| HIGHLIGHTS WCO Q12020 · Earnings: EPS improved 5% from $0.40 to $0.42. · Performance Drivers: o Effective cost containment. · Outlook: o Muted Revenue growth. o Likely headwinds due to substitute products and low price offerings of illicit trading activities. o Dampened demand due to uncertainty surrounding COVID-19 and contractions in operating jurisdictions. · Rating: Maintained at NEUTRAL. AHL Q12020 · Earnings: EPS increased by 20.0% from $0.05 to $0.06. · Performance Drivers: o Increased Revenue from flavoured rum introduction and higher Bitters exports. · Outlook: o Likely headwinds to performance due to temporary closure of bars and restaurants. Rating: Maintained at NEUTRAL. NFM Q12020 · Earnings: EPS advanced 100% from $0.03 to $0.06. · Performance Drivers: o Possible short-term demand ‘pull’. · Outlook: o Basic food item (flour) will likely provide some resilience amidst depressed demand surrounding COVID-19. · Rating: Maintained at NEUTRAL. |

Manufacturing Stocks Improve: WCO, AHL & NFM Reviewed

This week, we at Bourse review the financial performance of three stocks in the Manufacturing 1 Sector for the first quarter (Q1) ended March 31st, 2020- The West Indian Tobacco Company Limited (WCO), Angostura Holdings Limited (AHL) and National Flour Mills Limited (NFM). AHL’s positive performance was driven by an increase in revenue due to the introduction of new flavored rum and an uptick in the export of Bitters. WCO’s marginally improved performance was supported by improved profit margins. Meanwhile, NFM’s solid performance was influenced by significant (and likely transient) changes in consumption patterns of its core products as a result of COVID-19.

The West Indian Tobacco Company Limited (WCO)

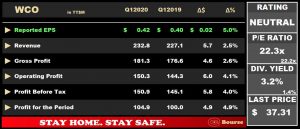

The West Indian Tobacco Company Limited (WCO) reported an Earnings per Share (EPS) of $0.42 for the first quarter ended 31st March 2020 (Q1 2020), 5% higher than the prior comparable period of $0.40. The Group generated Revenue of $232.8M for the period, surpassing Q1 2019 by 2.5%. This was accompanied by an increase in Cost of Sales from $50.4M to $51.5M, 2.2% higher Year on Year (YoY). Subsequently, Gross Profit stood at $181.3M, a 2.6% improvement from $176.6M in Q1 2019.

Operating Expenses for the period were $31M, 4.1% lower than $32.3M from the year before leading to a 4.1% improvement in Operating Profit from $144.3M to $150.3M. Similarly, Profit Before Tax (PBT) amounted to $150.9M, 4% up YoY. The Group incurred a Taxation charge of $45.9M in Q1 2020, marginally higher than $45.1M in the prior year, with the Effective Tax Rate moving from 31.05% to 30.45%. As a result, Profit for the Period advanced 4.9%, from $100M to $104.9M.

Revenue Improves

WCO has managed to generate increases in Revenue from Q1 2017 to Q1 2020, with a Compound Annual Growth Rate (CAGR) of 10.86%. Although the Group’s Revenue increased in 2020 to $233M, the growth rate for the period declined to 2.5% from a previous 20.9% in Q1 2019. This stunted growth may have been partly attributed to the weak economic environment with a shift in consumer spending patterns surrounding COVID-19.

WCO’s manufacturing operations in T&T were stopped for a just over a month as part of COVID-19 lockdown restrictions imposed by the government. The closure hampered the Group’s ability to supply products to British American Tobacco and Contract Markets and led to the depletion of local and CARICOM inventory levels. Although the effect of this was not factored into the Q1 2020 results, it is very likely to factor into second quarter performance. Moving forward, rising unemployment levels, muted consumer demand and projected GDP contraction may affect sales for WCO. The emergence of substitute products into the tobacco market such as “vaping” and lower prices associated with illicit cigarette trade activities remain a challenge.

