BOURSE SECURITIES LIMITED

12th August 2019

Mixed Results for AHL and TCL

This week, we at Bourse review the financial performance of two local Manufacturing companies for their respective six-month periods ended 30th June, 2019 – Angostura Holdings Limited (AHL) and Trinidad Cement Limited (TCL). Angostura continues to broaden its market share in the international space which, added to improvements in its commodity trade segment, would have led to improved overall performance. In contrast, TCL’s profitability continues to slide lower due to depressed local demand for its products and rising expenses.

Angostura Holdings Limited (AHL)

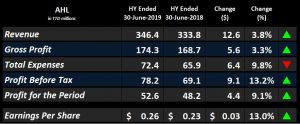

Angostura Holdings Limited (AHL) reported Earnings per Share of $0.26 for the HY period ended 30th June 2019, an increase of 13.0% from last period’s $0.23.

Revenue for the current period increased 3.8% to $346.4M from $333.8M in HY 2018. This was, however, accompanied by a rise in Cost of Goods Sold to $172.1M, an increase of 4.3% or $7.1M over the prior comparable period. Resultantly, Gross Profit rose 3.3% from $168.7M in 2018 to $174.3M in 2019. Gross Profit Margin edged slightly lower to 50.3% from 50.6%. Total Operating Expenses experienced a marginal 0.9% decline YoY, from $102.8M to $101.9M, attributable to a $8.4M (11.8%) reduction in Selling and Marketing Expenses, but offset by a $7.5M (23.9%) uptick in Administrative Expenses YoY. Results from Operating Activities improved 9.8%, from $65.9M to $72.4M. The Group’s Profit before Tax for the HY 2019 period amounted to $78.2M, representing a 13.2% or $9.1M improvement. Overall, Profit for the Period grew 9.1% YoY to a close of $52.6M as compared to the $48.2M recorded in the prior comparable period.

Outlook

AHL’s 2017 decision to downsize its unprofitable export commodity rum business and redirect resources to building the global profile of their brand appears to be a good one. For the HY 2019 period, both the Commodity Trade and Branded Products segments saw improved Revenue with Branded Trade Revenue remaining relatively unchanged (+0.1% YoY), while Commodity Trade Revenue doubled from the previous year from $11.6M to $23.8M, though still accounting for only a small portion (6.9%) of Total Revenue.

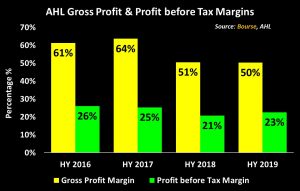

Gross Profit Margin for the HY 2019 was broadly unchanged at 50.0%, as opposed to 51.0% in the prior comparable period. This was due to the similar proportional YoY increases in both Revenue (+3.8%) and Costs of Goods Sold (4.3%) for the 2019 period. Conversly, Profit before Tax Margin for the period experienced moderate improvements, climbing from 21.0% in 2018 to 23.0% currently. This change would have been impacted by the fall in Selling and Marketing Expenses for the period, in combination with a decrease in Finance Costs and an increase in Finance and Other Income. The Chairman’s statements indicated that measures to expand the Group’s global reach are becoming fruitful, with increased sales of their Bitters product in North American markets and higher demand for its use in cocktails in UK markets. Going forward, the expansion of AHL’s global market share has a lot of potential to generate valuable foreign currency for the Group.

