BOURSE SECURITIES LIMITED

January 15th, 2018

2018 International Market Outlook

This week we at Bourse take a closer look at the performance of international markets in 2017. During the year, several equity and fixed income markets across the globe hit record highs, on the heels of improving global growth and investor sentiment. We review the performance of both equity and fixed income markets and highlight key factors likely to impact the market in the upcoming year.

US

The US equity market (measured by the S&P 500) climbed to record highs in 2017, delivering returns of 19.4%. The market was driven by several factors, including economic and corporate earnings growth and – more recently – the passage of legislation by both houses of US Congress to cut corporate taxation which is expected to boost overall corporate earnings.

The US economy is expected to grow by 2.3% in 2018 as per the IMF World Economic Outlook in October 2017. Economic indicators point to continued growth, with unemployment at the lowest since 2000 and core inflation contained at 1.8%. Investors will be keenly observing the outcome of the mid-term elections in the US –scheduled for November 2018. A shift towards a greater Democratic presence in both the House and Senate could create legislative gridlocks, which could dampen investor confidence. Nonetheless, the US equity market is likely to continue its upward climb, despite elevated valuations, which has already rolled over into the New Year.

Latin America

The Latin America region delivered returns of 20.8% (USD) in 2017. Chile was the best performing market in the region, returning 46.0% (USD).

The direction of the Brazilian equity market – the largest weighting in Latin America – will continue to strongly influence market sentiment in the region. Brazilian equity markets managed to overcome corruption allegation challenges, while also creeping out of its longest recession in 2017. The index, which achieved record highs on October 13th, eventually settled up 24.7% (USD) for the year.

Looking ahead, all eyes will be on the upcoming Brazilian presidential elections in October 2018. Investors will be keenly awaiting candidates’ policies as it relates to the proposed pension reforms, aimed at reducing the nation’s fiscal debt. The economic recovery is set to continue with IMF projections of 1.5% growth in 2018.

Elsewhere in the region, Mexico’s economy is expected to grow by 1.9%. However, uncertainty could arise as attention turns to the renegotiation of NAFTA, the outcome of the 2018 presidential elections and the election of a new Central Bank governor.

Investors seeking access to the Latin American markets may do so through one of several mutual funds available, including the Bourse Brazil Latin Fund (managed by Bourse).

Asia

Asia emerged as one of the best performing regions in 2017. The equity market returned 38.7% (USD) for the year. South Korea was the best performing market (up 37.2% in USD terms), followed closely by India (up 36.2% in USD).

In India, the equity market enjoyed a steady climb throughout the year, eventually closing the year at record highs. Investors have reacted positively to various policy reforms imposed by the Modi Administration, such as the Goods and Services Tax (GST). Moving forward, attention will turn to the upcoming budget in February for further clarity on any additional reforms. Growth in India is projected to remain one of the fastest in the world with the Reserve Bank of India expecting 6.7% for FY2018.

The Asian region remains a vital component of an investor’s portfolio in search of capital appreciation. Investors can gain exposure to this market through one of several available mutual funds, including the Savinvest India Asia Fund (managed by Bourse).

Fixed Income

Notwithstanding four interest rate hikes by the US Federal Reserve since December 2016 US dollar denominated emerging market investment grade and high yield bonds posted record returns for FY2017 of 7.4% and 9.7% respectively.

The persistent upward trend in bond prices has been driven by an unwavering search for yield by investors, fleeing from low or negative returns in developed markets. Moreover, supportive global economic conditions, stabilizing commodity prices and healthier fiscal positions of emerging market issuers served to bolster demand for the asset class.

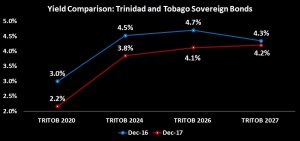

This was also evident for US dollar denominated bonds issued by Trinidad and Tobago (TRITOB). Despite two sovereign downgrades in 2017 by international credit rating agencies Standard and Poors (from ‘A-’ to ‘BBB+’) and Moody’s (from ‘Baa3’ to ‘Ba1’), the prices of the sovereign’s bonds inched higher (and yields lower) during the year. For example, the yields on TRITOB’s bonds maturing in 2026 fell from 4.7% in December 2016 to 4.1% in December 2017.

