two thirds of US economic activity, gained 0.2% in May whilst claims for unemployment benefits lowered.

In response to a question at the NATO Summit, U.S President Joe Biden stated that Americans will have to stomach high gas prices ‘as long as it takes’ to beat Russian president Vladimir Putin, in the Russia-Ukraine standoff. These comments may be a warning for households to brace for a longer-term bout of high gasoline prices, a major driver of inflation. The IMF revised its forecast downwards for Global growth to 3.6%, down 0.8% from its January 2022 forecast.

Growth in the EuroArea was revised by the IMF to stand at 2.8% in 2022, 1.1% lower than its previous forecast. European economies are facing a new shock from slowing deliveries of Russian natural gas, leaving an extraordinary gap to fill in an already tight energy market as the EU relied on Russia for as much as 40% of its gas needs before the war.

According to the World Bank, growth in China is forecast to slow to 4.3 percent in 2022, below estimates of potential growth, due to the lingering effects of the pandemic and weaker global demand. JPMorgan sees China as Equity ‘Safe Haven’, as the nation is easing policies to boost growth coupled with the recent ease in virus restrictions, increasing optimism for the third quarter.

In India, the World Bank slashed India’s economic growth forecast for fiscal 2022-23 to 7.5% lower than the previously projected 8.7%. Though, growth will be supported by fixed investments, incentives and reforms undertaken by the private sector and the Government to improve the business climate.

The IMF upgraded its 2022 growth forecast for Latin America to 2.5% relative to a previous 2.4%. Mexico is now expected to grow 2.0% in 2022 compared to a previous forecast of 2.8% while Brazil’s forecast shifted to 0.8% from a prior 0.3%. Despite fewer direct connections to Europe, the region is expected to continue its struggle with inflation and policy tightening. Lower expected activity for the United States and China also weighs on the outlook for trading partners in the region.

Equity Investor Considerations

The outlook for the second half of 2022, barring a rapid improvement in conditions, remains somewhat menacing for equity investors. Risks are expected to remain elevated, with investor sentiment likely to stay cautious. Notwithstanding a challenging macroeconomic environment, investors should still be able to find pockets of opportunity within the market depending on their risk tolerance and time horizon. A healthy dose of caution may be warranted, as it is difficult to forecast when stocks markets will turn around.

Investors with generally lower risk tolerance might consider reducing exposure to stocks, shifting their portfolio to more income-oriented and capital preservation investments. Options include Income Mutual Funds (like the Bourse Savinvest Structured Investment Fund), which provide capital preservation with ready access to cash, or Repurchase Agreements offered by broker-dealers (including Bourse) which offer more attractive short-term rates with investment tenors typically ranging from 90 days to 3 years.

Investors with moderate risk tolerance that are focused on preserving most of their capital while gaining modest exposure to growth might think about rebalancing their portfolios by topping up equity holdings. With a moderate risk mindset, this could be achieved by adding highly diversified sector or country ETFs (in the case of international investments) and/or being extra selective with local stocks, focusing on names with positive ratings/price targets.

Investors with a higher risk tolerance and a focus on longer-term growth may look past current market conditions, viewing this as a once-in-a-generation buying opportunity. For the higher-risk tolerant equity investor, adding more aggressive growth mutual funds, ETFs and/or generally higher-volatility stock positions. It should be noted that investors should consult a trusted and experienced advisor, such as Bourse, to make better informed decisions.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”