| HIGHLIGHTS FIRST Q1 2021

RFHL Q1 2021

|

FIRST, Republic Deliver Mixed Results

This week, we at Bourse review the performance of local Banking Sector stalwarts Republic Financial Holdings Limited (RFHL) and First Citizens Bank Limited (FIRST) for the first quarter ended 31st December, 2020. After coming to terms with pandemic pressures in FY 2020, RFHL was able to deliver acquisition-driven earnings growth. FIRST, meanwhile, reported lower profitability despite a moderation of credit impairment losses.

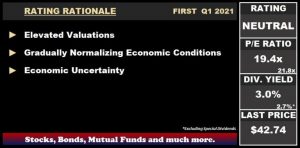

First Citizens Bank Limited

First Citizens Bank Limited (FIRST) recorded Earnings per Share (EPS) of $0.69 for the three months ended 31st December, 2020 (Q1 2021), down 22.5%, relative to $0.89 reported in the prior comparable period (Q1 2020).

Net Interest Income declined 11.0%, moving from $429.0M in Q1 2020 to $381.8M in the current period. Other Income fell 26.4%, amounting to $140.4M in Q1 2021. Cumulatively, Total Net Income was 15.8% lower, standing at $522.2M, relative to $619.9M in the previous period. The Bank recorded $16.0M in Credit Impairment Losses Net Recoveries in Q1 2021, down 17.6%, compared to a prior expense of $19.3M. Non-Interest Expenses amounted to $277.4M, $8.2M or 2.9% lower year on year. Operating Profit declined 27.3%, moving from $314.9M to $228.9M in Q1 2021. Share of Profit in Associates and Joint Ventures fell $2.2M to $4.0M in the current period. Profit Before Taxation (PBT) fell 27.5% in to $232.9M from a prior $321.1M. Taxation stood at $59.1M in Q1 2021. Overall, Profit After Taxation (PAT) fell 21.9% from $222.6M in the prior period to $173.9M.

PBT Lower

FIRST like many organizations is in the process of navigating the ongoing effects of the COVID-19 pandemic. Income generated by the group was adversely impacted by COVID-19 related client concessions including credit card rate reductions, waivers of late fees and rental fees on point of sale machines.

Retail & Corporate Banking, the Group’s largest operational segment (71%, PBT before eliminations) contracted 22.3% in Q1 2021 relative to the pre-COVID quarter Q1 2020. Likely linked to the decline in this segment is the reduction its ‘loans to customers’ portfolio, which fell 4.9% over the same period. Treasury and Investment Banking, which accounts for 22% of the Bank’s PBT earnings, contracted 11.6% year-on-year influenced by shifts in the local financial market. The Trustee and Asset Management segment reported the most significant decrease of 39.6% relative to Q1 2020.

Will Profitability Pressures Persist?

Total Net Income declined 5.2% between the period Q2 to Q4 2020 relative to Q2 to Q4 2019. In comparison to Q1 2020, Total Net Income fell 15.8% in the first quarter of 2021, potentially influenced by muted demand for loans and other banking solutions. Net Interest Income comprises more than 70% of Total Net Income, of which 60% is contributed by Loans to Customers while a further 36% is contributed by Financial Assets. The Group’s loan portfolio contracted by 5.1% to $18.6B in Q1 2021, from $19.6B in Q1 2020. Q1 2021’s accelerated reduction in Total Net Income raises questions as to whether further income generation challenges could be confronted in subsequent periods.

Credit Losses Moderate

Potentially offsetting revenue generation constraints for FIRST in subsequent periods is the normalization of Credit Impairment Loss Expenses. Q1 2021 Credit Losses declined 17.6% relative to Q1 2020. Between the period Q2 to Q4 2020, Impairment Losses swung to an expense of $193.9M relative to the prior year comparable of a gain of $10.4M, a 19 times increase. The moderation of Credit Losses in the first quarter of 2021 could signal stabilization of the lending environment, providing a cushion against revenue losses.