The outlook for emerging market bonds in 2018 remains muted. Though emerging market bonds continue to appear relatively attractive when compared to bonds of developed markets, the significant run up in bond prices and corresponding decline in yields may cause investors to question whether sufficient compensation is being offered for the level of investment risk of risk. As such, investors may become wary of stretching too far in their search for yield, putting selling pressure on emerging market bonds.

Higher US interest rates could also stir negative sentiment for bond markets. Interest rates in the US are projected to climb further in 2018 as the US FED is expected to perform three 25 basis point rate increases during the year and to continue reducing its US$4.5 trillion balance sheet. The probability of a rate increase at the FED’s meeting in March 21st 2018 now stands at 88%. Further, geopolitical confrontations, emerging market elections and a slowdown in China, the world’s largest consumer of commodities, can also negatively impact emerging market bonds.

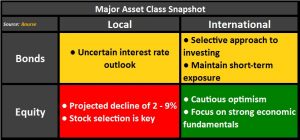

Finding value in fixed income markets has become more challenging for investors, with patience for a correction in bond prices becoming a more attractive proposition. Notwithstanding this, fixed income instruments remain a key component of a diversified portfolio with select issues providing value. When compared to US dollar money market funds (offering an average yield of 1.05%), emerging market investment grade and high yield bonds offer greater annual returns in the range of 3.5% to 4.5% and 4.5% to 5.5% respectively. Investors holding US dollars could therefore consider purchasing such bonds to improve portfolio returns.

Market Drivers in 2018

With the above in mind, several factors are likely to impact the market throughout 2018. These include:

- Energy Commodity Prices – Oil prices have seen a steady improvement throughout 2017, starting the year at US$ 53.72/bbl and closing at US$ 60.42/bbl (up 12.5%). Natural gas prices however, are yet to follow suit, closing the year at US$ 2.95/MMBtu (down 20.1%). Energy prices are likely to improve as O.P.E.C. aims to manage production, coupled with growing global demand. This may prove beneficial to some energy exporting countries, but could be detrimental to others as import costs rise, weighing on growth.

- Global Growth – Global economic activity is set to continue rising, with IMF projections of 3.7% for global growth in 2018. The IMF upgraded its growth forecasts for areas such as Europe, Japan and Emerging Asia in its World Economic Outlook in October 2017. Economic powerhouses such as India and China could take center stage, as economic growth continues to filter into corporate earnings growth.

- Political risk – A number of elections in emerging markets are set to unfold in 2018. Investors will be awaiting results to determine whether policy changes would impact on economic growth.

- US Monetary policy – A more aggressive stance by the FED could pose risks for equity and bond markets, including emerging markets. Higher US interest rates could make it more difficult for emerging market issuers to service US dollar denominated debt, while also placing pressure on EM currencies.

Investor Considerations

For investors seeking to rebalance their investment portfolios for the new year, there are several considerations which provide direction when arranging a selection:

- Add Value Through Diversification – diversification reduces the risk of an investment portfolio by limiting exposure to any one security

- Tailor Your Asset Class – alter exposure from asset classes with a negative outlook to those with a more positive one. E.g. Switch from local equity to international equity if possible

- Rebalance When/Where Necessary – reduce exposures to riskier securities or those no longer in line with your investment objectives and risk profile.

- Maintain a Long-term approach – investors should not be phased by shorter-term fluctuations in investment values, but pay close attention to the underlying quality of the asset.

Before making an investment decision, investors should have a conversation with a well experienced investment adviser. Investment advisers, such as Bourse, can help you tailor an investment portfolio suited to your liquidity needs, risk tolerance and time horizon.

For the detailed report and access to our previous articles, please visit our website at: http://www.remotestores.com

For more information on these and other investment themes, please contact Bourse Securities Limited, at 226-8773 or email us at invest@boursefinancial.com.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”