HIGHLIGHTS

TTNGL HY2025

- Earnings: Loss Per Share: $0.23, 176.7% decline from an EPS of $0.30

- Performance Drivers:

- Higher Profits from PPGPL

- Non-Cash Impairment Loss

- Outlook:

- Potentially Increased Production

- Resumption of Dividend Payments?

- Rating: Maintained at MARKETWEIGHT

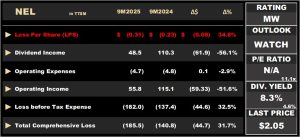

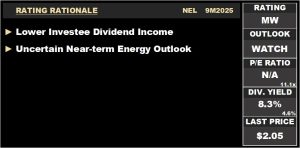

NEL 9M2025

- Earnings: Loss Per Share of $0.31, widened from a prior LPS of $0.23

- Performance Drivers:

- Significant Decrease on Fair Value of Investee Companies

- Lower Dividend Income

- Outlook:

- Potential Increase in Natural Gas Supply

- Rating: Maintained at MARKETWEIGHT

This week, at Bourse, we review the financial performance of Trinidad and Tobago NGL Limited (TTNGL) for the company’s fiscal Half Year ending June 30th, 2025, as well as National Enterprises Limited (NEL) for its fiscal nine-month period ending June 30th, 2025. Despite higher share of income from investee company, PPGPL, TTNGL reported a loss, driven by a non-cash Impairment charge. Similarly, NEL also reported losses due to a non-cash change in the fair value of assets as well as lower dividend income from investee companies. We discuss below.

Trinidad and Tobago NGL Limited (TTNGL)

TTNGL reported a Loss per Share (LPS) of $0.23 for the six-months ended 30th June 2025, down from a previous Earnings per Share of $0.30 in HY2024.

Share of Profit from its Investment in Joint Venture, Phoenix Park Gas Processors Limited (PPGPL), increased from $47.3M in HY2024 to $50.8M (+7.4%) in HY2025. According to TTNGL, PPGPL’s performance was supported by: (i) improved uptime efficiency, (ii) increase in NGL content, (iii) ongoing cost rationalization, and (v) a marginal drop in gas volumes to Point Lisas.

Total income amounted to $50.8M in the current period under review. The major negative impact to TTNGL’s performance came from an impairment loss of $85.2M in HY2025. Legal and professional fees and other expenses amounted to a total of $0.8M from $0.7M in the prior comparable period. Resultantly, Total Loss before Tax was $35.8M relative to a Profit Before Tax of $46.7M in the prior year. Overall, Loss after Tax was $35.8M in HY2025, relative to a Profit After Tax of $46.7M in the previous reporting period.

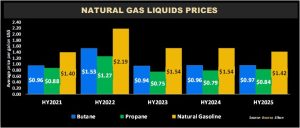

Benchmark NGLs Prices Mixed

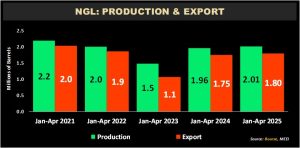

Domestic Production, Exports Stable

Based on the latest available data, Production and exports of NGLs during the Jan-Apr period have been generally stable, with production and exports ranging between 2.0-2.2 million barrels and 1.75-2.0 million barrels respectively (excluding Jan-Apr 2023).

For the period Jan – Apr 2025, NGL production rose 2.5% to 2.01M BBLS from 1.96M BBLS in the prior comparable period. Exports of NGLs by PPGPL increased from 1.75M BBLS to 1.80M BBLS (+2.8%) in the current period. This reflects continued improvement following the dip in both production and export volumes in 2023.

Energy Sector Announcements

- On July 11th, Perenco T&T Limited finalized the acquisition of the Greater Angostura oil and gas assets from Woodside Energy, significantly expanding its operations and production footprint in T&T. The Greater Angostura fields currently produce approximately 50,000 barrels of oil equivalent per day (boepd), roughly 12% of the Country’s total gas output.

- On August 12th, 2025, the Government of Trinidad and Tobago signed a production sharing agreement with the US energy giant, ExxonMobil which involves drilling of two exploration wells. If successful, ExxonMobil could invest up to US$21B in developing the block.

