| HIGHLIGHTS

SBTT FY 2020 · Earnings: EPS down 22.1% from $3.79 to $2.95. · Performance Drivers: o Revenue Contraction (waiver of fees, lower interest rates etc.) o Higher Impairment costs · Outlook: o Constrained Revenue Growth o Challenging Domestic Environment · Rating: Maintained at NEUTRAL. FCI FY 2020 · Earnings: EPS down 196.2% from an EPS of TT$0.70 to a LPS of TT$ 0.68 · Performance Drivers: o Extraordinary or One-off Costs Arising from The COVID-19 Pandemic o Higher Impairment Charges o Higher Credit Loss Expenses · Outlook: o Possible decline in Credit Impairment Loss o Potentially prolonged economic recovery · Rating: Maintained at NEUTRAL. |

Scotia, FCI Lower Amid Pandemic Pressures

This week, we at Bourse review the financial performance of two Banking stocks, FirstCaribbean International Bank Limited (FCI) and Scotiabank Trinidad and Tobago Limited (SBTT) for the financial year ended October 31st, 2020. Both SBTT and FCI reported lower earnings, heavily influenced by constrained revenue growth and higher provisioning for credit losses. With the health aspects of COVID-19 set to be addressed, could economic fortunes and company performance bounce back? We discuss below.

Scotiabank Trinidad and Tobago Limited (SBTT)

Scotiabank Trinidad and Tobago Limited (SBTT) reported Earnings per Share (EPS) of $2.95 for the Financial Year ended October 31st 2020 (FY 2020), down 22.1% from $3.97 in the prior comparable period.

Net Interest Income recorded a marginal decline of 1.0%, which amounted to $1.31B in FY 2020 from a previous $1.33B. Other Income contracted by 13.0%, moving from $534.7M to $465.1M. Total Revenue stood at $1.78B for the period, down 4.4% from a prior $1.86B. SBTT focused on controlling its Non-Interest Expenses under the prevailing pandemic conditions which inched 1.3% lower, to $757.3M. Net Impairment Loss on Financial Assets grew by 59.3% to $229.9M on account for potential future expected credit losses emerging from the impact of the COVID-19 pandemic. Income Before Taxation moved from a previous $949.3M to $790.9M, recording a 16.7% decrease. Income Tax Expense amounted to $270.1M in FY 2020. Overall, SBTT reported an Income After Taxation of $520.8M, a 22.1% decline, relative to $668.3M in the prior period.

Revenue Contracts

SBTT’s Revenue growth has slowed over the past several fiscal years, recording negative growth in FY2020. Net Interest Income, which contributed 73.8% to Total Revenue, recorded a marginal decline of 1.0% relative to the prior year, likely impacted by weaker loan demand. Other Income recorded a 13.0% YoY decline, affected by SBTT’s decision to reduce credit card rates and waive loan fees and penalties for late payments, to facilitate its customers in the economically suppressed environment.

Loan Growth Inches Up

Both Loans to Customers and Loans and Advances to Banks and Related Companies which accounted for 97.4% and 2.6% of SBTT’s Total Loans, respectively, improved by 1.1% YoY. Net Impairment Losses on Financial Assets tend to rise in tandem with the growth of loan portfolios. However, the observed and anticipated economic fallout of COVID-19 would have resulted in Net Impairment Losses expanding significantly by 59.3% YoY, despite the relative unchanged size of the Group loan portfolio. Should economic conditions recover quickly, reversals to expected losses could benefit the financial performance of SBTT and other sector peers in subsequent periods.

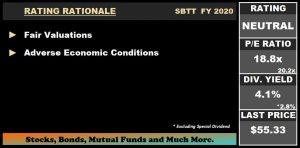

The Bourse View

SBTT is currently priced at $55.33, 9.3% lower year-to-date. The stock trades at a Trailing Price to Earnings ratio of 18.8 times, below the Banking Sector average of 20.2 times and offers investors a Trailing Dividend Yield of 4.1%, higher than sector average of 2.8% (excluding special dividend). SBTT declared a final dividend of $0.85, payable on January 11th, 2021. Cumulatively, SBTT is paying a Total Dividend of $2.25 for FY 2020, 25% lower than the $3.00 paid in FY 2019. While the domestic economy is projected to show some recovery in the near term by the IMF, the outlook remains clouded by the lingering effects of the pandemic. Nevertheless, SBTT continues to maintain a strong capital position. On the basis of fair valuations but tempered by ongoing economic uncertainty, Bourse maintains a NEUTRAL rating on SBTT.

