HIGHLIGHTS

|

Manufacturing Sector Fragile

This week we at Bourse review Manufacturing Sector stocks, within the context of the recent downward revision of Trinidad and Tobago’s 2021 growth forecast by the IMF’s World Economic Outlook dated April 2021 to 2.1% from a previous 2.6% (January 2021). Investors in Manufacturing Sector (I and II) stocks on the Trinidad & Tobago Stock Exchange (TTSE) will be keenly focused on developing economic and industry events which could impact the performance of these companies. Have domestic Manufacturing entities been able to withstand the COVID-19 induced economic shifts? Will slower forecast economic growth derail the performance of these companies, or can they effectively adapt to changing conditions? We discuss below.

Manufacturing Sector Valuations Decline

A combined index of the Manufacturing I and II Sectors on the TTSE shows that the value (market capitalization) of publicly-listed Manufacturing stocks fell 14.8% from $16.2B at the end of 2019 to $13.8B as at 16th April 2021. On a year-to-date basis, the index appreciated 4.4%.

West Indian Tobacco Company Limited (WCO), the largest manufacturing stock accounts for roughly 60.4% of the index value. Angostura Holdings Limited (AHL) is the second largest, contributing 23.1% to the index. Both stocks reported a decline in market value from the close of 2019 to date, with WCO depreciating 21% and AHL falling 5%. National Flour Mills (NFM) and Trinidad Cement Limited (TCL) which account for a combined total of 10% of the value of manufacturing stocks, rallied 67% and 50% respectively in the period, providing some support to the performance of the sector. All other stocks in the sector would have posted double-digit percentage declines.

Common Economic Challenges

The publicly-listed Manufacturing Sector stocks represent multiple industries, including construction materials, food processing, personal care products, broadcasting, distillers and wineries and tobacco. Despite the diverse industry backgrounds, all companies are likely to confront common factors of a low-growth environment including:

- T&T’s still-heavy reliance on the energy sector to drive economic activity

- Limited access for foreign exchange

- Potential inflationary pressures from

- The liberalization of fuel prices

- The potential increase in utility rates (water, electricity)

Industries Face Change

Trinidad Cement Limited (TCL) reported a Loss Per Share of $0.07 in FY2020 relative to a loss of $0.03 in FY2019. Despite recording a 1.3% growth in Revenue, increases in the Group’s Finance Cost, Deferred Taxation Expense and Income Attributable to Non-Controlling Interest contributed to the Loss. Reduced competition from potential trade restrictions on imported cement substitutes could bolster demand for TCL’s product, which would likely have also contributed to the recent run-up in its stock price. This, in addition to continuation of cost containment strategies could strengthen TCL’s profit margins and profitability. However, the onslaught of COVID-19 and the ongoing challenges in the local energy sector could constrain the Government’s revenue inflows, likely impacting its capital expenditure programs in the near term. Opportunities to improve TCL’s revenue growth will likely be more dependent on private sector construction initiatives, which in turn will rely on business and consumer confidence. A sluggish economic recovery is likely to prompt more cautious spending among private investors. Notably, local sales of cement grew 19.4% in the last quarter of FY2020, while exports were 14.3% lower.

Angostura Holdings Limited (AHL) reported an Earnings Per Share (EPS) of $0.71 in FY2020, 2.9% higher than $0.69 in the prior year. AHL’s performance was driven by a 6.9% increase in Revenue, primarily propelled by a shift to at-home consumption and the introduction of new products. The ongoing rollout of new products (such as the recently-launched White Oak Pink Grapefruit) could support AHL’s profitability, keeping the brand fresh and consumers engaged. However, the cancellation of Carnival festivities and the prolonged closure of traditional distribution channels (restaurants, bars etc.) present challenges to AHL’s normal operations. While the nature of AHL’s offerings as a consumer non-discretionary product may provide some revenue resilience, a sluggish economic recovery and consumer disposable income challenges could impede AHL’s financial performance.

National Flour Mills (NFM) reported an EPS of $0.20 in FY2020, a 300% increase from the $0.05 recorded in FY2019. Enhanced cost management initiatives undertaken by NFM, coinciding with marginal revenue growth (↑1.3%), propelled the Group’s FY2020 performance. The essential nature of NFM’s products is likely to support revenue even under varied lockdown measures, while its intent to upgrade equipment and strategically source raw materials is anticipated to improve operational efficiency. Supply chain management, particularly in the context of global production volatility of wheat during the pandemic, remains a challenge to revenue growth and profitability.

