HIGHLIGHTS

GKC HY 2021

- Earnings: Earnings Per Share of $0.161, an increase from $0.123 in comparable period

- Performance Drivers:

- Strong growth in Money Services and Food Trading Segments

- Outlook:

- Resilient Revenue Base

- Sluggish Economic Recovery

- Rating: Maintained at NEUTRAL

AGL 9M 2021

- Earnings: Earnings Per Share 14.6% higher from $1.30 to $1.49

- Performance Drivers

- Cost Containment Initiatives

- Higher Margins

- Outlook:

- Pandemic Induced Demand

- Ongoing Vaccination

- Lingering Economic Challenges

- Rating: Maintained at NEUTRAL

This week, we at Bourse review the performance of GraceKennedy Limited (GKC) for the six-month period ended June 30th 2021 and Agostini’s Limited (AGL) for the nine-month period ended June 30th, 2021. Both entities produced improved results with a mix of organic growth and acquisition activities. What might investors expect in the months ahead? We discuss below.

GraceKennedy Limited (GKC)

GraceKennedy Limited (GKC) reported earnings per share (EPS) of TT$0.161 for the half-year period ended June 30th 2021 (HY 2021), TT$0.037 or 30.1% higher than the EPS reported in HY 2020. Revenue from Products and Services advanced 12% from TT$2.4B in HY2020 to TT$2.7B in HY 2021. Interest revenue increased 5.3% to TT$101.5M. Total Revenue for the period expanded 12.1%, from TT$2.5B in HY 2020 to TT$2.8B in HY2021. Direct and Operating Expenses increased TT$281.2M, while Net Impairment Losses on Financial Assets decreased 54.2% to TT$10.3M year-on-year (YOY). Other Income stood at TT$68.3M, a 2.1% increase over the comparable period. As a result, Profit from Operations increased 18.3% from TT$204.0M in HY 2020 to TT$241.3M in HY 2021. Share of Results from Associates and Joint Ventures increased 14.9% from TT$12.9M in HY 2020 to TT$14.7M in HY 2021. Profit Before Tax was TT$243.4M, an improvement of 20.4% compared to TT$202.1M in the prior comparable period Overall, Net Profit Attributable to Equity Holders was TT$160.4M, a 30.6% increase from TT$122.8M reported in HY 2020.

Food Trading Boosts Profits

GKC continued their trend of strong operating performance with Profit Before Tax (PBT) increasing 20.4% YOY. The Group’s Food Trading Segment, which accounted for 49% of PBT before eliminations, increased 50.6% to TT$125M after the implementation of a number of sales promotions and new marketing campaigns in its domestic market. GKC noted the increased threat of food inflation, with rising freight costs potentially impacting production costs.

GraceKennedy Money Services, the second largest contributor to PBT (36% before eliminations), grew 16.0% to $94M driven by a strong performance in Bill Express Online in Jamaica with a 26% increase in transactions recorded relative to the prior comparable period. The Group continues to increase its digital offerings with Electronic Registration and Direct to Bank (D2B) services being introduced in Jamaica, Guyana and Trinidad and Tobago markets.

Insurance Services (9% of PBT before eliminations) expanded 4.5% as the Group’s Motor Portfolio, Key Insurance, Allied Insurance Brokers and Canopy insurance all experienced steady growth while maneuvering constricted markets. Post-earnings publication, GKC completed the acquisition of Scotia Insurance Eastern Caribbean on August 3rd 2021 with the company to be rebranded under the name “GraceKennedy Life Insurance Eastern Caribbean Limited (GK Life)”.

Banking and Investments (6% of PBT before eliminations) improved 33.3% over the period driven by a growth in deposits as well as increased top line growth by corporate finance, brokerage and principal investment activity.

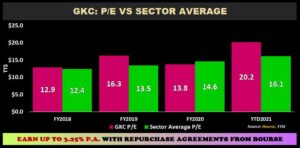

P/E Rises Above Sector Average

GKC’s trailing Price-to-Earnings ratio(P/E) increased from 13.8 times (sector average 14.6) in FY 2020 to 20.2 times (sector average 16.1) YTD 2021, with the stock’s price and multiple expansion far outpacing earnings growth and the sector average multiple respectively. This could either be an indication of some near-term overshooting of the stock price to the upside, or investors’ vote of confidence in the future growth prospects. As GKC continues to pursue growth through acquisition, investors appear to be anticipating a ‘catch-up’ of earnings to growth in its stock price.