WCO has managed to maintain its profitability throughout the past four Q1 periods as evidenced by improving profit margins. The Gross Profit Margin has consistently increased over the last four-year period, recording a figure of 77.9% in Q1 2020, in line with the previous year. Meanwhile, the Operating Profit Margin trended upward from Q1 2018 to 64.6% in 2020, marginally higher than 63.6% in 2019. Similarly, the Profit after Tax Margin increased for the last three year periods, moving to 45.1% from 44.1% in the prior year period. This is reflective of the Group’s effective cost containment strategies.

The Bourse View

At a current price of $37.31, WCO trades at a trailing Price to Earnings of 22.3 times, in line with the Manufacturing 1 sector’s average of 22.2 times. The stock also offers investors a trailing Dividend Yield of 3.2%, above the sector’s average of 1.4% despite the Group’s decision to not pay a first interim dividend payment due to the uncertainty surrounding COVID-19. On the basis of fair valuations and effective cost containment, but tempered by the economic uncertainty due to COVID-19, Bourse maintains a NEUTRAL rating on WCO.

Angostura Holdings Limited (AHL)

For the period ended 31st March, 2020 AHL was able to report a 20.0% increase to its Earnings Per Share, moving from $0.05 to $0.06.

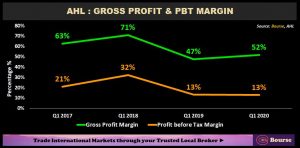

Revenue for the period stood at $153.1M, an 11.5% uptick from $137.4M recorded in Q1 2019. This comes as the Group attributed this improvement to renewed interest in the Angostura brand due to the introduction of flavoured rum blends such as White Oak Sorrel and White Oak Coconut, as well as increased sales of Bitters to export markets. Gross Profit for the period meanwhile amounted to $79.1M, 21.3% up from $65.2M reported in the prior comparable period. The Gross Profit Margin shifted from 47% to 52% in Q1 2020 as AHL was able to expand its product line while exercising proficient cost containment. Operating costs for the period increased 17.5% to stand at $57.5M as Selling and Marketing Expenses grew 11.8% year-on-year (YoY) while Administrative Expenses grew 17.4%. Nevertheless, Results from Operating Activities improved 32.7% moving from $16.3M in the prior period to $21.6M. Finance Income moved to $2.25M from $1.92M contributing to a 31.7% increase in Results from Continuing Operations which stood at $23.8M. Group Profit Before Tax for the period was $19.6M, 9.2% up from Q1 2019 as Foreign Exchange Losses of $4.3M trimmed some of the Group’s profitability. Overall, AHL recorded a Profit for the Period of $13.1M, a 20.0% YoY uptick partially attributed to a 7.5% decline in Taxation Expense for the period.

Segment Performance

Over the course of Q1 2020 AHL was able to report growth across most of its operational segments. Rum, which grew 4.3% in terms of Revenue, fell roughly 27% in terms of Operating profits. Bitters recorded significant growth to Operating Results, more than doubling relative to the prior comparable period of Q1 2019, with the segment’s profitability being bolstered by an increase in export sales. LLB reported a similar trend with its Operating Results, almost quadrupling in value relative to the prior comparable period from $0.6M to $2.2M. This was due to the brand’s association with the Caribbean Premier League tournament and a consequent uptick in demand regionally.

Heading into the second quarter of its financial year, AHL is likely to face headwinds to its financial performance as bars and clubs were forced to close on the 21st of March and will tentatively reopen on the 22nd of June. Bars and clubs facilitate a significant portion of AHL’s product sales, which, when combined with the inability of persons to hold household gatherings and parties, could negatively impact AHL’s top line performance.

Gross Profit Margin for the period rose from 47% to 52%, as AHL was able to exercise proficient manufacturing cost containment strategies while expanding its product portfolio.

