| HIGHLIGHTS Prestige Holdings Limited

JMMB Group Limited

|

JMMBGL Advances, PHL Declines

This week we at Bourse review the financial performance of Prestige Holdings Limited (PHL) for the six-month period ended 31st May, 2020 and JMMB Group Limited (JMMBGL) for its financial year ended 31st March, 2020. PHL’ s performance was influenced by operating and accounting factors, including the enforced temporary total closure of its restaurants for approximately one month and adoption of new accounting treatments in the form of IFRS 16. JMMBGL reported an improvement in earnings supported significantly by a one-off Gain arising from the acquisition of an associate and lower taxation expenses.

JMMB Group Limited

JMMB Group Limited reported an Earnings Per Share of TT$0.19 for the financial year ended 31st March, 2020 a 70.5% increase from TT$0.11 recorded in the prior year.

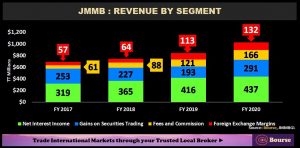

Net Interest Income in FY 2020 stood at TT$437.1M, a 5.0% year-on-year increase. Operating Revenue climbed 19.3% to TT$1.013B, assisted by a 50.6% increase in Gains on Securities Trading and slightly dampened by a TT$12.6M Net Loss on Financial Assets. The Group reported an Operating Expense of TT$750.3M in the period, 22.6% greater than TT$611.8M in the prior year. Impairment Losses impacted the Group’s profitability, increasing to TT$66.2M from a previous TT$13.1M. However, Share of Profit of Associate (TT$9.2M) and Gain on Acquisition of Associate (TT$131.8M) attributed to JMMBGL’s acquisition of a 22.5% in Sagicor Financial Company Limited provided support to the bottom-line. Profit Before Taxation resultantly rose 48.2% to TT$339.9M. Gain on Acquisition of Associate represented a significant one-off benefit to the Group’s performance. Adjusting for this particular item, the Group would have reported a Profit Before Taxation of TT$208.1M, 9.3% less than $229.4M reported in the prior year. Taxation Expense was lower (on account of deferred tax considerations) at TT$7.07M compared to a prior TT$47.2M. JMMBGL’s effective tax rate for FY2020 was 2.1%, compared to FY2019’s 20.6%. Overall, JMMBGL ended FY 2020 with a Profit of TT$332.8M, 82.7% greater than the TT$182.2M recorded in FY 2019. Adjusting for the Gain on Acquisition of Associate, Profit for the Year would stand at TT$201.0M, a 10.3% YoY increase, assisted by a significant YoY decline in Taxation Expense.

Over the course the FY 2020 JMMBGL was able to report a YoY improvement to most components of its Operating Revenue. Net Interest Income, the largest source of revenue, grew 5.0% while Gains on Securities Trading and Fees and Commission Income increased 50.6% and 37.2% respectively. Margins on Foreign Exchange also improved 17.1%. However, the Group recorded a Net Loss of TT$12.6M from financial assets at fair value through profit or loss, a likely consequence of the destabilization of financial markets towards the end of March. Having a financial year-end of 31st of March, the Group’s top line performance was left relatively unscathed by the COVID-19 virus. Notably, JMMBGL also reported a 63% increase to its Customer Deposit portfolio.

Jamaica accounts for an estimated 83% of JMMBGL’s Net Profit, while Trinidad and Tobago accounts for an estimated 13%. With the COVID-19 virus not reaching its peak in these islands until the later part of March into April, the economic sting of the virus is more likely weigh on the Group’s performance in the upcoming quarters.

Sagicor deal ‘supports’ earnings

On the 5th December, 2019 JMMBGL completed a 22.5% acquisition of insurance provider Sagicor Financial Company Limited (SFC) through a private placement purchase of 33,213,764 common shares. JMMBGL purchased its stake in SFC at a cost of CAD$332,137,638 (TT$1.69B). The move, geared at improving the Group’s operational diversification and growth prospects, was funded by equity and debt proceeds. On the 19th of November, 2019 the Group completed an Additional Public Offering making 325,000,000 ordinary shares available to the public at a price of TT$1.90 for existing shareholders and TT$1.94 to other shareholders. The conclusion of this issue allowed JMMBGL to attain J$12.3B (TT$577.0M) in proceeds.