The Bourse View

GKC is currently priced at $6.25 having appreciated 62.3% year-to-date (YTD) and trades at a trailing P/E ratio of 20.2 times compared to the Conglomerate Sector average of 16.1 times. The stock currently offers shareholders a trailing dividend yield of 1.3%, below the sector average of 2.5%. The Group noted its intention to restructure its current holdings to create a unified GraceKennedy Financial Group under a new holding company. The change is slated for 2022 with the aim of maximizing shareholder value. On the basis of a positive earnings momentum and acquisition activity, but offset by food inflation concerns and above-average valuations, Bourse maintains a NEUTRAL rating on GKC.

Agostini’s Limited (AGL)

Agostini’s Limited (AGL) reported an Earnings Per Share of $1.49 for the nine-month period ended June 30th, 2021 (9M 2021), 14.6% higher than $1.30 in the previous period. Revenue marginally increased by 2.6% to $2.68B from a previous $2.61B. Operating Profit rose a noteworthy 17.1% to $231.4M, compared to $197.7M in 9M 2020. Finance Costs were $3.9M (14.8%) lower, at $22.3M in the current period. Profit Before Taxation climbed 21.9% from $171.5M to $209.2M in 9M 2021. Taxation Expense was $66.5M relative to the prior $48.4M. Profit Attributable to Owners of the Parent was at $103.3M, 15.2% higher than $89.7M reported in the prior period.

Profits Improve

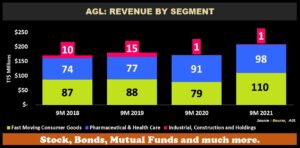

Fast Moving Consumer Goods (FMCG) which accounted for 52.5% of PBT, grew 38.9% from $79M to $110M in the current period, while Revenue generated by the segment rose 1.3% YoY.

The Pharmaceutical & Health Care segment (46.8% of PBT) improved 7.2% from $91M to $98M in 9M 2021, despite reduced demand for its cosmetics and related products and likely normalizing demand for pharmaceutical products. The recently acquired Oscar Francois Ltd and Intersol Ltd businesses, as well as the integration with Smith Roberson and Company Ltd also contributed towards the 5.5% YoY increase in this segment’s Revenue.

Industrial, Construction and Holdings increased 36.3% from $1.1M to 1.5M in 9M 2020, despite the setbacks faced due to closure of operations from the Pandemic-induced lockdown in Trinidad and Tobago, curbing construction activities. The Group is awaiting regulatory approval for the 100% acquisition of Process Components Limited through its subsidiary Rosco Petrovance, which was announced on June 1st, 2021. The energy equipment supplier company is intended to meet the growing regional demand for energy services in Guyana and Suriname. The lifting of the lockdown restrictions in mid-July 2021, should bode well for the performance in this division.

Margins Improve

Accompanying AGL’s revenue growth were improvements to its Operating Profit and Profit Before Tax margins. Both have trended continuously upward as AGL focuses commitment to improving operational efficiency, increasing throughput and maintaining cost containment initiatives. Operating Profit Margin improved to 8.6% in 9M 2021 from 7.6% in 9M 2020. Profit Before Tax Margin also moved to 7.8%, in comparison to a prior 6.6%.

The Bourse View

AGL is priced at $23.01 and currently trades at a Price to Earnings Ratio of 11.4 times, in comparison to the Trading sector average of 7.9 times. AGL currently offers shareholders a trailing dividend yield of 3.5%, relative to a sector average of 3.2%.

With economic uncertainty surrounding the impact of new COVID-19 viral strains and its impact on AGL’S core operating jurisdiction of Trinidad and Tobago and its other key jurisdictions, demand for cleaning products and pharmaceuticals is likely to persist. The Group’s ongoing acquisition initiatives are anticipated to capture both existing markets and regional energy market growth.

On the basis of, acquisition activities and improving margins but tempered by lingering economic challenges, Bourse maintains a NEUTRAL rating on AGL.

DISCLAIMER: “This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”