| HIGHLIGHTS MASSY HY 2021 Earnings: Earnings Per Share of TT$2.98, ↑23.7% from TT$2.41 Performance Drivers: Investment Gains Lower Costs Outlook: Elevated Demand for Gas Products (Oxygen) Demand for Consumer Staples Economic Uncertainty Rating: Maintained at NEUTRAL GKC Q1 2021 Earnings: Earnings Per Share of TT$0.07, ↑25.8% from TT$0.06 Performance Drivers: Increased Revenue Lower Net Impairment Losses Outlook: Growth from Acquisition Resilient Revenue Base Economic Normalization in Core Jurisdictions Rating: Maintained at NEUTRAL |

GKC, MASSY Record Improved Earnings

This week, we at Bourse review the performance of regional conglomerates, Massy Holdings Limited (MASSY) for the half year ended 31st March, 2021 and GraceKennedy Limited (GKC) for the first quarter ended 31st March, 2021. MASSY reported improved earnings owning to increases in investment gains and improvements in expense, offsetting economic challenges in its jurisdictions. GKC benefitted from growth in its revenue and a decline in Net Impairment Losses. With both entities benefitting from conditions set forth by the pandemic in 2020, will growth continue into 2021? We discuss below.

Massy Holdings Limited (MASSY)

Massy Holdings Limited (MASSY) reported Earnings per Share (EPS) of $2.98 for the six-month period ended March 31st 2021 (HY 2021), 23.7% higher than the EPS of $2.41 reported in HY 2020. MASSY’s Revenue from Continuing Operations marginally fell 0.7% YoY, from $6.12B to $6.07B. Operating Profit After Finance Costs advanced 21.5% to $437.4M. Resultantly, the Operating Profit Margin moved from 5.9% to 7.2%. Share of Results of Associates and Joint Venture contracted by 27.1% to $24.8M influenced by turnaround expenses in Caribbean Industrial Gases Unlimited and lower business activity for Massy Wood. Nonetheless, Profit Before Tax (PBT) expanded by 17.3% to $462.2M. Overall, Profit Attributable to Owners of the Parent from Continuing Operations stood at $293.5M, (up: 24.7%) compared to $235.3M reported in the previous period.

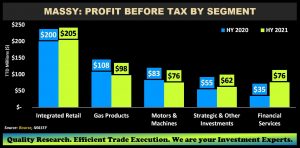

Financial Services Propels PBT

Despite recording a 0.7% decline in Revenue, MASSY’s PBT expanded by 17.3% during HY 2021 mainly driven by MASSY’s approach in managing its operations as an Investment Holding Company, which benefitted from recovery in Financial markets as compared to the sharp decline in HY 2020. As a result, Financial Services (7.2% of PBT) recorded stellar performance, increasing by 119.6%, as MASSY was able to record $61M more in investment gains. Integrated Retail, representing 41.7% of PBT improved 2.3% during the period owing to cost management, which offset the 4.6% contraction in Revenue attributed to lower consumer spending.

Gas Products, (HY 2021 PBT: 22.5%) recorded a 9.7% reduction in PBT during the period, influenced by lower margins from Carbon Dioxide sales in Trinidad. Notably, the segment’s revenue improved 4.2%. However, lower business activity in Jamaica’s hospitality industry has reportedly affected demand for Liquefied Petroleum Gas, while muted activity in Trinidad and Tobago’s Petroleum Sector has resulted in lower volumes of Nitrogen sales, posing a challenge to further revenue growth. In the short run, pandemic-induced demand for Oxygen could provide a short-term boost to segment revenue.

MASSY reported a 9.3% increase in revenue reported by its Motors and Machines segment owing to growth in the Colombian market. However, the Group experienced lower sales in its main operating jurisdiction (Trinidad & Tobago) linked to lower levels of inventory, contributing to an 8.6% contraction in the segment’s PBT.

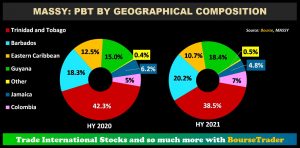

Trinidad PBT Dominance Declines

As part of its geographical diversification strategy, MASSY has been increasing its exposure across the Caribbean and Latin America. PBT contributed by Trinidad and Tobago now represents 38.5% of PBT, compared to 42.3% in HY 2020. Jamaica, which represented 6.2% of PBT in HY 2020, now accounts for 4.8%. Meanwhile, PBT contributed by Barbados increased from 18.3% in HY 2020 to 20.2% in HY 2021. Similarly, Guyana now accounts for 18.4% of PBT, $95.3M relative to $71.9M or 15.0% of PBT in HY 2020 and Colombia represents 7% of MASSY’s overall PBT relative to 5% in HY 2020.

