AHL Profits Decline, UCL Improves

| HIGHLIGHTS AHL HY 2020 · Earnings: EPS 23.1% lower, from $0.26 to $0.20. · Performance Drivers: o Increased Demand from Carnival season o Shifts in demand to at home consumption o Closures of primary demand channels such as bars and restaurants o Higher production costs amid facility upgrades · Outlook: o Challenged ‘traditional’ distribution channels (bars, events etc.) o New Product launches (flavored rums, cocoa bitters) · Rating: Maintained at NEUTRAL. UCL HY 2020 · Earnings: Earnings Per Share moved from $0.01 in HY 2019, to $0.23 in HY 2020 · Performance Drivers: o Increased Revenue due to increased demand for home care products in early 2020 o Lower Costs due to restructuring exercise · Outlook: o Weaker economic conditions, potential lower disposable income o Likely threats from existing lower cost substitute products · Rating: Upgraded to NEUTRAL.

|

This week, we at Bourse review the financial performance of two stocks in the Manufacturing 1 Sector for the Half Year (HY) ended June 30th, 2020 – Angostura Holdings Limited (AHL) and Unilever Caribbean Limited (UCL). AHL profits declined, despite higher revenues, on account of increases in production costs amid facility upgrades. Meanwhile, UCL improved due to reduced costs arising from its restructuring exercise and revenue growth from pulled forward demand for cleaning agents and other home care products.

ANGOSTURA HOLDINGS LIMITED (AHL)

For the period ended 30th June 2020, AHL reported a 23.1% decrease to its Earnings Per Share, moving from $0.26 to $0.20.

Revenue for the period stood at $358.5M, a 3.5% increase from $346.4M recorded in HY 2019. Cost of Goods Sold, however, grew 11.5% to $191.9M (HY 2019: $172.1M). As a result, Gross Profit amounted to $166.6M, 4.4% lower than the $174.3M reported in the prior comparable period. Selling and Marketing Expenses fell 10.0% year-on-year (YoY), while Administrative Expenses grew 6.5%. An Expected Credit Loss Reversal on Trade Receivables of $2.3M in HY2019 swung to a loss of $8.4M in the current period. Results from Operating Activities declined 19.9% from $72.4M to $58.0M. Results from Continuing Operations fell 17.1% to $63.1M, benefitting from an increase in Finance Income to $5.5M. Group Profit Before Tax for the period was $61.6M, 21.3% lower than $78.2M in HY 2019. Overall, AHL recorded a Profit for the Period of $40.8M, 22.4% lower than a previous $52.6M.

Revenue Up

AHL reported revenue growth of 3.5% in HY 2020, driven by its Rum and Bitters segments which registered growth of 7.8% and 3.9% respectively. Both segments, which collectively account for roughly 87% of AHL’s top line, benefitted from early growth during the Carnival season and later shifts in demand to at home consumption. However, the closure of bars for more than two months have inevitably weighed on performance. The Group’s Bulk and LLB product line suffered the effects of constrained global and regional demand, declining 29% and 10% respectively.

The recent launch of Cocoa Bitters and the expansion of AHL’s flavored rum product line promise increased opportunities for revenue growth. However, with the COVID-19 pandemic adversely impacting economic conditions and limiting the ability of persons to engage in social events, AHL may face near-term headwinds to demand for its products.

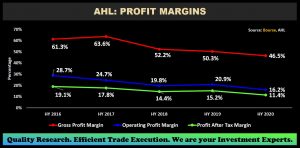

Margins Decline

AHL faced higher production costs as ongoing work on its Water Resource Recovery and Anaerobic Digester Facility created temporal inefficiencies. Gross Profit Margin in HY 2020 was 46.5% relative to 50.3% in the prior period. Margins are expected to normalize in subsequent periods, with work on the facility now being completed. Having to account for a greater probability of credit loss, AHL incurred a higher operational cost, resultantly, Operating Profit Margin stood at 16.2% in HY 2020 relative to 20.9% HY 2019. Profit After Tax margin declined from 15.2% to 11.2%.

The Bourse View

AHL is currently priced at $16.30 and trades at a trailing P/E of 25.9 times, above the Manufacturing Sector average of 22.5 times. AHL’s Board of Directors have acted to preserve the Group’s balance sheet by deferring its interim dividend payment. Resultantly, AHL offers trailing dividend yield of 1.0%, below the sector’s average of 1.6%. With ongoing uncertainty surrounding the normalisation of entertainment channels which account for a significant amount of AHL’s revenue, the Group’s top-line performance may be impacted. On the basis of product innovation, but tempered by relatively high valuations and the prevailing environmental challenges to revenue generation, Bourse maintains a NEUTRAL rating on AHL.

UNILEVER CARIBBEAN LIMITED (UCL)

Unilever Caribbean Limited (UCL) reported an Earnings Per Share of $0.23 in HY 2020, greater than $0.01 reported in the prior comparable period.

For HY 2020 the Company recorded a 7.1% increase in Revenue, moving from $137.8M to $147.6M. UCL reported a 6.2% decline to its Cost of Sales, at $81.7M relative to a prior $87.1M. This decline comes despite the addition of logistics costs, with UCL now sourcing Laundry Detergents and Dish Wash Soaps from affiliates rather than through production. Selling and Distribution Costs rose 19.8% to $44.3M, while Administrative Expenses fell 25.6% to $12.4M. Despite a one-off asset write-down cost of $2.2M, the Company reported a 266.9% YoY increase to its Operating Profit of $7.2M relative to a prior loss of $2.7M. Finance Costs stood at $0.1M while Other Income fell 11.3% to $1.3M. Profit Before Taxation was $8.5M, a more than 700% jump from a previous $1.0M. Taxation Expense was $2.6M. Overall, Profit for the Period was $5.9M relative to $0.4M in HY 2019.

Margins Recover

After several comparable periods of declining profitability, UCL undertook a restructuring exercise in 2019 which reduced its staff count and decommissioned its Laundry Detergent and Hand Dishwash Soap manufacturing facilities. This restructuring has been a contributing factor to the decline in Cost of Goods Sold and improvements to the Company’s profit margins. In HY 2020, UCL reported a Gross Profit Margin of 44.7%, its highest in 4-years (HY 2016: 42.1%). Operating Profit Margin rose to 4.9%, a notable improvement from -1.9% in HY 2019. Profit Before Tax Margin was 5.8% in HY 2020, its highest since 11.6% in HY 2016 and a marked improvement from 0.9% in the prior period.

Economic Challenges Ahead

The completion of the restructuring exercise and a sharp increase in demand for home care products in the earlier part of 2020 have bolstered UCL’s performance. In the context of falling disposable income and accessible lower cost substitute products, however, UCL may face some challenges to continued revenue growth. With the introduction of anti-bacterial variants within its Quix and CIF portfolios as well as the addition of Baby Dove and Suave Kids, UCL aims to facilitate new avenues for growth, supported by increased Marketing. UCL has also acted on a commitment to conservatively manage cash flows as its cash base increased 86% to $32.7M.

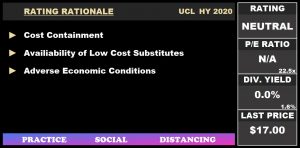

The Bourse View

UCL is currently priced at $17.00 and trades at a Market to Book ratio of 1.7 times relative to a sector average of 4.0 times. Due to the decision to not pay a dividend in the last 12 months, UCL has a trailing dividend yield of 0.0% relative to a sector average of 1.6%. On the basis of improved cost management and operating margins, but tempered by adverse economic conditions and the threat of low cost substitutes, Bourse upgrades its rating on UCL to a NEUTRAL.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”