The Bourse View

FIRST is currently priced at $42.74 and trades at a P/E ratio of 19.4 times, lower than the Banking Sector average of 21.8 times (excluding FCI). However, its current P/E ratio remains higher than its four-year historical average of 14.6 times. The Bank declared an interim dividend payment of $0.36 per share, 18.1% lower than the prior $0.44 (Q1 2020). The stock offers a dividend yield of 3.01%, greater than the sector average of 2.72% (excluding special dividends). On the basis of elevated valuations relative to historical levels but tempered by potential (though likely protracted) improvements in economic and credit conditions, BOURSE maintains a NEUTRAL rating on FIRST.

Republic Financial Holdings Limited

RFHL reported a Diluted EPS of $2.40 for the first quarter ended December 31st 2020 (Q1 2021), up 4.8% from $2.29 reported in the prior comparable period. Net Interest Income declined marginally by 0.8% to $1.00B from $1.01B. Similarly, Other Income recorded a 4.3% decline to $4.6M in Q1 2021. Operating Income fell 1.9% from a previous $1.49B to $1.46B. Operating Expenses marginally increased (up: 0.6%) from $854.2M to $849.4M. Share of Profits of Associated Companies contracted by 18.3%, amounting to $1.2M in the current period. Operating Profit moved 3.7% lower ($23.7M) to $608.6M in the period under review. Credit Loss Expenses inched 1.0% higher to $39.3M in the current period. Profit Before Taxation (PBT) stood at $569.3M in Q1 2020, 4.1% lower than $593.4B in the prior year. Taxation Expense fell to $144.9M, reflecting an Effective Tax Rate of 25.5% compared to the previous rate of 30.4%. Overall, Profit Attributable to Equity holders of the parent improved 4.6% from $373.9M to $391.1M.

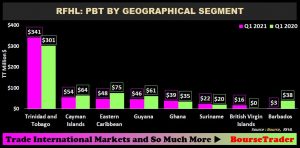

PBT Broadly Lower

Similar to industry peers, RFHL also made the decision to reduce its credit card rates, waive fees and penalties in response to conditions set forth by the COVID-19 virus. Q1 2021 net interest and fee margins were lower than the prior comparable period. This filtered into the Group’s Profit Before Tax for the period, which was down 3.7% despite a marginal reduction in expenses.

Although broadly lower YoY, RFHL was able to record an improvement in operations across its largest operation jurisdiction Trinidad and Tobago. Despite existing economic challenges, PBT generation from Trinidad & Tobago grew 13.2% relative to the prior period. The acquisition Scotiabank’s banking operation in the British Virgin Islands resulted in a contribution from this jurisdiction of $16M in Q1 2021. Tourism-based economies such as the Cayman Islands, the Eastern Caribbean and Barbados reported a reduction in PBT, with lockdowns and closed borders inevitably affecting economic activity.

Revenue Stabilizing?

Relative to the pre-COVID quarter of Q1 2020, Operating Income in the current period fell 1.9% year-on-year. During the periods Q2 to Q4 2020, Operating Income fell 7.3% compared to the prior period. The deceleration in decline of Operating Income could provide some leading indicator to top line performance for RFHL in the remainder of FY 2021.

Credit Losses Abate

While Credit Loss Expenses grew a marginal 1.0% in Q1 2021 relative to Q1 2020, the change in value reflects a marked reduction in its rate of growth since the pandemic affected period of Q2 to Q4 2020, which reported a fourfold increase. Notably, the period of Q2 to Q4 2020 included a one-off Impairment Loss from the Group’s decision to impairment the Goodwill of its Barbados operations. Anticipated stabilization of Credit Losses could provide further positive earnings momentum in subsequent reporting periods.

The Bourse View

At a current price of $134.97, RFHL trades at a trailing P/E of 23.9 times, above the sector average of 21.8 times (excluding FCI). The stock offers a trailing dividend yield of 2.0%, lower than the sector average of 2.7% (excluding special dividends). With Operating Income showing signs of stabilization and expenditure (primarily contributed by reduced Credit Losses) expected to moderate, RFHL’s earnings and dividends are increasingly likely to recover in FY 2021. RFHL’s Total Assets expanded by 2.5% to stand at $104.7B, reflecting growth from acquisition activities and the Group continues to remain well-capitalized in the volatile economic environment. On the basis of the geographical diversification of operations but tempered by historically elevated valuations and prevailing economic uncertainty, Bourse maintains a NEUTRAL rating on RFHL