Operating Profit Margin for the period stood at 14% relative to 12% recorded in the prior comparable period. The Profit Before Tax Margin was relatively flat in Q1 2020 at 13%, unchanged from that recorded in the prior period.

The Bourse View

AHL is currently priced at $14.40 and trades at a trailing P/E of 20.6 times, below the Manufacturing Sector average of 22.2 times. The stock offers a trailing dividend yield of 1.8%, above the sector’s average of 1.4%. On the basis of improved earnings and fair valuations, but tempered adverse economic conditions, Bourse maintains a NEUTRAL rating on AHL.

National Flour Mills (NFM)

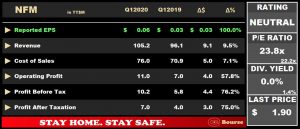

NFM reported an Earnings Per Share (EPS) of $0.06 in the first quarter (Q1) of 2020, up 100% from the previous comparable period, as the Group was able to capitalize on increased demand for flour and exercise competent cost management.

Revenue for the period jumped 9.5% to $105.23M from a prior $96.12M primarily driven by an uptick in sales of staple products. Cost of Sales rose to $75.95M, up $5.01M (7.1%), likely impacted by increased price volatility in the grains market. Nevertheless, Gross Profit was up 16.3% to $29.28M and the Gross Profit Margin improved, moving from 26.2% to 27.8%. Selling and Distribution Expense declined 6.5% owing to better operational management, whilst Administrative Expense record an increase of 4.3%. Other Operating Income was down 12.3% to $11.03 in Q1 2020. Net Finance Costs experienced a 28.7% reduction, from $1.23M to $0.88M. NFM saw a 76.2% surge in Profit Before Tax (PBT) in Q1 2020, from a previous $5.76M to $10.16M. Overall, NFM recorded a Profit After Taxation (PAT) of $7.0M, up 75% as compared to $4.0M reported in Q1 2019.

NFM was able to report top line growth of 9.5% in Q1 2020, likely spurred by increased domestic purchases arising from COVID-19 uncertainty. Widespread hoarding and ‘panic buying’ of staples and essential goods by consumers were observed, as T&T went into a period of ‘lockdown’ towards the end of March. Although Revenue improved YoY, the Q1 2020 figure is still lower than the Revenue earned in Q1 2018. Were purchases of flour to be ‘pulled’ forward into Q1 2020, it could suggest lower-than-usual sales in the subsequent quarter. As a basic component of diets, the essential nature of flour across households and restaurant-based industries is expected to provide some resilience in these uncertain conditions.

Looking forward, NFM plans to place more emphasis on serving regional clientele and seek opportunities for revenue diversification into viable agricultural based industries, with foreign exchange potential. The Group has commenced work on the feasibility of a 300-acre pilot project on Cocoa production and processing.

In FY 2019, NFM suffered from inefficiencies surrounding the cost of raw materials and the stagnant price of flour since 2008, which inflated its Cost of Sales and deflated its margins. NFM commissioned PWC to identify the root issues in order to prevent a reoccurrence of these inefficiencies. As a result, the Company modified its operating, information and cost accounting system to eliminate systemic weaknesses and increase control of the strategic purchasing and utilization of raw materials.

NFM’s Gross Profit Margin improved from 26.2% to 27.8% for the period. Improvements employed to contain the cost in other areas were able to offset increased costs in the grains markets, resulting in a 7.1% rise in Cost of Sales.

The Bourse View

At a current price of $1.90, NFM trades at a trailing P/E of 23.8 times, just above the Manufacturing I sector average of 22.2 times. The stock maintains a trailing dividend yield of 0% as the company has taken the decision to not pay final dividends for FY 2019. On the basis of fair valuations but tempered by historical declines in profitability and economic uncertainty surrounding COVID-19, Bourse maintains a NEUTRAL rating on NFM.

For more information on these and other investment themes, please contact Bourse Securities Limited, at 226-8773 or email us at invest@boursefinancial.com.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”