Reinstated lockdown measures in the primary operating jurisdiction of Trinidad and Tobago could weigh on MASSY’s near-term operations, particularly in its Motors and Machines segment. Constrained energy sector activity may be partially offset by non-traditional increases in demand for its Gas Products segment. The Integrated Retail segment has proven to be resilient throughout the pandemic, despite lower revenue. Supply chain management, inflationary pressures and consumer spending power could all play a role in the fortunes of this segment in the months ahead.

In addition to expanding it LPG operations in Colombia, MASSY is expanding its footprint in the Colombian economy as an exclusive dealer of Mazda and Mercedes Benz, while maintaining dealerships for brands including Volvo and Kia. Colombia is expected to expand by 5.1% in 2021 (IMF April 2021 Outlook), although recent civil unrest – arising from highly unpopular proposed taxation changes – could lead to economic disruption. Similarly, MASSY continues to improve its exposure in Guyana, a region poised for ongoing economic development and one that has been proactive in its vaccination rollout.

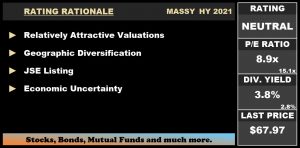

Massy Holdings Limited to Cross List

In a notice issued on the 10th of May, MASSY advised shareholders of its intention to list on the Jamaica Stock Exchange (JSE), with the Group citing market sophistication and growth opportunities as supporting factors for its decision. Given a current market price of $67.97, this equates to a price of approximately J$1,513.81 at current multiples and FX rates. Notably, MASSY currently trades at materially lower valuation multiples when compared to its Jamaican peer, GraceKennedy Limited.

The Bourse View

At a current price of $67.97, MASSY trades at a trailing P/E of 8.9 times, below the Conglomerate sector average P/E of 15.1 times. The stock offers investors a trailing dividend yield of 3.8%, above the Conglomerate sector average of 2.8%. The Group increased its interim dividend by 10%, to $0.55 payable on June 15th 2021. Through its 10% stake in Caribbean Gas Chemicals Limited (CGCL), MASSY’s ability to continue to generate foreign exchange through the export of methanol can continue to support the group’s profitability, contingent on the supply of Natural Gas. Methanol prices have increased 13.4% YTD to US$396.57/MT. While resilient as a firm, MASSY’s broader operating jurisdictions are likely to confront challenges in the immediate future as regional economies attempt to overcome the lingering effects of the COVID-19 pandemic. The intended cross-listing of MASSY should also generate additional investor interest in the stock, given the recent (though still-early) experience of other Groups that have opted to cross-list on the Jamaica Stock Exchange, for various reasons. On the basis of relatively attractive valuations, improving operations across regional territories and cross-listing opportunities on the JSE but tempered by lingering economic uncertainties, Bourse maintains a NEUTRAL rating on MASSY.

GraceKennedy Limited (GKC)

For the first quarter ended 31st March, 2021 GKC reported Earnings per Share of TT$0.0745 relative to TT$0.0593 in the prior period, an increase of 25.8%. Revenue from Products and Services amounted to $1.36B relative to a prior $1.25B, a 9.0% increase spurred by continued demand for its food trading products. Interest Revenue also improved 2.9% to $50.0M. Total Revenue for the period amounted to $1.41B based an increase of $114.0M or 8.8%. Direct and Operating Expenses grew 8.9% to $1.34B from a previous $1.23B. Net Impairment Losses on Financial Assets moved to $4.7M from a prior expense of $11.1M. Other Income stood at $37.8M improving from $28.8M in Q1 2020. Profit from Operations was $106.3M, 23.2% up year on year. Interest Income from Non-Financial Services stood at $5.8M while Interest Expense from Non-Financial Services amounted to $11.9M. Share of Results of Associates and Joint Ventures was $12.8M for Q1 2021, an increase of $2.3M relative to $10.5M reported in Q1 2020. Profit before Tax was $113.1M an improvement of 26.6% compared to $89.4M in the prior comparable period. Taxation Expense was $30.5M for an Effective Tax Rate of 27% consistent with that reported in Q1 2020. Net Profit for the Period was $82.6M. Overall, Profit Attributable to Owners of the Group was $74.3M, a 25.6% increase from $59.2M in Q1 2020.

