HIGHLIGHTS

FCI HY 2022

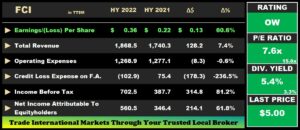

- Earnings: Earnings Per Share 60.6% higher, from TT$0.22 to TT$0.36

- Performance Drivers:

- Increased Revenue

- Reversal on Credit Loss Expense on Financial Assets

- Outlook:

- Interest Rate Normalization

- Rating: Maintained at OVERWEIGHT

SBTT HY 2022

- Earnings: Earnings Per Share 17.0% higher, from $1.73 to $2.02

- Performance Highlights:

- Higher Revenues

- Reduced Non-Interest Expenses

- Outlook:

- Economic Uncertainty

- Rating: Maintained at MARKETWEIGHT.

This week, we at Bourse review the performance of two Canadian-owned Banking stocks, FirstCaribbean International Bank Limited (FCI) and Scotiabank Trinidad and Tobago Limited (SBTT) for the six-month period ended April 30th 2022 (HY 2022). SBTT reported lower Net Interest Income which was offset by increased revenues from other business lines. FCI, meanwhile, benefitted from increased Total Revenues and a reversal on Credit Losses. Could both entities benefit from a rising interest rate environment? We discuss below.

FirstCaribbean International Bank Limited (FCI)

FirstCaribbean International Bank Limited (FCI) reported Earnings Per Share of TT$0.36 for the six-month period ended April 30th 2022 (HY 2022), 60.6% higher compared to TT$0.22 recorded in HY 2021. Total Revenue increased 7.4%, from TT$1.7B in HY 2021 to TT$1.9B in HY 2022. Operating Expenses fell 0.6% to stand at TT$1.3B. In light of favourable changes to updated macro-economic regional forecasts, FCI reported a reversal on Credit Loss Expense on Financial Assets in the amount of TT$102.9M. Income Before Tax (PBT) stood at TT$702.5M, 81.2% higher than TT$387.7M in HY 2021. Resultantly, FCI reported an Income Tax Expense of TT$99.4M (301.3% higher). The Group’s effective tax rate increased significantly from 6.4% in HY 2021 to 14.1% in the period under review. Overall, the Group reported Net Income Attributable to Equity Holders of TT$560.5M, up 61.8% from a prior TT$346.4M.

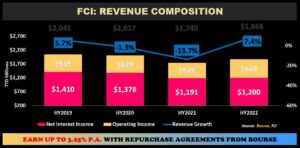

Revenue Recovers

FCI’s Total Revenue recovered in HY 2022 (up 7.4%) after falling in the prior period. Net Interest Income, the Group’s largest revenue contributor (HY 2022: 64.2%) increased marginally by 0.8% to TT$1.2B. Notably, the Group’s loan portfolio contracted 3.0% from TT$43.0B in HY 2021 to TT$41.8B in HY 2022. With FCI’s primary operating jurisdictions being heavily dependent on Tourism, this may be a result of lower demand for loans due to muted economic activity during the period. Operating Income, which accounted for 35.8% of Total Revenue, advanced 21.6% owing to increased client transaction volumes.

Operating Segment Advance

Before Tax (PBT) expanded 81.2% for HY 2022 primarily attributable to revenue improvement and a reversal on credit losses, reflecting an improvement in the Group’s loan portfolio. The Bank’s largest contributor to PBT growth, Corporate and Investment Banking (CIB: 89.4%), advanced 83.3% from TT$360M to TT$660M. Despite volatile financial markets in the first quarter of 2022, segmental revenue grew 11.6%. Retail, Business and International Banking (RBB) recorded a Profit Before Tax of TT$36M, a recovery from a Loss of TT$2M in the previous period. Similarly, Wealth Management swung from a Loss of TT$5M in HY 2021 to a Profit Before Tax of TT$42M in HY 2022.