JMMBGL’s Share of Profit of Associate from SFC was TT$9.19M. A second and more significant line item for FY2020 arising from this SFC acquisition comes in the form of a TT$131.8M Gain on Acquisition of Associate. JMMBGL accounted for this gain on the basis of the equity method of accounting, in which an investment is recognised at cost and adjusted for any changes in the fair value of the investee’s identifiable net assets.

The carrying value of SFC on JMMBGL’s balance sheet is significantly above the market value of SFC shares as traded on the Toronto Stock Exchange (TSX). As at the 31st of March, 2020 JMMBGL’s 22.5% equity stake in SFC had a carrying value of TT$1.74B. Comparatively on the 31st of March SFC’s shares closed on the TSX at a price of CAD$6.85 (TT$34.75). With 33,213,764 shares held by JMMBGL, the Group’s SFC holdings at market value would be TT$1.08B, 37.9% or TT$658.7M lower than the carrying value.

SFC has continued to face headwinds to its market valuation on the TSX. As at the 30th of June, 2020 shares of the financial services group closed at CAD$5.40 (TT$27.19). Using this price JMMBGL’s holding would be valued at TT$903M a 16.3% from market value as at 31st of March and 48% from carrying value as at this date. With the prolonged decline in SFC’s market price, investors may be concerned by the possibility of an impairment of the value JMMBGL’s associate holding in subsequent quarters.

Historically JMMBGL’s Financial Leverage ratio remains around the 10x level. However, with the Group’s Share Capital increasing by $577M in FY 2020 due to its 325,000,000 additional public offering, its reliance on debt fell on a relative basis. The increase in the Group’s Total equity meant that in FY 2020 its Leverage ratio stood at 9.7 times. Although lower than its historical average, JMMBGL’s Leverage ratio is the highest amongst Non-Banking Finance peers and the second highest amongst Banking sector peers, topped only by FirstCaribbean International with a ratio of 10.7 times. Within the Non-Banking Finance Sector JMMBGL is greater than both AMBL and GHL which reported Leverage ratios of 3.2 times and 8.3 times in their most recent financials.

In terms of its valuation JMMBGL has a price to book ratio of 2.0 times, higher than the Non-Banking Finance sector average of 1.5 times.

COVID-19 Impact

The Caribbean, while faring better than most regions from the health impact of COVID-19, has not been immune from the economic shock. Jamaica, in particular, is expected to face significant short-term pressures. A prolonged slowdown in tourist arrivals due to border closure and travel restrictions in expected to continue to pose a challenge for the economy. As a result, the IMF forecasted a 5.6% contraction of the Jamaican economy in 2020 while Trinidad and Tobago is expected to contract by 4.5% in 2020, due to the large movements of energy prices in the international markets and a reduction of economic activity. Collectively, the Latin America and Caribbean region is projected by the IMF to contract by 9.4% in 2020.

Additionally, remittances from abroad which accounts for an estimated 15% of Jamaican GDP is expected to face some headwinds as economic activities in the US continue to experience upheavals in an attempt to curb the spread of the coronavirus. This adverse economic environment is likely to lead to an increase in Impairment Losses, which may weigh negatively on JMMBGL’s bottom line going forward.

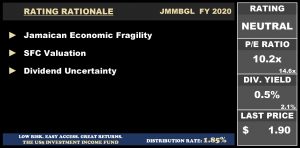

The Bourse View

JMMBGL is currently priced at $1.90 and trades at a trailing price-to-earnings (P/E) ratio of 10.2 times, below the average of the Non-Banking Financial sector average of 14.6 times. When adjusted for the one-off gain on acquisition of associate, the Group trades at a P/E of 18.5 times, which is above its sector average. JMMBGL which falls under the mandate of the Bank of Jamaica, can only pay dividends to shareholders owning 1% or less of the Group’s shares. The Group has not yet indicated their decision on the payment of final dividends for FY 2020, consequently its trailing dividend yield stands at 0.5%, below the sector average of 2.1%. With COVID-19 weighing the Caribbean economy, particularly the Group’s tourism dependent operational base of Jamaica, an increase in impairment costs and a decline in revenue performance remains a possibility. This could be partially offset by the broad-based recovery in financial markets over the second quarter of 2020. On the basis of prospective growth from JMMBGL’s equity stake in SFC, but tempered by economic impact of COVID-19, Bourse maintains a NEUTRAL rating on JMMBGL.

