| HIGHLIGHTS SBTT HY2020 · Earnings: EPS down 23.2% from $1.94 to $1.49. · Performance Drivers: o Lower Revenue from COVID-19 measures (waiver of fees, lower interest rates etc.) o Higher impairment costs · Outlook: o Constrained Revenue Growth o Challenging domestic environment. o Uncertainty surrounding SFC’s acquisition of ScotiaLife with the agreement expiring 30th June 2020. · Rating: Maintained at NEUTRAL.

FCI HY2020 · Earnings: EPS down 182.2% from a profit of TT$0.30 to a loss of TT$ 0.25 · Performance Drivers: o Extraordinary or one-off costs arising from the COVID-19 pandemic o Higher impairment charges · Outlook: o Potential headwinds due to GDP contractions in majority of operating jurisdictions. o Potential increase in Credit Loss Expense. · Rating: Maintained at NEUTRAL.

|

SBTT, FCI Earnings Decline

This week, we at Bourse review the financial performance of two recognized Canadian-origin brands in the Banking sector, Scotiabank Trinidad and Tobago Limited (SBTT) for the half year period ended April 30th, 2020 and FirstCaribbean International Bank Limited (FCI) for their fiscal half year period ended 31st March, 2020. Both SBTT and FCI reported markedly lower earnings numbers, impacted by weaker revenue generation and higher impairment charges related to the fallout from COVID-19.

Scotiabank Trinidad and Tobago Limited (SBTT)

SBTT reported Earnings Per Share (EPS) of $1.49 for the Half Year ended April 30th 2020 (HY 2020) a 23.6% Year on Year decline (YoY) from $1.94 recorded in the prior comparable period.

Net Interest Income in HY 2020 stood at $663.6M, marginally higher at 0.8% from $658.1M recorded in the previous period. Meanwhile, Other Income fell 3.9% YoY ending the period at $251.3M. Resultantly, Total Revenue declined 0.5% moving from $919.5M to $914.9M. Non-Interest Expenses increased 6.7% YoY ending the period at $403.1M. Net Impairment Loss on Financial Assets recorded a significant uptick moving to $119.1M from $74.7M, due to adverse conditions with financial markets. SBTT’s Income Before Taxation figure stood at $392.8M, a 15.9% decline from $466.9M in the previous period. The Group incurred a greater taxation charge of $130.7M as compared to $124.0M in the prior period. Overall, Income After Taxation closed at $262.1M, 23.6% lower than $342.9M in the previous period.

Revenue Stalls

In HY 2020, SBTT reported a 1% decline to its topline performance. Net Interest Income, which contributed roughly 73% of Total Revenue, recorded a marginal improvement of 0.8%. Other Income, which rounds out SBTT’s revenue driving components, reported a 3.9% decline over the comparable period.

As the domestic economy recorded a plunge in productivity due to measures implemented to mitigate the spread of the COVID-19 virus, financial pressures extended across all sectors of the economy. Resultantly, the banking sector, with SBTT being no exception, faced headwinds to its revenue generating abilities. Loan payment deferrals offered to more than 64,000 retail and business banking customers, reduced interest rates and the waiver of certain fees would have also dampened SBTT’s Revenue during HY 2020. With the economic ramifications of COVID-19 expected to linger into the foreseeable future, it is likely that the Group’s topline performance may face stagnated growth in the coming periods.

In 2018, Sagicor Financial Company Limited (SFC) announced its intention to acquire the life insurance operations of Scotiabank in Trindad & Tobago- the completion of which would lead to SBTT losing 9% of its revenue base in exchange for roughly US$96M (TT$643M). However, with the agreement expiring on June 30th and economic challenges persisting, there is no assurance by SFC that the acquisition will be completed.

Loan Portfolio Growth

SBTT was able to report a 12% increase to its loan portfolio over the prior comparable period. Loans and advances to Banks and related companies advanced 11.0% relative to the prior comparable period, while Loans to Customers rose 12%. Subsequently, both components of Total Loans contributed to a $1.9B YoY increase.

The impact of the COVID-19 virus began to materialize in March, worsening in April. While T&T is moving closer to a ‘full’ reopening of the economy, future loan demand could be subdued as the economy stagnates or shrinks. Like other companies in the sector, SBTT is likely to confront stagnated demand for banking solutions.