TTNGL has not declared any dividend payments since 2022, largely as a result of unresolved legislative restrictions. This has been viewed by investors as counterintuitive, given that the Company’s cash position remains strong, with $177.9M in cash and near-cash resources, or $1.15 per share, its highest level in five years.

For HY2025, the non-cash impairment charge weighed heavily on results, but excluding this, operating earnings were $0.32 per share, 6.7% above HY2024 EPS ($0.30), yet still well below pre-2023 levels.

Overall, the sharp decline in TTNGL’s stock price to the current $2.70 from $20.62 in HY2022, could be largely attributable to an absence of dividends, stemming from legislative restrictions as opposed to weak operating results. There is currently no timeline for the resumption of dividends.

The company’s Book Value Per Share (BVPS) declined from $7.66 in HY2024 to $6.38 in the most recent period. After peaking at 1.6 times in HY2023, the Price-to-book (P/B) reached to a low of 0.4 times in HY2025, led by a weakening in the stock price.

The Bourse View

Investor sentiment remains cautious, driven by concerns over the near-term energy production outlook and the continued absence of dividend payments. The Company’s ability to resume dividends, however modest, would be pivotal in restoring confidence in the stock. Accordingly, Bourse maintains a MARKETWEIGHT rating on TTNGL.

National Enterprises Limited (NEL)

The Group’s Dividend Income declined to 48.5M from $110.3M, a 61.9% contraction. Other Income grew 13.9%, moving from $10.7M to $12.2M. Operating Expenses declined by 2.9% to $4.7M in the current period, from $4.8M in 9M2024. Operating Income fell by 54.1% to $50.8M in HY2025, mainly driven by the heavy decline of lower dividend income. NEL reported a Loss before Tax Expense of $182.0M for HY2025, increasing from a loss of $137.4M (9M2024). The Change in Fair Value of Assets amounted to $237.7M, a small improvement from $252.5M year-on-year. Tax expense increased by 3.0% to $3.5M. Overall, the Group recorded Total Comprehensive Loss of $185.5M, a 31.7% increase year on year.

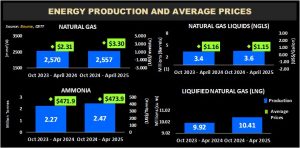

Energy Prices Mixed

During the period October 2024 – April 2025 Natural Gas production in T&T averaged 2,557 mmcf/d, marginally lower than the 2,570 mmcf/d recorded in the prior comparable period. The average price of Natural Gas (based on Henry Hub pricing) saw a substantial improvement, increasing 42.6% from US$2.31/MMBtu for the period October 2023 – April 2024 to US$3.30/MMBtu in October 2024 – April 2025.

Domestic production of Natural Gas Liquids (NGLs) improved by 4.3%, from 3.4M barrels to 3.6M barrels over the comparable period. However, the average price of NGLs (propane, butane, and natural gas) decreased slightly by 0.4%, down from US$1.16/Gallon to US$1.15/Gallon in the prior comparable period.

NEL’s exposure to the Ammonia industry faced an upswing with both production as well as average price increasing YoY. For the period October 2024 – April 2025 production stood at 2.47 Million Tonnes (MT) at with an average price of US$473.91/Tonne. This compares to 2.27MT with an average price of US$471.93/Tonne a year ago. This represents an increase of 8.9% and 0.4% respectively.

In the same period, Liquefied Natural Gas (LNG) production rose by 5.0%, totalling 10.41M cubic meters compared to 9.2M cubic meters in the prior period.

The Bourse View

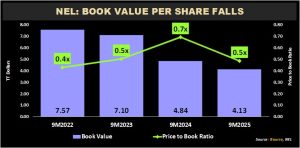

NEL currently trades at a price of $2.05, down 26.5% YTD and trading at a market-to-book ratio of 0.5 times, in line with its four-year average. The company declared a final dividend of $0.11 per share to be paid on September 29th, to shareholders on record as of September 16th 2025.

While the near-term energy industry outlook currently remains relatively subdued, over the medium-to-long term, several planned projects are expected to boost the energy sector. At a recent investor meeting, the Company indicated that it is evaluating all options to deliver increase value to shareholders, including but not limited to expanding its investee portfolio through new investments. On the basis of a muted energy industry outlook but tempered by relatively attractive valuation multiples, Bourse maintains its MARKETWEIGHT rating on NEL.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.