BOURSE SECURITIES LIMITED

20th May, 2019

Mid-Year Review: Better Days Ahead?

This week, we at Bourse consider some of the key takeaways from the 2019 Mid-Year Budget Review, as presented by the Honourable Minister of Finance on May 13th 2019. We also look at select production trends in the energy sector and highlight some of the investment opportunities on the horizon.

Economic growth improves

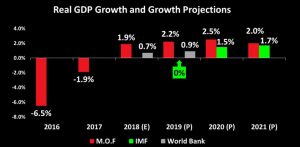

According to data from the Central Statistical Office, Real Gross Domestic Product (GDP) experienced three consecutive quarters of growth in 2018 (Q1: 0.9%, Q2: 2.1%, Q3: 1.5%), a turnaround from the overall contraction of 1.9% and 6.5% recorded in 2017 and 2016 respectively. Estimates for overall GDP growth in 2018 were maintained at 1.9%, exceeding the World Bank growth estimate of 0.7%. However, the Ministry of Finance’s projections were revised downward from 2.1% to 2.0% by 2021. The World Bank expects growth of 0.9% in 2019 and based on the International Monetary Fund’s (IMF) World Economic Outlook, the Trinidad and Tobago economy is expected to remain flat in 2019, but experience growth of 1.5% and 1.7% in 2020 and 2021 respectively.

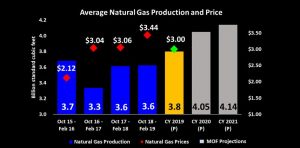

Looking at the first five-month period of the fiscal year 2018/2019, gas production was maintained at its 2017/2018 level of 3.6 billion standard cubic feet per day (bcfd). The average Natural Gas price during this period improved 12.4% to US$3.44 per MMBtu from US$3.06 in during the same period of the prior year. Projections from the 2018/2019 Budget indicated that Natural Gas production was expected to expand to 3.94 bcfd in 2019, 4.05 bcfd in 2020 and 4.14bcf in 2021. While 2019 natural gas production may live up to current projections, recent announcements by BPTT may cast some uncertainty over production forecasts for 2020 and 2021 projections (all other factors held constant). With the price of (Henry Hub) Natural Gas averaging around US$3.31 per MMBtu in the first half of fiscal 2019, the gas price assumption was revised upward to US$3.00 per MMBtu.

FY2019 Fiscal Deficit widens

First half 2019 (1H2019) Revenues exceeded the budgeted estimate (approximately TT$20.85bn) by TT$706M. Taxes on Income and Profits amounted to TT$195M more than initially budgeted for 1H2019, attributable to TT$452M in better-than-anticipated receipts from Other Companies. This was, however, tempered by a decline in receipts from Oil Companies TT$395M below estimates, as oil prices fell from a high of US$70 per barrel to a low of US$49 per barrel within the first quarter of fiscal year 2019. Capital Revenue also surpassed expectations due to transactions involving the repayment of debt issued to CLICO. Total Central Government Expenditure was TT$2.55B below budget (approximately TT$25.96bn) for 1H2019. The net impact was that the 1H2019 fiscal deficit – originally budgeted to be TT$5.11B – narrowed significantly (63.8%) to TT$1.85B.

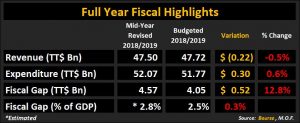

Overall, projected Revenue for FY2019 was revised downward to TT$47.5B, TT$220M or 0.5% lower than initially budgeted. The oil price assumption was also subject to a second revision, from US$55 in January 2019 (revised from US$65 in 2018/2019 budget) to US$60 per barrel. Furthermore, Expenditure for FY2019 is now estimated to amount to TT52.07B, TT$300M or 0.6% up from the budgeted figure of TT$51.77B. As a result, the fiscal deficit for 2019 is expected to widen further to TT$4.57B (estimated 2.8% of GDP), a 12.8% increase from initial projections of TT$4.05B (2.5% of GDP).

Foreign Reserves trend downward, Debt to GDP rises

Foreign Reserves rose from US$7.47B (8.1 months of import cover) in September 2018 to a high of US$7.61 in January 2019, and have since fallen on a monthly basis to US$7.31B (8.2 months of import cover) as at April 2019. Despite this decline, the current import cover surpasses the international benchmark of 3 months.

The ratio of Net Public Sector Debt to GDP was reported as 62.0%, up 1.2% from 60.8% in September 2018. This corresponds to an estimated Net Public Sector Debt figure of TT$100.4B as at April 2019 (holding all other factors constant), a TT$4.9B increase from the outstanding debt in September 2019.

The Honourable Minister indicated that retail prices increased by 0.8% between March 2018 and March 2019 and that food inflation remained at 2% year-on-year. Core Inflation was reported as 1.0% in 2018, the lowest level since 2003.

Funding the Gap

With the budget deficit expected to be TT$4.57B in FY2019, decisions will have to be made regarding funding of this gap. Potential funding sources include borrowing, withdrawals from the US$6.1 billion Heritage and Stabilisation Fund (as eligible) and the sale of assets.

Investor Considerations

Housing Bonds set to debut

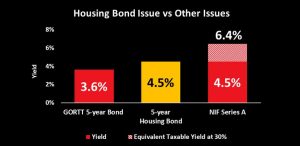

Within the next few weeks, investors will be able to participate in the issuance of five-year housing bonds, offering a return of 4.5% per annum – an initiative to make the financing of the Housing Construction Programme self-sustainable. According to the Minister of Finance, the bonds will be underwritten such that in the event of undersubscription by individual investors, they will be issued to institutional investors on the secondary market following the closure of the bond issue. Individual investors opting to purchase the bonds (at a minimum face value of $5000) will be granted preference for HDC housing units, and their holdings in the bond may be used to reduce the balance payable for their HDC housing units.

TPHL (Petrotrin) 2019 bond maturity

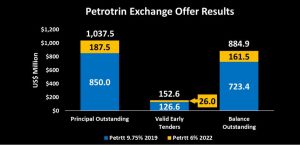

Holders of existing Trinidad Petroleum Holdings Limited (TPHL; formerly Petrotrin) 2019 bonds may have been on the lookout for information in the mid-year review about the upcoming maturity of the US$850M bond in August. Early results of the proposed Exchange Offer revealed that US$126.6M of the US$850M total outstanding 2019 bonds and US$26M of the total US$187.5M outstanding 2022 bonds were validly tendered – altogether exceeding the minimum tender requirement of $150M. Still to be announced is the securing of term loan financing to repay the vast majority of bondholders (US$723.4M face value) of the 2019 bonds at maturity.

For more information on these and other investment themes, please contact Bourse Securities Limited, at 226-8773 or email us at invest@boursefinancial.com.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”