The Bourse View

SBTT is currently priced at $54.50, down 10.6% year-to-date. The stock trades at a Trailing Price to Earnings ratio of 16.4 times, lower than the Banking Sector average of 21.9 times (which considers the significant one-off impact to earning for multiple banks) and offers investors a Trailing Dividend Yield of 5.5%, higher than the Banking Sector average of 3.6% (4.2% including special dividends). In response to COVID-19 and its economic impact, SBTT lowered its second interim dividend payment from a prior $0.50 to $0.40 (a 20% decline). On the basis of fair valuations, but tempered by ongoing economic uncertainty Bourse maintains a NEUTRAL rating on SBTT.

FirstCaribbean International Bank Limited (FCI)

FirstCaribbean International Bank Limited (FCI) reported a Loss per Share (LPS) of TT$0.25 for the half year ended 31st March, 2020 (HY 2020), a 182.2% reduction as compared to the Earnings per Share (EPS) of TT$0.30 in the previous year. This comes as the bank grappled with a number of extraordinary or one-off costs arising from the COVID-19 pandemic. Total revenue amounted to TT$2B, 1.3% lower Year on Year (YoY), while Operating Expenses increased 3.7% from TT$1.3B to TT$1.4B. The Bank’s Credit Loss Expense on Financial Assets was significantly higher for the period, moving from TT$3.3M to TT$711.2M. A significant line item of note was the Impairment of Intangible Assets amounting to TT$339.5M, a one-off expense attributed to the Bank’s non-cash charge to the value of goodwill. As a result, Loss Before Tax (LBT) stood at TT$409.3M as compared to the Income Before Tax (IBT) of TT$714.9M in HY 2019. FCI experienced an Income Tax Credit of TT$18.9M instead of the Income Tax Expense of TT$221.7M incurred in the prior year. Overall, Net Loss for the Period amounted to TT$390.4M relative to the Net Income for the Period of TT$493.2M in the previous year. Net Loss attributable to Equity holders was reported at TT$391.4M, compared to the Net Income of TT$478.2M in HY 2019.

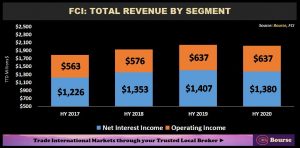

FCI’s Total Revenue registered its first decline over the comparable period in 4 years, falling 1.3% YoY. The Group’s Total Revenue is broadly divided into Net Interest Income, which accounts for approximately 68% of Revenue, and Operating Income which accounts for the remaining 32%. Although Operating Income for the period remained stable from the prior year at TT$637M, Net Interest Income fell 2.2% YoY.

Operating Segments Decline

Each of FCI’s three main operating segments experienced declines in Profit before Tax (PBT) during the HY 2020 period driven by several significant items. These included TT$670M (US$100M) of provisions for Credit Losses, a TT$341.7M (US$51M) non-cash Goodwill Impairment charge on account of the expectation of higher defaults, losses arising from defaults and macroeconomic uncertainty surrounding COVID-19 factors. Despite increasing from HY 2017 to HY 2019, the Group’s largest contributor to PBT growth, Corporate & Investment Banking, fell 48.4% from TT$401M to TT$207M. Similarly, PBT from the Wealth Management segment lost 16.2% from TT$99M to TT$83M after consistently increasing over the last 3-year period. The Retail & Business Banking segment ended its upward trend, experiencing a Loss before Tax of TT$186M for the 2020 period as compared to a PBT of TT$219M in the previous year.

COVID-19 Impact

The impact of the global pandemic on the Group’s results during the quarter influenced capital adequacy, with FCIs Tier 1 ratio slipping to 12.8% (previous quarter of 14.3%) and the Total Capital ratio of 14.5% below the Q1 2020 figure of 16.1%. Going forward, FCI is likely to face some headwinds as the IMF projects GDP contractions for FY2020 in the majority of its countries of operations. Additionally, since the probability of customers defaulting on payments is higher, Credit Loss Expenses may potentially increase. The Group’s exposure to the Eastern Caribbean islands, which are heavily dependent on the Tourism Sector, may also pose a threat to FCI’s revenue generating ability as border restrictions remain in effect.

Thus far, in an effort to provide assistance to its clients amidst the negative economic impact of COVID-19, the Bank has offered a 6-month moratoria on loans on request and a 3-month automatic moratoria on credit card payments.

The Bourse View

At a current price of TT$7.25, FCI trades at a Trailing Price to Earnings ratio of 47.1 times, more than double the Banking sector’s average of 21.9 times. The stock also offers investors a Trailing Dividend Yield of 4.6% (7.6% including special dividends), above the Banking sector’s average of 3.6%. (4.3% including special dividends). Notably, the stock pays dividends in USD, providing valuable USD cash flows in an environment of limited foreign exchange availability, but tempered high valuations, dampened earnings and uncertainty surrounding COVID-19, Bourse maintains a NEUTRAL rating on FCI.