| HIGHLIGHTS Energy Markets

|

Stabilization Across Energy Market Continues

This week, we at Bourse recap recent developments in the domestic energy market and international markets. With global energy prices recovering while questions grow around the local production outlook, how might investors in local energy-related assets fare? Internationally, sentiment for energy stocks has revealed signs of growing optimism. Will the international energy rally last, or could it run out of fuel? We discuss below.

Oil, Natural Gas Prices Strengthen

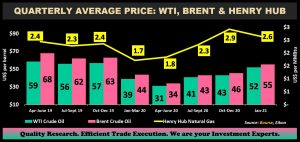

Since dipping to an all-time low of negative US$37.6/barrel in April 2020, West Texas Intermediate (WTI) oil prices have continued along a course of recovery. At the end of 2020, WTI rose to a price of US$48.52/barrel, with price momentum continuing into January on the decision by the world’s largest oil exporter, Saudi Arabia, to restrict output by an additional 1M barrels per day in February and March. WTI and Brent prices averaged US$52.10 and US$55.32 in January, (both) 7% higher than their December closing prices. Natural Gas prices averaged US$2.65/mmbtu in January 2021, 4% greater than its December 2020 closing price.

The US Energy Information Administration (EIA) in its January 26th 2021 report expects WTI spot prices to average US$49.70 per barrel in 2021, 4.6% lower than an average of January prices. Brent Crude oil is estimated to average US$52.70 in 2021, 4.7% lower than January prices. Henry Hub Natural Gas Spot Price is forecast to average US$3.01/MMBtu in 2021, increasing to US$3.27/MMBtu in 2022.

Downstream Prices Rebound

Like the broader energy market, downstream market participants encountered depressed prices over the course of 2020. Ammonia prices averaged US$162.90 per tonne between July to September 2020 (a five-year average low) and 10.2% lower than a preceding quarterly average low of $181.50, in the third quarter of 2019. However, as economic pressures and COVID-19 restrictions eased, ammonia prices recovered 19.9% in the last quarter of the year, recording a quarterly average price of US$195.30.

Methanol prices averaged US$271.20 per metric tonne in the period July to September 2020, its lowest since $250.50 recorded in the second quarter of 2016. In the last quarter of the year, methanol prices climbed to US$321.0 improving 18.3% from the prior three-month average.

NGL Prices Higher

An equally-weighted basket of NGL prices averaged US$0.46 per gallon between April to June 2020, 43.1% lower than an average of US$0.80 in the quarter ended December 2020. NGL prices have recorded some improvement, with Propane recovering 357% as at 29th January 2021, to US$0.91/gallon from US$0.20/gallon in March 2020 and Butane rebounding 207% from a low of US$0.29, also in March. Similarly, Natural Gasoline prices, improved 179% from a low of US$0.43/gallon in April. In January 2021, Natural Gasoline, Propane and Butane averaged $1.19/gallon, $0.86/gallon and $0.88/gallon, respectively.

Domestic Energy Prices Recover

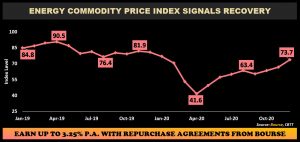

Published by the Central Bank of Trinidad and Tobago, the Energy Commodity Price Index (ECPI) is a measure of average energy prices faced by domestic energy producers, based on T&T’s top ten energy commodity exports. At the close of 2020, the ECPI stood at 73.7, 8.7% lower than 80.7 recorded at the end of 2019. Nevertheless, the ECPI recovered 77.2% since a low of 41.6 recorded in April 2020. For local energy producers, the ECPI suggests a very welcome improvement/recovery in prices.

Domestic Production Challenges Persist

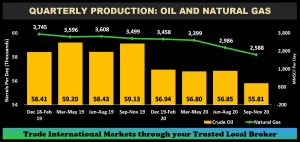

While conditions have improved on the pricing front, production of hydrocarbons at the domestic level remains challenged. Between the trailing three-month period September to November 2020, Natural Gas production averaged 2,588 mmscf/d, 30.9% lower than 3,745 mmscf/d recorded between the months of December 2018 to February 2019. For the most recent quarter crude oil production stood at 55,814 barrels per day (bopd), 4.4% lower than an average of 58,033 bopd produced in three-month period of December 2018 to February 2019. Crude oil production remains notably lower than levels reported at the start of 2018 (70,767 bopd).

Methanol & Ammonia

The production of Ammonia and Methanol declined consecutively since March 2020, following the same trajectory as that of natural gas production. Between the three-month period September to November 2020 Ammonia production totalled 1.18 million metric tonnes. The lowest quarter since 1.19 million metric tonnes reported in the period June to August 2018. While Methanol production reported a momentary recovery in the quarter ended November 2020 at 0.9 million metric tonnes relative to 0.83 million metric tonnes in the quarter ended August 2020, production still remains at a three-year low.

