BOURSE SECURITIES LIMITED

January 30th, 2017

Growing your USD wealth

This week, we at Bourse consider several investment options available to individuals to make the most of their US dollars. In an environment that offers limited opportunities to generate positive investment returns in TT dollar assets, it makes sense to better utilize your US dollar holdings. Investors holding US dollars have the opportunity to boost returns, as well as diversify their holdings by asset class and geography.

Constructing your USD portfolio

When selecting US dollar investments to be included in your portfolio, several factors should be considered:

- Return Requirements – What level of annual returns would you like to make from your US dollar portfolio?

- Investment Horizon – Are you willing and/or able to invest for longer or shorter periods of time?

- Liquidity needs – How much of your US dollar do you need to have (almost) immediate access to?

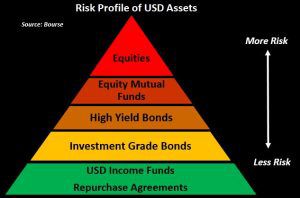

- Your Risk profile – Your level of comfort with seeing the value of your investments fluctuating over short periods of time, as well as your preference for relative certainty of income versus uncertain capital gains may help determine the level of risk your portfolio should contain.

With a better idea of your investment objective, risk appetite and time horizon, you are now better prepared to choose from a wide pool of US dollar investment options available at local investment providers, including US income funds, equities, equity mutual funds, repurchase agreements and US dollar bonds.

USD Income Mutual Funds

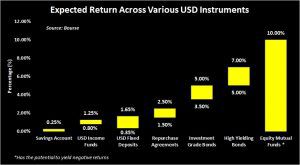

Investors with a low appetite for risk and in need of ready access to their cash may consider US dollar income Mutual Funds. By investing in a diversified portfolio of primarily fixed income instruments, these Funds provide investors with a good degree of safety and principal stability. USD income funds offer investors better rates of return – currently ranging from 0.8% to 1.25% per annum – while providing the quick access to cash associated with a traditional savings account.

Repurchase Agreements

Another attractive investment option for USD dollar investors looking for lower risk but, but more attractive rates of return, are US$ Repurchase Agreements (Repos). Repos are customizable investment instruments, which have a fixed interest rate and tenor known at the beginning of the investment. At maturity, the investor is paid the repurchase price – principal plus interest. The collateral used to secure the USD investments include primarily government and corporate bonds.

Repos are designed for the short-to-medium-term investor, looking for superior fixed returns as compared to those offered by traditional Bank fixed deposits. This is also a flexible investment vehicle, with investment tenors ranging from 3 months to as long 1, 2 or 3 years.

US dollar Bonds

US dollar-denominated bonds are suitable for investors with a medium to long-term investment timeline (generally over 3 years), seeking to balance higher returns with relative certainty of income. Bonds generally pay a fixed coupon (interest) rate in semi-annual coupon payments and upon maturity, bond holders are repaid their principal.

Though bonds are largely considered to be lower risk investments when compared to other asset classes, such as equities, the level of risk for a bond depends on a myriad of factors. In general, conservative investors may opt for investment grade bonds (less risk bonds), while more risk-tolerant investor may consider investing in high yield bonds.

The return on bonds vary based on the credit ratings, time to maturity, rate, seniority and other factors. In the current environment, investment grade bonds with 5-7 years to maturity are offering annual returns in the 3.5% to 5% region, while high yield bonds offer between 5% to 8% in annual returns.

Equity Mutual Funds

Investors that are more risk tolerant, with a longer time horizon (3 to 5 years), may opt for US dollar equity mutual funds. Unlike individual equities, mutual funds offer the benefit of diversification, by investing in equities across various geographical locations, sectors and currencies. A fund’s prospectus outlines its investment strategy and guidelines, which investors can use to determine if it matches their own goals and objectives. This also gives a sense of the fund’s asset allocation and can therefore help investors better understand its performance. US dollar equity mutual funds provide access to international equity markets, which have historically performed better than the local equity market (over the last 5 years).

Which USD investment is right for you?

Ultimately, the USD investor has a wide menu of investments from which to choose. Be it USD Income Funds, Repos, Bond or Equity Mutual Funds, most investors will be able to construct an appropriate portfolio to grow their US dollar wealth. Consulting with an expert and independent investment adviser, such as Bourse, may help to make more informed investment decisions and add to your value.

For the detailed report and access to our previous articles, please visit our website at: http://www.remotestores.com

For more information on these and other investment themes, please contact Bourse Securities Limited, at 628-9100 or email us at invest@boursefinancial.com.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”