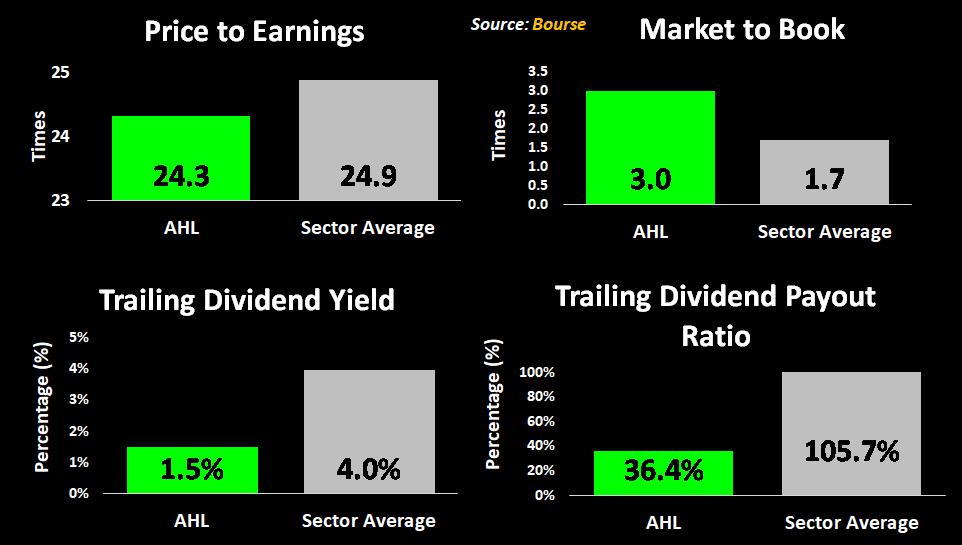

The Bourse View

At a current price of $16.05 per share, AHL trades at a trailing P/E ratio of 23.3 times, above the Manufacturing 1 sector average of 24.9 times (excluding Guardian Media Limited and Unilever Caribbean Limited). The stock offer’s investors a dividend yield of 1.5%, below the sector average of 4.0% (excluding GML and UCL). On the basis of a strong international brand with stable USD earnings, but tempered by lower consumer demand in its local market, Bourse maintains a NEUTRAL rating on AHL.

Trinidad Cement Limited (TCL)

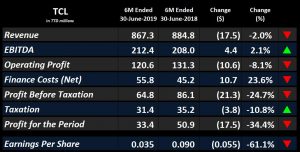

Trinidad Cement Limited (TCL) reported Earnings per Share (EPS) of $0.035 for the half-year (HY) ended 30th June 2019, 61.1% decline from the EPS of $0.09 recorded in HY 2018.

TCL recorded Revenue of $867.3M for the HY 2019 period, a 2.0% or $17.5M decline YoY. On the other hand, the Group’s EBITDA improved 2.1% from $208.0M to $212.4M. Depreciation Expense increased by $12.8M (21.1%), followed by a $2.7M uptick in Manpower Restructuring Costs, the effect of which was tempered by the non-recurrence of a $4.2M Integration Restructuring Expense recorded in HY 2018. As a result, Operating Profit slid 8.1% or $10.6M lower YoY to $120.6M. Operating Profit margin declined from 14.8% to 13.9%. Net Finance Costs rose $10.7M from $45.2M in HY 2018 to $55.8M in HY 2019. This resulted in a 24.7% reduction in the Group’s Profit Before Tax (PBT) from $86.1M to $64.8M. Taxation Charge declined 10.8%, amounting to $31.4M for the period, however the Effective Tax Rate climbed from 39.0% to 48.5% YoY. Overall, Profit for the period closed at $33.4M, a significant 34.4% decline as compared to the $50.9M recorded in HY 2018.

Outlook

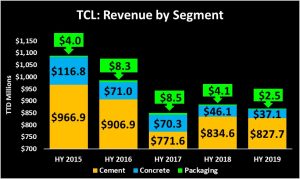

Overall, TCL’s Revenue has experienced a downward trend over the past five comparable periods. Revenue from the Cement segment has declined 14.4% from $966.9M in HY 2015 to $827.7M in HY 2019. Revenue from the Concrete segment has declined consistently since 2015, amounting to $37.1M in HY 2019. Whereas in HY 2015, Concrete sales would have accounted for 10.7% of Total Revenue, it contributed 4.3% in HY 2019. Growth in the packaging segment continues to deteriorate, generating $2.5M for the period compared to $4.1M last year.

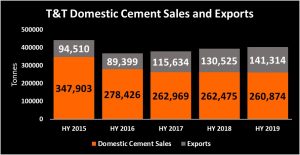

In the broader domestic economy, cement sales have exhibited a downward trend over the last five half-year periods. Domestic cement sales fell less than 1% YoY, from 262,475 tonnes in HY 2018 to 260,874 tonnes in HY 2019. On the other hand, exports of cement have trended upward over the past four comparable periods, rising 8.3% YoY, from 130,525 tonnes to 141,314 tonnes. It remains to be seen whether TCL would be able to benefit from the pick-up in demand, suggested by the overall increase in cement sales YoY, and improve its bottom line.

CCJ rules against TCL

The Caribbean Court of Justice, on Tuesday 6th August 2019, upheld the decision of Caricom’s Council for Trade and Economic Development, classifying the product imported by TCL competitor, Rock Hard Distribution Limited as hydraulic cement. The decision implies that Rock Hard, who has increased competitive pressure in TCL’s operating jurisdictions since its opening in 2015, will be subject to between 0-5% Common External Tariff (as opposed to 15% as claimed by TCL) on the import of its cement from Turkey and Portugal.

The Bourse View

At a current price of $2.45, TCL’s share price has fallen 10.3% year-to-date. The stock trades at a market-to-book ratio of 1.4 times, just below its three-year average of 1.5 times. On account of deteriorating profitability, TCL has been inconsistent in the payment of dividends to its investors, with only two payments over the last ten years, the last of which was paid in August 2017. On this basis, along with reductions in revenue, margin compression and competitive pressures, Bourse maintains a SELL rating on TCL.

For more information on these and other investment themes, please contact Bourse Securities Limited, at 226-8773 or email us at invest@boursefinancial.com.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”