Natural Gas Liquids production falls

During January-November 2020, production of natural gas liquids (NGLs) declined 15% to 6.67 million metric tonnes relative to 7.86 million metric tonnes for the same period in 2019. Underpinning this decline in production was muted demand and a narrower supply of natural gas. The export of NGLs also contracted within the reported 11 months of 2020 with a total of 5.94 million metric tonnes or 89% of production, compared to 7.51 million metric tonnes or 96% of production in the prior period.

Rebound Anticipated?

Locally, the Minister of Energy in conjunction with BHP confirmed on January 22nd 2021 that the Broadside-1 well did not deliver any hydrocarbons. Continued Natural Gas supply constraints, among other challenges, led to a number of downstream plants shuttering/idling operations in 2020. Ammonia plants closures included Nutrien’s PCS 02 and PCS 01 plants, which were closed temporarily in 2020. Trinidad Nitrogen Company and Yara co-owned Tringen 1 was also temporarily closed in 2020. Methanol producer Methanex Corporation announced the idling of its Titan plant indefinitely. BpTT has also indicated that it would only not be able to meet the full natural gas feedstock demand of Methanex’s Atlas Plant demand, stemming from the natural field declines and the delaying of Cassia Compression from 2021 to 2022. BpTT, which accounted for roughly 55% of T&T’s Natural Gas production (Jan – Nov 2020) expects production in 2021 to be lower than 2020, before improving in 2022 from higher production volumes from the start-up of the Cassia Compression and Matapal Project.

The Ministry of Energy’s recent pronouncement of production growth in 2022, if realized, could lead to an improvement in the domestic energy production story. Upcoming projects forecast to support natural gas production growth include BHP’s Ruby field (producing 150 mmscf/d), BP’s Matapal (300 mmscf/d) and Shell’s Barracuda and Colibri (cumulatively 450 mmscf/d).

Investor Considerations

Locally, energy related stocks continue to face challenges mainly stemming from the shortage of feedstock and the disequilibrium between demand and supply for energy derivatives. Despite reporting a 100% QoQ increase in its Earning Per Share (EPS) (Q2 2020 vs Q3 2020), Trinidad and Tobago NGL Limited’s (TTNGL) EPS at the end of the 9M 2020 period was 63.5% lower than 9M 2019. In 2020, the stock declined 29%, closing at $17.00 and has depreciated 9.4% YTD in 2021. The continued recovery in NGL prices and demand could provide stock price support but this may be counteracted by lower production levels.

National Enterprises Limited (NEL) is also intimately linked to the local energy industry, through its ultimate 13.5% and 3.8% stake in PPGPL and Atlantic LNG Train 1, respectively. Additionally, the Group maintains a 51% stake in ammonia plants, Tringen I and II. At the end of 2020, NEL’s share price fell 45.7%, while year-to-date it has advanced 2.2%. Improving commodity prices and improvements in production could spur some support for NEL’s stock price in 2021.

Overall, however, the outlook for local energy-related stocks remains clouded by challenges to production uncertainty, translating into feedstock availability for downstream processors.

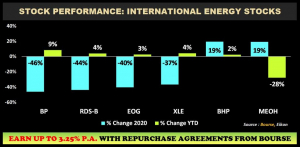

US listed energy stocks faced significant pricing pressures in 2020, amidst the mismatch between demand and supply instigated by the COVID-19 virus. BP PLC (BP) was the worst performing energy stock under consideration in 2020, down 45.6% followed by Royal Dutch Shell (RDS-B) 44.0% lower and EOG Resources (EOG) which declined 40.5%. The BHP Group (BHP) and Methanex Corporation (MEOH) were the better performing energy stocks in 2020 gaining 19.4% and 19.3% respectively.

The Energy Select Sector SPDR Fund (XLE), representing the broader Energy sector, depreciated 37% in 2020. After underperforming US markets in 2020, investor sentiment for energy stocks has seemingly shifted in 2021. Year-to-Date, the XLE has appreciated 4.2% outperforming the broader market which is down 1.2% as measured by the S&P 500. BP, the worst performing large cap energy stock in 2020, is up 9.0% YTD. Methanex, one of the best performing energy stocks for 2020, has seen a reversal of fortunes in January declining 28.0%.

At a global level, investors have started the year much more bullish on the energy sector after significant underperformance in 2020. Despite improving sentiment for energy across the US markets, investors should be cognizant of new strains of the covid-19 virus, delays in vaccine distribution and fresh travel curbs which could weigh on near-term oil and gas demand recovery.

DICLAIMER: “This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”