FirstCaribbean International Bank (FCI)

FCI reported a Loss per Share (LPS) of TT$0.68 for the financial year ended October 31st, 2020 (FY 2020), relative to the Earnings per Share TT$0.70 in the previous year.

Total Revenue declined 7.2% Year on Year (YoY) to TT$3.83B in FY 2020. Operating Expenses fell 1.0% to TT$2.65B. Credit Loss Expense on Financial Assets was significantly higher, increasing to TT$1.08B (TT$1.05B greater) compared to a previous TT$24.4M. Following the economic shocks arising from the COVID-19 pandemic, FCI was forced to write down its Goodwill resulting in an Impairment of Intangible Assets of $1.17B. Consequently, the Bank reported a Loss Before Taxation (LBT) of TT$1.07B (TT$2.49B higher) relative to an Income Before Tax (IBT) of TT$1.42B in the comparable period. Overall, Net Loss for the Period stood at TT$1.06B, compared to a Net Income for the Period of TT$1.14B in FY2019. Net Loss attributable to Equity holders amounted to TT$1.07B, TT$2.18B lower than the previous period.

Revenues Dip, Expenses Climb

With its core operating jurisdictions being primarily tourist dependent economies, FCI suffered a 7.2% decline in Total Revenue for FY 2020 likely associated with the limitations imposed by the pandemic. Notably, Barbados accounted for 30.5% of Total Revenue before Eliminations in FY 2019, while Bahamas contributed a further 22.3%. According to the International Monetary Fund both these economies were projected to decline 11.6% in the case of Barbados and 14.8% for the Bahamas by the end of 2020. The IMF also projects a jump in the unemployment rate of both countries in 2020, before gradually normalising in subsequent years.

Weaker economic outlooks for FCI’s operational regions have impacted not only the revenue growth of the Bank but also asset quality. A material increase in default risk necessitated the Bank to record a Credit Loss Expense on Financial Assets charge of TT$1.085B relative, almost 45 times the $24.4M recorded in FY 2019. The Impairment of Intangible Assets led to the incurrence of a TT$1.17B expense as the Bank wrote down its Goodwill due to its near term outlook being clouded by adverse economic conditions.

As global travel continues to normalise and a Covid-19 vaccine becomes accessible to the world’s population, economies like that of Barbados and The Bahamas are more likely to record gradual economic improvements. Economic recovery could potentially lead to improved asset (loan) quality and better lending conditions.

GNB Acquisition Ongoing

The unforeseen circumstances associated with 2020 have halted the growth trajectory of FCI. While a COVID-19 vaccine signals some resumption of life as usual, the length of the road to recovery remains highly uncertain. In November 2019, GNB Financial Group Limited announced its intention to acquire a majority 66.73% interest in FCI. The GNB Group offered total consideration of US$797M in its takeover bid, equating to a per share price of roughly TT$5.07 or a 39.1% discount relative to the current market price of TT$7.05. However, for its stated total consideration, the GNB Group will be paying a premium of roughly 22.0% relative to a Book Value of US$653.4M for the targeted stake in FCI. As at the time of writing, the transaction remains open, pending regulatory approval.

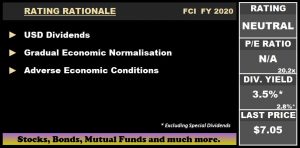

The Bourse View

FCI is currently priced at $7.05 and trades at a market to book ratio of 1.7 times relative to a sector average of 2.0 times. Despite taking the decision to not pay a final dividend for FY 2020 the stock still offers a trailing dividend yield of 3.5% excluding special dividends (6.5% including special dividends) relative to a sector average of 2.8%. FCI would have paid dividends for three consecutive quarters in FY 2020 in addition to a special dividend of US$0.0317. On the basis of USD dividend payments, but tempered by adverse conditions within its operational jurisdictions with potentially prolonged economic recovery Bourse maintains a NEUTRAL rating on FCI.