HIGHLIGHTS

FCI Q1 2022

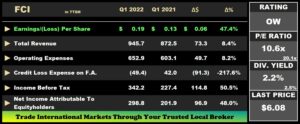

- Earnings: Earnings Per Share 47.5% higher from $0.13 to $0.19.

- Performance Drivers:

- Higher Revenue

- Reversal on Credit Loss Expense on Financial Assets

- Outlook:

- Interest Rate Normalization

- Rating: Assigned at OVERWEIGHT

International Markets

- March 2022 Performance:

- US Markets – SPY ↓ 9.6% YTD

- Asian Markets – AAXJ ↓ 11.1% YTD

- European Markets – VGK ↓ 13.2% YTD

- Russian markets- RSX ↓ 78.8% YTD

- Latin American Markets – ILF ↑ 17.2% YTD

This week, we at Bourse review the financial performance FirstCaribbean International Bank Limited (FCI) for the first quarter ended January 31st, 2022. FCI reported an improvement in its performance on account of increased revenue and a reversal on Credit Loss Expenses. We also consider the performance of the international equity markets against a backdrop of significant geopolitical tensions. Is this a buying opportunity, or should investors remain cautious? We discuss below.

FirstCaribbean International Bank Limited (FCI)

FirstCaribbean International Bank Limited (FCI) reported Earnings Per Share of TT$0.19 for the three-month period ended January 31st 2022(Q1 2022), 47.4% higher compared to TT$0.13 recorded in Q1 2021. Total Revenue increased 8.4%, from TT$872.5M in Q1 2021 to TT$945.7M in Q1 2022. Operating Expenses climbed 8.2% to stand at TT$652.9M, according to the Group, this was primarily due to higher operational costs and spending on strategic initiatives. In light of a favourable change in updated macro-economic regional forecasts, FCI reported a reversal on Credit Loss Expense on Financial Assets in the amount of TT$49.4M. Income Before Tax (PBT) stood at TT$342.2M, 50.5% higher than TT$227.4M in Q1 2021. Resultantly, FCI reported an Income Tax Expense of TT$27.2M (43.9% higher). Overall, the Group reported Net Income Attributable to Equity Holders of TT$298.8M, up 48.0% from a prior TT$201.9M.

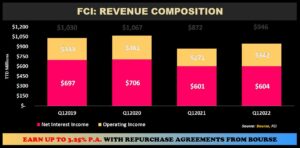

Revenue Increases

FCI’s Total Revenue recovered in Q1 2022 (up 8.4%) after falling in the prior period. Net Interest Income, the Group’s largest revenue contributor (Q1 2022: 63.8%) increased marginally by 0.5% to TT$ 603.7M, reflecting the challenge of operating in a low interest rate environment. Despite this, FCI was able to grow its loan portfolio by 3.8% to TT$43.4B. Operating Income, which accounted for 36.2% of Total Revenue, advanced 26.2% from TT$271.0M in Q1 2021 to TT$342.0M in Q1 2022 amid increased client transaction activity.

Operating Segment Advance

FCI grew its Profit Before Tax (PBT) by 50.5% year-on-year owing to revenue improvement, expense management and a reversal of credit losses, signaling an improvement of their loan portfolio. The Bank’s largest contributor to PBT Growth, Corporate and Investment Banking (CIB:93.7% of PBT), advanced 45.9% from TT$229M to TT$334M, with segmental revenue gaining 10.3% in Q1 2022. Retail, Business and International Banking (RBB) recorded a Profit Before Tax of TT$13M in Q1 2022, a recovery from a Loss of TT$15M in the prior comparable period. Wealth Management recorded a 54.3% rise from TT$6.1M in Q1 2021 to TT$9.3M in Q1 2022.

On October 12th 2021, FCI announced the sale of its banking assets in four territories within the Organization of the Eastern Caribbean States (OECS). It’s wholly owned subsidiary, FCIB Barbados, agreed to sell its banking assets in St. Vincent and the Grenadines, Grenada and the Commonwealth of Dominica and St Kitts and Nevis, all transactions still subject to regulatory approval. Additionally, FCIB Cayman agreed to sell its banking assets in Aruba, which received approval from the various regulatory authorities and was closed on February 25th, 2022.

The Bourse View

At a current price of TT$6.08, FCI trades at a Trailing Price to Earnings ratio of 10.5 times, significantly below the Banking sector’s average of 19.9 times. The stock also offers investors a Trailing Dividend Yield of 2.2%, below the sector average of 2.5%. The Group declared an interim dividend payment of TT$0.068 (US$0.010) per share to be paid on April 22nd, 2022. On the basis of improved performance and attractive valuations but tempered by continued economic uncertainty, Bourse assigns an OVERWEIGHT rating on FCI.

