HIGHLIGHTS

PHL 9M 2021

- Earnings: Earnings Per Share declined from $0.14 to a Loss Per Share of $0.50

- Performance Drivers:

- Restaurant Closure

- Lower Revenue

- Outlook:

- Likely to recover?

- Gradual Reopening

- Economic Challenges

- Rating: Maintained at NEUTRAL

Growing Inflationary Pressures

- Surge in International Commodity Prices

- Rising Domestic Prices

- Supply Chain Constraints

This week, we at Bourse review the financial performance of Prestige Holdings Limited (PHL) for the nine-month period ended August 31st 2021. Lockdown measures would have significantly impaired PHL’s ability to operate in the earlier part of the year, with PHL’s performance likely supported in subsequent periods by economic reopening. Inflation has been at the forefront of investor minds in recent times, with official data starting to reflect the reality of higher prices in the economy. What might investors expect in the months ahead? We discuss below.

PRESTIGE HOLDINGS LIMITED (PHL)

Prestige Holdings Limited (PHL) reported a Diluted Loss per Share (LPS) of $0.50 for 9M 2021 period, compared to an Earnings Per Share of $0.14 recorded in the previous period. Revenue declined 26.4%, from a previous $666.1M in 9M 2020 to $490.5M, as a result of a 48-day mandated closure and dine-in restrictions. Gross Profit declined 26.9% to $158.4M. PHL’s Operating Profit was significantly lower, moving to a loss of $23.2M in 9M 2021. Finance Costs jumped 4.3%, from $13.9M to a current $14.5M. The Group recorded a Loss Before Tax (LBT) of $37.7M, compared to a profit of $2.6M in the prior period. Overall, PHL reported a Loss Attributable to Owners of the Parent Company of $30.9M.

Revenue Lower

PHL’s revenue, like most other operators in the restaurant industry, was constrained by enforced closures for 48 of the 92 days in Q3 2021 (32 days in Q2 2021) and an overall 80 days during the fiscal period. The Group’s revenue subsequently fell from $666M in 9M 2020 to $491M in 9M 2021(down 26.4%). The reintroduction of in-house dining for vaccinated persons from October 11th will be welcome news to investors, giving the Group an opportunity to recover.

Margins Trend Lower

PHL’s Gross Profit Margin in 9M 2021 was 32.2% relative to 32.6% in the comparable period, reflecting some degree of consistency despite heavily interrupted operations. Overall, the margins were affected by the slump in the top line performance, due to the closure of restaurants amid measures implemented to curb the COVID-19 virus.

PHL’s Operating Profit Margin declined from 2.4% to -7.7% in 9M 2021, with unavoidable fixed costs being incurred despite its inability to operate. This would have also filtered into its Profit Before Tax (PBT) margin, falling from 0.5% to a -7.7% in 9M 2021.

The Bourse View

At a current price of $7.34, PHL trades at a market to book ratio of 1.7xs compared to the Trading sector average of 1.1 times. The stock offers investors a trailing dividend yield of 0.8%, below the sector average of 2.9%. Despite previous setbacks from pandemic-induced lockdown restrictions, PHL is likely to rebound as the country cautiously continues to reopen. On the basis of an increasing likelihood of recovery, but tempered by economic uncertainty as it relates to Covid-19 variants, Bourse maintains a NEUTRAL rating on PHL.

INFLATIONARY PRESSURES GROW

The Central Bank of Trinidad and Tobago confirmed in its Monetary Policy announcement that inflationary pressures have increased locally.

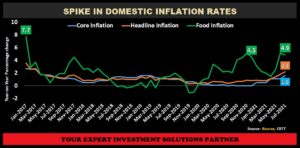

Retail prices indicated that headline inflation, on a year-on-year basis, moved from 0.8% in December 2020 to 2.2% as at July 2021. Core inflation, which omits the traditionally volatile food component remained relatively flat as at December 2020 and advanced to 1.6% in July 2021. To a large degree, the surge in inflation reflects a combination of pandemic-induced supply-demand mismatches and rising commodity prices. According to the CBTT, inflation rates have the potential to further accelerate in the months ahead as a result of recently announced hikes in transportation fares.

Food inflation garnered upward momentum after retreating from 4.5% y.o.y. in December 2020 to 4.9% in July 2021 Year-on-Year. The acceleration in food costs was broad-based, with most sub-indices showing a significant rise in growth. Given the pandemic-induced global food supply shortages and the surge in international commodity prices, this led to the gradual increase in food prices.

‘FIRST’ BECOMES ‘FCGFH’

On Wednesday 13th October 2021, trading in FIRST shares was suspended for 3 business days ending Friday 15th October 2021 to facilitate the completion of the Group’s corporate legal restructuring process. Shareholders on June 30th 2021 approved the corporate legal restructure in which the bank would no longer be the holding company of the First Citizens Group but would instead become a subsidiary of a new holding company, First Citizens Group Financial Holdings (FCGFH). From Monday 18th October 2021, trading will resume under the new stock exchange ticker: “FCGFH”. In a notice in June, the bank stated that the restructuring was a result of the substantial growth of the group both locally and regionally over the years. Moreover, the bank indicated that shareholders would have the same percentage of shares in the new holding company and will also have the same voting rights.

DICLAIMER: “This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”