BOURSE SECURITIES LIMITED

January 23rd, 2017

MASSY: Dividends stable, Earnings lower

This week, we at Bourse review the year-end performance of one of the major conglomerates listed on the local stock exchange, Massy Holdings Limited (MASSY). We offer some insight on what might have impacted the performance of its various segments throughout 2016. Finally, we consider various factors which are likely to impact earnings in the coming year.

Massy Holdings Limited (MASSY) reported Earnings per Share (EPS) of $5.10 for the year ended September 30 2016. This represents a 21.9% ($1.43) decline when compared to the EPS of $6.53 earned in FY2015. A closer look at the numbers, revealed two significant one-off costs during the fiscal year; maintenance to its Oxygen Plant investment and the impairment of its 20% ownership in a Costa Rican I.T. company (I&G Technologies). Adjusting for these one-off items, EPS would be in the region of $5.81, down 11% year-on-year.

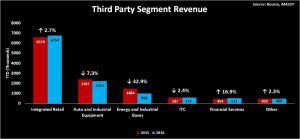

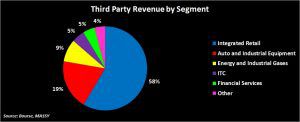

MASSY’s main business segment – Integrated Retail (59% of revenues) – grew 2.7% in 2016. However, other significant revenue-earning segments like Automotive and Industrial Equipment and Energy declined by 7.3% and 33% respectively. Overall, revenue fell by $410.8 million or 3.44%. Though gross profit margins improved (from 26.7% to 27.6%), operating expenses increased by 3%, while other income decreased by 1.35%. As a result, operating profit fell by 8.4%. MASSY’s finance costs declined 29.3%, driven by lower interest expense. Share of results of associates incurred a loss of $21.5 million, (compared to a gain of $40.2 million in 2015) largely due to the impairment of the Costa Rican I.T. company. Profit before taxation fell by 12.9%, while taxation expenses increased from 27% to 33%. This was due to higher Business Levy and Green Fund Levy taxes. Ultimately, profit after taxation declined from $668.3 million to $536.1 million, or a shortfall of 19.8%.

Sector Breakdown

Integrated Retail

This segment accounted for $6.7 billion (59%) of the Group’s revenue in 2016. The marginal improvement of 2.7% was driven by growth in revenue in all territories with the exception of Trinidad and Tobago. Its main market is likely to face headwinds in the upcoming year as consumer confidence is tested. Continued growth in other markets such as Guyana and Barbados could, however, help offset muted activity in the domestic economy.

Automotive and Industrial Equipment

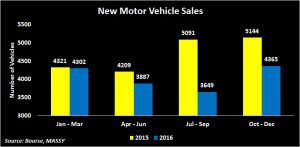

The Automotive and Industrial Equipment segment recorded revenues of $2.2 billion in 2016, representing a decline of 7.3% over 2015 results. Again, weakness in the Trinidad & Tobago market would have been a factor, with new car sales falling 13.7% in 2016. A slowdown in construction, with cement sales declining 20% last year, alongside a general slowdown in capital expenditure, would have impacted on the sales of industrial equipment. In a period of persistent economic contraction, it is likely that that consumer durable purchases such as vehicles will may remain constrained in 2017.

Outlook

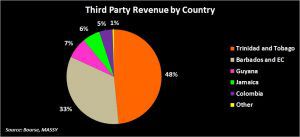

With 48% of the Group’s revenue stemming from Trinidad and Tobago, MASSY’s performance is likely to be impacted by ongoing softer economic conditions. To reiterate the driving factors mentioned, lower economic activity and consumer spending, limited access to USD, a depreciating TTD and higher corporate taxation of 30% (previously 25%) are all expected to weigh on the Group’s earnings. The second largest geographical territory, Barbados and Eastern Caribbean, is projected to grow at marginal rates, around 1% GDP growth in 2017.

The Group noted its intention to promote a service-based culture by implementing various ‘Leadership Transformation Programmes’. In addition, measures are being taken to improve efficiency in operations in an attempt to eliminate waste. Looking ahead, the Group intends to review its portfolio growth strategy by examining strengths and financial performance in its various segments.

The Bourse View

At a current price of $51.48, MASSY trades at a trailing P/E of 10.1 times, lower than its only locally competing conglomerate AMCL, which trades at 14.7 times. After adjusting earnings for one-off expenses however, MASSY’s P/E multiple stands at around 8.9 times. The Group pays an attractive trailing dividend yield of 4.1%, above the market average of 3.5%. Total dividend payments for the year amounted to $2.10 per share, which results in a trailing pay-out ratio of 41%. These three metrics are consistent with Bourse’s themes for investing in the current environment, namely investing in (i) stocks which are trading at relatively low valuations, (ii) stocks with above-average dividend yields and (iii) stocks with low dividend pay-out ratios, providing the opportunity to preserve dividends paid to shareholders even amidst lower earnings. On the basis of the aforementioned factors, but tempered by an overall weaker operating environment, Bourse maintains its NEUTRAL rating on MASSY.

For the detailed report and access to our previous articles, please visit our website at: http://www.remotestores.com

For more information on these and other investment themes, please contact Bourse Securities Limited, at 628-9100 or email us at invest@boursefinancial.com.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”