Russia, Inflation Roil International Markets

Spiraling multi-decade high inflation is being amplified by spiking oil, gas and agricultural commodity prices, feeding volatility and risk aversion across the U.S. and other international stock markets. Compounding recent supply chain woes that have plagued the global economy and threatened to stall growth, the ongoing Russian invasion of Ukraine has triggered a wave of international policy moves which could hobble the highly-interdependent international trade community.

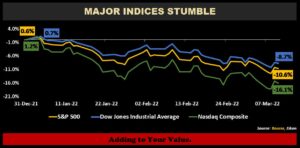

Annual Inflation in the US accelerated to 7.9% in February 2022. The S&P 500 Index and the tech-heavy Nasdaq Composite Index reeled into correction territory declining 10.6% and 16.1% respectively, year-to-date (YTD). The blue-chip Dow Jones Industrial Average (DJIA) is down 8.7% YTD.

Most major equity markets have traded lower year-to-date, driven by soaring commodity prices, geopolitical tensions and slower than expected economic activity. Responding to all of these factors, Regional Exchange Traded Funds (ETFs) have tumbled year to date (YTD), reflecting considerable worry among investors. One exception has, thus far, been Latin America, which has revelled in the surge of energy, metals and agricultural commodity prices.

As at Thursday 10th March 2022, Asian Markets are currently down 11.1% YTD. European Markets fell 13.2% YTD while US Markets declined 9.6%. Latin America was the only region to record positive YTD results, up 17.2% YTD compared to a contraction of 6.5% in the year ago period. Russian equity markets, as measured by the VanEck Russia ETF (RSX), is currently down 78.8% YTD.

Russian Sanctions have Global Impact

The Russian invasion of Ukraine on February 24th 2022 has prompted global response in the form of severe financial and trade sanctions on the largest country in the world. Included in the sanctions are:

- Bans on Russian aircraft and ships from the US, EU and several other countries

- Suspension of trading of Russian bonds and equities

- Freezing of overseas assets of the Russian Central Bank and National Wealth Fund

- Blocking of Russian banks’ access from the SWIFT international payment system

- Seizure/freezing of Russian wealthy and ‘influential’ Russian citizens

- US, G7 proposed removal of Russia from preferred trading partner status

- Growing ban on exports of Russian energy and other products.

The imposed sanctions, while targeted at forcing Russia to end its assault on Ukraine, will inevitably have much broader implications for the global economy.

Both Russia and Ukraine are key suppliers of raw materials and energy for many crucial supply chains. When combined, Russia and Ukraine account for nearly a quarter of global Wheat production. Prolonged disruption from the Russian invasion could lead to production shortages, pushing the price of wheat and other agricultural commodities higher. Wheat futures climbed past record highs set in 2008 to US$11.06 per bushel on Friday, corn futures traded over US$7.62 per bushel, the highest since December 2012. Meanwhile, soybean futures were US$16.76 per bushel its highest since September 2012.

Russia is also one of the largest producers of fertilizers, accounting for around 13% of global production.

The U.S., British and other countries’ bans on imports of Russian oil and fuel products has sent energy prices soaring. Brent crude futures were up at US$112.30/barrel on Friday relative to US$98.52/barrel and U.S. West Texas Intermediate (WTI) crude futures rose 18% to $109.43/barrel from $92.81/barrel since the start of the invasion. These price movements have already begun to affect the cost of living, through higher electricity and gas bills for households. Most of Europe, meanwhile, remains highly reliant on Russian crude oil and natural gas for its energy needs. Russia, has historically provided around 30% of Europe’s energy needs.

The ripple effect on global markets could include a longer period of stagflation – low/negative economic growth accompanied by above-target inflation. For the international investor, these developments introduce further uncertainty into the investment outlook. Key considerations when making investment decisions include:

- A higher inflationary environment and its impact on financial assets

- The path of US monetary policy on increasing interest rates

- Potential further geopolitical fallout between the US and China (China remains an ally and key trading partner of Russia)

- Diverging growth paths across countries/regions

A Buying Opportunity?

For the highly risk-tolerant investor with a longer-term investment horizon, current market conditions appear to offer an opportunity to ‘average-in’ to Index ETFs and value stocks which have fallen in price.

It should be noted, however, that equity and bond markets remain fraught with uncertainty. Lower risk-tolerant investors, under these circumstances, might consider rotating into safer instruments such as short-term bonds, repurchase agreements and/or income-oriented mutual funds to preserve capital until the investment outlook improves.

As always, it makes sense to consult with your trusted investment adviser, such as Bourse, to make the most informed investment decisions.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”