Prestige Holdings Limited (PHL)

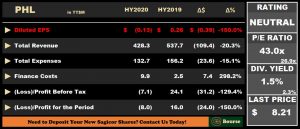

Prestige Holdings Limited (PHL) reported a Diluted Loss per Share figure of $0.13 for the Half Year ended May 31st 2020 (HY 2020), down 150.0% from the Diluted EPS of $0.26 reported in the previous period. Revenue plunged 20.3% from $537.7M in HY 2019 to $428.3M in HY 2020. Cost of Sales declined 17.4% from $356.4M to $294.2M in HY 2020. Other Operating Expenses fell 15.1% whilst Administrative Expenses declined 15.0%. PHL’s Operating Profit was down 89.5%, declining from $26.6M to $2.8M. Finance costs amounted to $9.9M, increasing $7.4M Year on Year (YoY), from $2.5M in the previous period.

PHL recorded a Loss before Taxation of $7.1M, 129.4% lower than the Profit before Taxation of $24.1M recorded in HY 2019. With the exclusion of costs related to IFRS 16 which PHL adopted in 2019, the Group’s Pre-Tax Loss would have been $2.8M. IFRS 16 lease standard adjusted the recognition, measurement and disclosure of PHL’s lease obligations. Loss for the Period closed at $8.0M, 150.0% lower than the Profit for the Period of $16.0M from the prior reporting period.

Revenue Contracts

All restaurants closed on the 7th April and later reopened on the 11th of May, as a result roughly one sixth of the Group’s revenue generating ability was slashed in HY 2020. The closure of restaurants for this period coupled with shifts in the spending patterns of consumers due to economic headwinds, contributed to a 20.3% year-on-year (YoY) decline to the Group’s top line performance. Profit Before Tax (PBT) Margin moved from 4.5% in HY 2019 to -1.7% in HY 2020, with PBT being impacted by an increase in Finance Costs coinciding with a decline in Operating Profit.

Historically, PHL has been able to maintain and as is the case in HY 2019 improve on its margins. In the last three years ending in HY 2019 PHL recorded a Gross Profit (GP) Margin of approximately 34%. However, in HY 2020 the Group’s Gross Profit Margin slipped to 31.3%, affected by a slump in top line performance due to the closure of restaurants amid measures implemented to curb the COVID-19 virus. The fall in the GP Margin comes as the decline in Revenue outpaced the fall in Cost of Sales, as Revenue fell 20% relative to a 17% fall in Cost of Sales. The closure of PHL’s restaurants for 34 days and its decision to continue paying salaries for this period albeit at a 50% of normal wages of its monthly paid workers likely added some weight to costs incurred by the Group.

Gross Profit for the period fell 26% YoY, while the cost of Other Operating Expense and Administrative Expenses fell 15% YoY. The reduction in cost ultimately was unable to completely offset the downward shift in Revenue, contributing to an Operating Profit Margin of 0.7% for the period relative to 4.9% recorded in the prior year. Net Profit Margin meanwhile stood at -1.9%, as the Group recorded a Loss for the Period of $7.9M, weighed by a $9.9M Finance Cost. The increase in Finance Costs is likely related to the adoption of IFRS 16 which increased the Total Liabilities of PHL in period.

Operations Begin to Normalise

On the June 15th restaurants were allowed to commence dine-in services in addition to existing delivery and take-out services. With the gradual normalization of operations PHL has reported encouraging sales trends. However, in coming periods it is likely that economic factors will continue to weigh on the spending patterns on consumers and possibly impact the profit generation abilities of PHL.

The Bourse View

At a current price of $8.21, PHL trades at a trailing P/E multiple of 43.0 times, greater the Trading Sector average of 26.9 times. PHL reversed its decision to pay a final dividend for FY 2019 while the decision to pay HY dividend is currently pending. Due to the gradual normalization of operations and the continuation of demand for PHL’s lower cost offerings, it is likely that there will be a quarter on quarter improvement in Q3. However, ongoing economic headwinds, the continuation of social distancing measures which limits seating capacities for in-house dining and foreign exchange access constraints can pose a threat to profitability. On the basis of potential improvements in the upcoming periods but tempered by high valuations and foreign exchange constraints, Bourse maintains a NEUTRAL rating on PHL.

For more information on these and other investment themes, please contact Bourse Securities Limited, at 226-8773 or email us at invest@boursefinancial.com.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”