BOURSE SECURITIES LIMITED

27th January, 2020

MASSY Advances

This week, we at Bourse review the financial performance of MASSY Holdings Limited (MASSY) for its year ended 30th September, 2019. We examine the Group’s performance and provide a brief outlook, considering some developments on the horizon.

MASSY Holdings Limited (MASSY)

MASSY Holdings Limited (MASSY) reported a Basic Earnings per Share (EPS) of TT$5.76 for the full year ended 30th September, 2019, an 8.3% improvement over the reported 2018 figure of TT$5.32. Group Revenue remained relatively flat, increasing to TT$11.6B for 2019 (up 0.4%). Operating Profit after Finance Costs stood at TT$853.3M, a 7.3% increase over the previous year at TT$795.2M. However, Share of Results of Associates and Joint Ventures experienced a 16.3% decline to TT$66M for the period, reportedly on account of several one-off charges. Profit Before Tax advanced 5.2% Year on Year (YoY) from TT$874.1M to TT$919.2M. Overall, MASSY recorded a Profit for the Period of TT$613.2M, up 8.4% from the prior year of TT$565.5M.

Outlook

MASSY’s Profit Before Tax grew 5% in 2019, led by Integrated Retail’s 31% contribution. Despite tepid economic conditions, MASSY’s Integrated Retail segment posted PBT growth of 2.2%. The Group’s second largest segment, Energy and Industrial Gases, recorded a 4.0% decline in 2019 as MASSY contended with higher selling costs as well as one-off costs associated with write offs of legacy receivables. Caribbean Gas Chemical Limited, which is 10% owned by MASSY, is expected to commence operations in Q2 2020, with the petrochemical complex producing Methanol and Dimethyl Ether (DME). Automotive and Industrial Equipment grew 7.1% and is expected to benefit from Guyana’s projection economic expansion in coming periods. MASSY’s ITC & Other Investments segment would have grown 19% partially based on a one off gain from the sale of MASSY Technologies Applied Imaging (Trinidad) Limited. Meanwhile, Financial Services declined 6.3%, impacted by net claims arising from Hurricane Dorian amounting to TT$40.5M.

Organizational Evolution

In an effort to improve competitiveness and focus, MASSY has reorganized its business to place emphasis on three main operating segments: Integrated Retail, Motors and Machines, and Gas Products. The decision was made after an assessment of the competence and capabilities of all Business Units, aimed at determining the most significant and credible growth opportunities.

In doing so, MASSY intends to improve decision-making efficiency and foster a more entrepreneurial spirit across the entire Group.

Margins Improve

MASSY has delivered improvements to operating efficiency, evidenced by its Operating Margins which have improved since 2017. In 2019 the Group was able to report a 6% improvement to its Operating Profit compared to the prior financial year, with better cost management reducing Operating Expenses by $71M. Profit After Tax margins have also improved, moving from 3.2% in 2017 to FY2019’s figure of 4.7%.

Guyana Grows

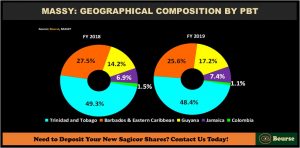

MASSY’s Profit Before Tax (PBT) by geography continues to be predominantly dependent on its Trinidad and Tobago and Barbados markets. While Economic conditions were less than favorable in these two regions, MASSY was able to report increased PBT figures from Guyana and Jamaica.

In the Trinidad and Tobago market, PBT improved from TT$498M in 2018 to TT$505M in 2019 owing to improved efficiency and expense management policies. Foreign exchange availability continues to challenge the Group’s operations, like so many other businesses dependent on ‘hard currency’ for import needs. MASSY is actively seeking strategic investments which earn foreign exchange, such as its 10% stake in CGCL.

Barbados remains in the early stages of its Economic Recovery Transformation Programme, with substantial improvement likely to be a drawn out process. The Group has undertaken various strategies to improve performance in the jurisdiction, including production rationalisation, improved efficiency structures and cost containment.

Guyana’s PBT figure grew from TT$143M in 2018 to TT$180M in 2019, with the contribution to overall PBT up 3% from 2018 to 2019 and is expected to improve further in 2020. The Group plans to continue to expand its operations throughout various segments in Guyana to capitalize on the anticipated economic growth. Concerning the Integrated Retail segment, the Group opened a MASSY Mega Store in September 2019. Within the new Motors and Machines segment, MASSY is enhancing their dealerships in strategic locations in Guyana, as well as restructuring to move the Bermudez distribution business to Guyana’s MASSY Distribution to focus on automotive and industrial equipment sales.

The Bourse View

At a price of $61.51, MASSY trades at trailing P/E of 10.7 times, below the Conglomerate sector average of 14.1 times. The stock also offers investors a trailing dividend yield of 3.7%, above the Conglomerate sector average of 3.0%. Despite muted revenue growth, MASSY has managed to improve its results through greater efficiency and cost management. These improved efficiencies, coupled with the realization of certain one-off asset sales, more than offset several one-off charges experienced in FY2019.

On the basis of attractive valuations, expansion initiatives into higher-growth markets and the likelihood of improved earnings in coming periods, Bourse maintains its BUY rating on MASSY.

For more information on these and other investment themes, please contact Bourse Securities Limited, at 226-8773 or email us at invest@boursefinancial.com.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”