The Bourse View

At a current price of TT$5.00, FCI trades at a Trailing Price to Earnings ratio of 7.6 times, significantly below the Banking sector’s average of 15.6 times. The stock also offers investors a Trailing Dividend Yield of 5.4%, above the sector average of 3.3%. The Group declared an interim dividend of TT$0.068 (US$0.010) per share payable on July 8th 2022. With the IMF projecting growth of 3.2% in 2022 for Tourism Dependent Caribbean countries (IMF April 2022 outlook), FCI’s profitability may continue its upward momentum as economic activity and demand for consumer discretionary items increase. Additionally, recent increases in interest rates may bode well for the Group in the form of higher margins, though inflation could impact on consumer disposable income in the near-term. On the basis of improved performance, attractive valuations and recovering dividends, Bourse maintains an OVERWEIGHT rating on FCI.

Scotiabank Trinidad and Tobago Limited (SBTT)

Scotiabank Trinidad and Tobago Limited (SBTT) reported earnings per share (EPS) of $2.02 for the six-month period ended April 2022 (HY 2022), a 17.0% increase compared to $1.73 in the prior comparable period.

Net Interest Income declined 3.4% to $599.3M, while Other Income showed a significant increase of 42.3% from $248.2M in HY 2021 to $353.1M in HY 2022. Total Revenue for HY 2022 came in at $952.4M, a 9.6% increase from the prior period. Non-Interest Expenses shifted 3.5% lower from $373.8M in HY 2021 to $360.5M in HY 2022, as the Bank focused on improving operational efficiency. SBTT recorded a 31.5% expansion in Net Impairment Loss on Financial Assets, amounting to $45.4M (HY 2021: $34.5M). Income before Taxation (PBT) stood at $546.5M, 18.7% higher relative to $460.4M recorded in HY 2021. The Taxation expense rate moved from 33.9% to 34.8% in the period under review. Overall, SBTT reported a Profit for the Period of $356.5M, up 17.0% compared to $304.6M in HY 2022.

Revenues Higher

SBTT’s Total Revenue recovered in HY 2022 (up 9.6%) after falling in the prior comparable period.

Net Interest Income, the Group’s largest revenue contributor (HY 2022: 62.9%) fell by 3.4% to $599M, as a result of the continued low interest rate environment and margin compression. Meanwhile, Other Income (37.1% of Total Revenue) recorded a 42.3% increase driven by an improvement in core banking activities.

The Bank’s largest operational segment by revenue, Retail Corporate & Commercial Banking (90.5% of Total Revenue) and its Asset Management segment expanded 9.8% and 120.8% respectively, year-on-year. Its Insurance Services segment improved by a less outstanding 2.7% in HY 2022 signalling customers’ continued confidence in their brand as they offer products to suit different needs.

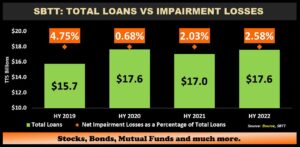

Marginal Loan Growth, Impairment Expenses Expand

SBTT recorded a 3.1% increase of its Total Loan Portfolio from $17.0B in HY 2021 to $17.6B in HY 2022, as continued recovery in economic activity stabilized loan demand.

Loans to Customers (95.1% of Total Loans), the Bank’s largest interest earning asset, increased 3.9% or by $627.6M year on year, driven by increased consumer demand and aided by enhanced digital customer engagement initiatives. Meanwhile, Loans and advances to banks and related companies fell 5.9%.

Net Impairment losses on financial assets increased to $45.4M from $34.5M in the prior period, resulting in an increase in the ratio of Net Impairment Losses to Total loans to 2.58% from 2.03% in HY 2021. The Group’s credit quality continues to show improvement as displayed by the ratio of non-performing loans as a percentage of gross loans improving from 2.3% to 1.9% in HY 2022.

The Bourse View

SBTT is currently priced at $77.08, up 12.5% year-to date. The stock trades at a Trailing Price to Earnings ratio of 20.8 times, above the Banking Sector average of 15.6 times. The stock also offers investors a Trailing Dividend Yield of 4.7%, above the sector average of 3.3%. The Group declared an interim dividend payment of $0.65 per share to be paid on July 15th, 2022. SBTT’s dividend yields continue to remain healthy, rewarding shareholders in the form of dividend payments (pay-out ratio: 64.4% in HY 2022) as well as capital appreciation. On the basis of consistent dividend payments, but tempered by elevated valuations, Bourse maintains a MARKETWEIGHT rating on SBTT.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”