HIGHLIGHTS

TTNGL HY 2021

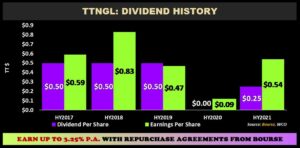

- Earnings: Earnings Per Share of $0.54, up from EPS of $0.09

- Performance Drivers:

- Recovering Commodity Prices

- Outlook:

- Higher International Trading Volumes

- Economic Uncertainty

- Rating: Maintained at NEUTRAL

PLIPDECO HY 2021

- Earnings: Earnings Per Share of $0.68 a decline from Earnings Per Share of $1.57

- Performance Drivers:

- Improvement in Revenue

- Decline in Operational Performance

- Outlook:

- Advances in Operating Systems

- Economic Uncertainty

- Rating: Maintained at NEUTRAL

This week, we at Bourse review the performance of Trinidad and Tobago NGL Limited (TTNGL) in the energy sector and the Point Lisas Industrial Port Development Corporation Limited (PLIPDECO) both for the 6-month period ended June 30th 2021. TTNGL reported improved earnings on account of the stabilization of energy markets and benefited from higher profitability driven by their investment in PPGPL. Meanwhile, PLIPDECO faced operating challenges due to sluggish economic activity. Will both companies continue to progress? What might investors expect in the months ahead? We discuss below.

Trinidad and Tobago NGL Limited (TTNGL)

TTNGL reported earnings per share (EPS) of $0.54 for the half-year period ended June 30th 2021 (HY 2021), a 500% increase from $0.09 reported in the prior comparable period. Share of Profit from its sole investee company, Phoenix Park Gas Processors Limited (PPGPL), increased by $69.6M, from $14.9M to $84.5M primary driven by (i) an increase in Mont Belvieu prices and (ii) a 3.8% increase in NGL production due to 5% higher NGL content in feedstock from the Natural Gas Company of Trinidad and Tobago. Interest Income declined 57.0% to $0.06M, while expenses increased 35.2% from $0.65M to $0.88M over the period. Profit Before Tax increased 477.2% year-on-year (YOY), from $14.5M to $83.7M. Overall, the Group reported Profit After Taxation of $83.62M, a 475.5% increase compared to $14.53M reported in the previous period.

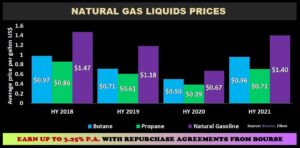

NGLs Prices Recover

TTNGL’s performance improved with recovering energy commodity prices, in particular the continuing recovery in prices of natural gas liquids, as measured by Mont Belvieu benchmarks. Average Butane prices increased 92% from $0.50 per gallon in HY2020 to $0.96 in HY2021. Average Propane increased 82% to $0.71 per gallon, while Average Natural Gasoline increased 109% year-over-year to $1.40 per gallon. Notably, all average benchmark NGLs prices were also higher than the corresponding levels in HY2019. Stronger energy commodity prices would be welcome news to TTNGL and its investors, improving the earnings prospects of the company.

Production and Export Declines

During the period of January- May 2021, production of NGLs declined 33.2% to 2.59 million barrels relative to 3.45 million barrels produced during the period of January-May 2020. Export of NGLs also contracted 26.6% from 2.97 million barrels during the period January-May 2020 to 2.18 million barrels during January- May 2021. Nevertheless, the Group successfully renewed key sales contracts in the Eastern Caribbean market while maintaining consistent demand from local downstream partners.

Overseas Assets Deliver

According to TTNGL, PPGPL’s North American Subsidiary, Phoenix Park Trinidad and Tobago Energy Holdings Limited (PPTTEHL) continues to grow as the subsidiary experienced high trading volumes for the half-year period and continued to benefit from improved margins from sales contracts with its counterparties. PPTTEHL contributed approximately 7% to PPGPL’s profit after tax, with the Company expecting continued earnings growth from the business segment.

A Dividend Recovery Story?

TTNGL announced a dividend of $0.25 per share payable on September 15th 2021, after opting not to pay a dividend during the half-year period of 2020. PPGPL previously stated its commitment to conservative cash management intended to preserve its financial profile during uncertain economic times. With stabilizing energy prices and improving profitability, TTNGL’s ability to offer more attractive dividends to investors could also improve.

The Bourse View

At a current price of $17.66, TTNGL trades at a trailing P/E of 36.0 times. The stock has appreciated 3.9% year-to-date and offers investors a trailing dividend yield of 1.7%. With Mont Belvieu prices gradually recovering and resilient demand for energy commodities as economies normalize, PPGPL and by extension TTNGL, should continue to benefit from the upward cycle in energy markets. On the basis of rising energy commodity prices, but tempered by short-term dividend uncertainty and lower domestic energy production concerns, Bourse maintains a NEUTRAL rating on TTNGL.

Point Lisas Industrial Port Development Corporation (PLIPDECO)

PLIPDECO reported an Earnings per Share (EPS) of $0.68 for the six months ended June 30th, 2021 (HY 2021), 56.7% lower than an EPS of $1.57 reported in HY 2020.

Revenue for the period amounted to $155.6M in HY 2021, up 6.4% or $9.3M as reported in the prior period, with Gross Profit moving from $102M to $109M. PLD’s performance has been impacted by Unrealized Fair Value Gains, falling from $54.2M IN HY2020 to $16.3M in HY 2021. Operating Profit declined 55.4% to $30.2M in comparison to $67.8M in HY 2020. Without the impact of Unrealized Fair Value Gains, Operating Profit declined a modest 0.4%, while adjusted PBT (excluding the impact of Unrealized fair value gains) improved 11.5% to $13M as compared to $11.7M in the prior period. Reported Profit Before Tax (PBT), however, fell 55.4% drop for the period, from $65.9M to $29.4M.

The Group recorded a decline in Finance Costs from $2.37M to $1.24M and taxation expenditure of $2.5M. Consequently, Profit for the Period declined 56.6% from $62M reported in HY 2020 to stand at $26.9M in HY 2021.

Profit from Operations Recover

Discounting Unrealized Fair Value Gains for both years, results in an adjusted EPS of $0.25 as compared to $0.24 in HY 2020, an increase of 4.2%.

The decline in reported Profit Before Tax (PBT) from $65.9M to 29.4M was mainly attributable to the decline in Unrealized Fair Value Gains on Investment Properties from $54.2 to $16.3 in HY 2021. Excluding this usually volatile item, adjusted PBT from operations increased 12% from $11.7M to $13.1M in HY 2021.

The increase in group revenue of 6.4% was mainly as a result of an increase in cargo throughput at the Port as well as an improvement in revenue earned from the management of the Point Lisas Industrial Estate. The Port experienced a 29% growth in general cargo tonnage and a marginal increase of 1% in containerized cargo volumes.

The Bourse View

At the current price of $3.20 and a reported trailing EPS of $1.33, the stock trades at a trailing P/E of 2.4 times. After adjusting for the impact of unrealized fair value gains on investment properties, PLD trades at an adjusted P/E of 7.4 times. The Group made a decision to not to declare an interim dividend payment in its latest earnings release.

In the light of the COVID-19 Pandemic, PLD reiterated its cautious approach to operations and reporting obligations while making the requisite changes to its operating systems. Increased vaccination efforts locally may provide some optimism for a more stable and gradual economic recovery which could ultimately benefit the Group. However, the emergence of the Delta Variant contributes to uncertainty as it relates to the path of full economic recovery. On this basis, Bourse maintains a Neutral rating on PLIPDECO.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”