Food Trading, Money Services Advance

Food Trading, which comprised 53.4% of GKC’s Profit Before Tax (pre-eliminations) in Q1 2021, recorded the largest absolute increase for the period with the segment expanding $12.3M from $53.9M to $66.2M. The growth in the segment was attributable to double digit growth in its domestic market of Jamaica, as demand for its established product offerings remained strong. Additionally, its sales in international markets primarily Canada, USA and the UK have continued to improve. In the US, the Group purchased televised ads for its Jamaican patties, complementing the listings of items in retail outlets such as Kroger, Target, Stop and Shop and Shoprite. Notably, in February 2021 GKC announced the investment of a reported US$3M in the construction of a second plant at its Grace Food Processors (Canning) complex to facilitate a merger with the manufacturing operations of National Processors (Nalpro). The construction is expected to be completed by the second quarter of 2022, at which time, GKC will be looking to either lease or divest the Nalpro factory. Arising from the merger, GKC will now operate five manufacturing plants across Jamaica. GKC estimates that the merger will improve its operational efficiency and create further opportunities for revenue growth. In March, the Group also announced its acquisition of Jamaican bottled water brand 876 Spring Water.

GKC’s Money Services, accounting for 38% of the Group’s pre-eliminations PBT, grew by TT$10.9M or 29.7%. Western Union, engaged in the provision of money transfer services to clients is a key contributor of this segment’s performance. Other major lines of business include bill payments facilitated through Bill Express and foreign currency trading facilitated through FX Trader. The World Bank estimated that remittances into Latin America and the Caribbean will grow by 4.9% in 2021 relative to US$103B in 2020, which, if realized, is likely to benefit the Money Service operations of GKC.

Insurance Services contributed 3% of PBT before eliminations in Q1 2021 amounting to TT$3.8M, relative to a Loss of $0.2M in the prior period. For Q1 2021, the Group reported an improvement in the revenue generating abilities of the three operational components of this segment: GK General Insurance, Key Insurance Company Limited of which GKC owned a 65% stake as at 31st December 2020 and Canopy Insurance which is a joint venture of which GKC owns 50%. GKC further expanded its insurance portfolio in May 2021, announcing an increased stake in Key Insurance to 73.6%, having spent J$163.4M (TT$7.34M) to acquire the additional interest. In March 2021, GKC also advised that it would be acquiring 100% of Scotia Insurance Eastern Caribbean Limited. To fund this acquisition, in addition to that of 876 Spring Water, GKC raised J$3B (TT$134.7M) through a privately placed bond.

Banking & Investments accounted for 5.4% of PBT before eliminations and grew $3.1M to $6.7M in Q1 2021. For the period, the Group added another location to its banking network, and benefitted from improvements in its investment banking and brokerage division.

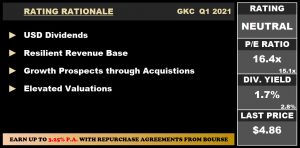

The Bourse View

GKC is currently priced at $4.86 having appreciated 26.2% year to date, and trades at a price to earnings ratio of 16.4 times relative to the Conglomerate Sector average of 15.1 times. The stock currently offers shareholders a trailing dividend yield of 1.7% relative to the sector average of 2.8%. According to the Group’s 2020 Annual Report approximately 53.4% of its revenue is generated from Jamaica while 27.3% is generated in North America. With the US and Canada reporting a continuous easing of restrictions as vaccine rollouts continue and Jamaica in recent weeks showing a downward trend in the number of new cases reported, GKC may benefit from the economic normalization of its core jurisdictions.

With a significant proportion of GKC’s revenue earned through the sale of food products (a consumer staple), GKC is well-positioned to weather any shifts in the economic cycle. The recently noted acquisition activities initiated by GKC are anticipated to provide a platform for further regional growth particularly in the provision of financial services. On the basis of USD dividend payments, growth prospects from acquisition, a relatively resilient revenue base but tempered by elevated valuations, Bourse maintains a NEUTRAL on GKC.