Unilever Caribbean Limited (UCL) reported an EPS of $0.71 in FY2020, a reversal from a Loss Per Share of $2.89 in FY2019. Pandemic-driven demand for hygiene products and improvements in the Company’s operating efficiency amid the completion of its 2019 restructuring exercise were influential factors to UCL’s performance. Ongoing covid-19 measures are likely to leave demand for personal care and hygiene products elevated, supporting UCL’s revenue base in the short term. UCL’s continuation of improved cost management as reported in FY2020 could also support the stabilization of the Company’s performance. However, the availability of lower priced substitutes in an economy plagued by sluggish recovery could limit demand for UCL’s products, should economic pressures and consumer disposable income continue to deteriorate.

West Indian Tobacco Company Limited (WCO) reported a modest 1.8% decline in its Earnings Per Share from $1.65 in FY2019 to $1.62 in FY2020. Cost management in the context of marginally lower revenue was primarily responsible for the Group’s relatively resilient FY2020 performance. Operating in the heavily regulated Tobacco industry, WCO’s revenue growth has faced challenges, now compounded by the latest increase in excise duties placed on cigarettes. The Group, which has traditionally dealt with revenue growth challenges through the maintenance of strong profit margins, recently announced its intent to launch new alternative tobacco and nicotine products. The implementation these of new products will be key to WCO’s future Revenue growth. Potential threats to performance remain ongoing from restrictions on WCO’s traditional distribution through entertainment channels (bars, casinos etc.), as well as the availability of cheaper illicit substances and “vaping” substitutes.

One Caribbean Media (OCM) reported a reversal in performance for FY2020 moving from a loss per share in the prior year of $0.89 to an EPS of $0.04. Despite a 15.9% decrease in Revenue, the Group’s performance was supported by a $88.0M decline in Impairment Losses. Industry peer Guardian Media Limited (GML) recorded an EPS of $0.12 in FY2020 swinging from a prior Loss per share of $0.14. While GML’s Revenue fell 8.1% in the year, improved cost management aided the Group’s performance.

Traditional media has faced pressures in recent years, as internet-based entertainment and advertising continues to find popularity. As a result, OCM and GML have faced challenges in expanding their revenue and consumer base. These challenges were exacerbated in 2020, with the economic impact of covid-19 likely prompting many businesses to slash advertisement budgets. Both entities have attempted to improve revenue growth prospects. GML has embarked on a campaign to increase its offerings of what is stated, as more engaging entertainment and current affairs content. OCM, meanwhile, has opted to diversify its service base with operations in broadband provision, solar panel installing, distribution and packaging in addition to its traditional media services. Despite the growth prospects for these diversified product and service offerings, sluggish economic recoveries in Trinidad and Tobago and Barbados provide macro-level risks to growth for both groups.

Is There Value in Manufacturing Stocks?

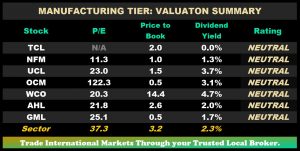

While listed within the same sector, the majority of publicly-listed Manufacturing stocks have little in common to justify a straight comparison. The average Price to Earnings (P/E) ratio for the Manufacturing Sector is 37.3 times, with NFM being the lowest-priced stock on the tier trading at a P/E ratio of 11.3 times. In terms of Price to Book, the sector average stands at 3.2 times, OCM stands at one of the lowest market priced stocks relative to book value with a P/B ratio of 0.5 times. WCO trades at the highest P/B ratio of 14.4 times and also generates the highest dividend yield at 4.7% relative to a sector average of 2.3%.

Ultimately, an investor would need to determine whether they are looking for (i) ‘cheaply-valued’ stocks, often characterized by lower P/E and/or P/B ratios or (ii) income-earners, typified by higher dividend yields. While identifying stocks with these different attributes appears fairly straightforward, a more in-depth understanding of the company’s recent performance and future outlook is essential to selecting the right stock for your portfolio. Having a good idea of your investing time horizon is also important, as the time taken to realize perceived value from holding any stock (particularly in the prevailing environment) could be protracted.

The Manufacturing Sector Tier of the Trinidad and Tobago Stock Exchange offers not only the most listings on any equity tier on the TTSE, but also the most diverse in terms of industry representation. As the economy attempts to transition into a phase of economic consolidation/recovery, the outlook remains fairly obscure. The economic environment remains dynamic in the context of vaccine rollouts, the potential for a second wave of the virus and developments in the currently subdued domestic energy sector.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”