HIGHLIGHTS

AGL 9M2025

- Earnings: Earnings Per Share (EPS) grew 4.8% from $2.49 to $2.61

- Performance Drivers:

- Revenue Growth

- Lower Margins

- Outlook:

- Growth from Acquisition Activities

- Rating: Maintained at MARKETWEIGHT

PHL HY2025

- Earnings: Diluted Earnings Per Share increased 50.1% from $0.37 to $0.56

- Performance Drivers:

- Increased Revenue

- Improving Margins

- Outlook:

- New Restaurant Openings / Regional Expansion

- Rating: Maintained at OVERWEIGHT

This week, we at Bourse review the performance of Trading sector giants Agostini Limited (AGL) and Prestige Holdings Limited (PHL) for their respective nine months (9M2025) and six months (HY2025) reporting periods ended June 30th, 2025 and May 31st, 2025 respectively. AGL and PHL both reported improved performance, driven by solid revenue growth. With AGL, securing the minimum target shareholding required to complete its planned acquisition of PHL, the restaurant holding giant is now set to delist from the Trinidad and Tobago Stock Exchange (TTSE) and be absorbed by AGL. We discuss below.

Agostini Limited (AGL)

Agostini Limited (AGL) reported an Earnings Per Share of $2.61 for the six months ended June 30th, 2025 (9M2025), an increase of 4.8% relative to $2.49 reported in the previous comparable period.

Revenue expanded 7.7% to $4.12B from a previous $3.83B, driven by acquisition activities. Operating Profit grew 1.3% to $386.4M, compared to $381.4M in 9M2024. Finance Costs remained flat at $46.0M. Resultantly, Profit Before Taxation advanced 1.5% from $335.4M to $340.4M. Taxation Expense dropped from $98.7M in 9M2024 compared to $95.6M in 9M2025, with AGL’s Profit for the Period amounting to $244.8M compared to $236.7M (3.5% higher). Overall Profit Attributable to Owners of the Parent improved by 4.8% to $180.3M from $172.0M reported in the prior period.

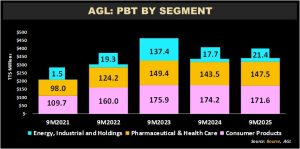

PBT Advance

For the third quarter of 2025 (9M2025), AGL’s Profit before Taxation increased by 1.5% to TT$340.4M.

Consumer Products (Acado), representing 50.4% of PBT, declined 1.5% year-on-year to $171.6M, attributed to restructuring activity in its St. Lucia operations. According to AGL, the acquisition of Massy Distribution (Jamaica) by Acado remains ongoing, pending final regulatory approval. Pharmaceutical & Health Care (Aventa), (43.3% of PBT), rose 2.8% from $143.5M in 9M2024 to $147.5M in 9M2025. Energy, Industrial and Holdings, (6.3% of PBT), grew 20.6% over the period to $21.4M from $17.7M, supported by real estate transactions in Guyana.

AGL secures on PHL Deal

In a recent media release, AGL confirmed that it had secured the minimum target shareholding required for its proposed acquisition of Prestige Holdings Limited (PHL). The transaction is still subject to final approvals, including authorization from the Trinidad and Tobago Fair Trade Commission. Once completed, the consolidation of PHL is expected to further strengthen and diversify the Group’s operations.

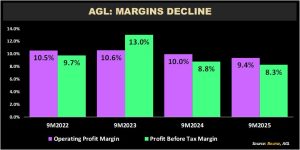

Margins Decline

AGL’s solid revenue growth was, however, accompanied by lower Operating and Profit before Tax margins. Operating Profit Margin decreased from 10.0% in 9M2024 to 9.4% in 9M2025, falling below the Group’s trailing five-period average of 9.8%. Meanwhile, the Profit before Tax Margin contracted to 8.3% from 8.8%.

The Group’s 12M Trailing EPS amounted to $3.67 in 9M2025, a 15.4% increase compared to $3.18 in 9M2024. The Group’s Price-to-Earnings (P/E) multiple fell to 18.5 times from 21.5 times in the prior corresponding period, still reasonably fair compared to its 5-year historical average of 16.8 times and the current Trading sector average of 21.9 times.

The Bourse View

AGL currently trades at a price of $68.00, currently up 1.9% year-to-date, offering a dividend yield of 2.3%, below the sector average of 2.9%.

AGL’s revenues continue to grow through a combination of organic expansion and strategic acquisitions. The planned consolidation of Prestige Holdings Limited (PHL) will expand AGL’s acquisition pipeline, strengthen its earnings base and reinforce the Group’s acquisition-driven growth strategy. The method of payment for acquisition (a share exchange) will, however, increase the quantity of outstanding shares and may partially offset the increase in aggregate earnings from the PHL acquisition. On the basis of revenue growth, and acquisition activity, tempered by relatively fair valuations, Bourse maintains a MARKETWEIGHT rating on AGL.

Prestige Holdings Limited (PHL)

For the Half Year (HY2025) ended May 31st 2025 Prestige Holdings Limited (PHL) reported a Diluted Earnings per Share (EPS) of $0.56 increasing 50.1% from $0.37 recorded in HY2024.

Revenue moved from $654.9M in HY2024 to $707.3M in HY2025, an 8.0% increase, largely

due to the timing of Carnival 2025 according to the Company. Cost of Sales increased by $34.3M, up 7.9% from $435.2M in HY2024. Similarly, Gross Profit also increased 8.3%, moving to $237.8M from $219.0M. PHL’s overheads namely Other operating expenses remained relatively flat while Administrative Expenses increased 3.2% to $59.6M. As a result, Operating Profit surged 34.5%, from $44.2M to $59.5M. In HY2025 financing costs fell to $8.4M compared to $9.2M for the same period last year. Profit Before Tax improved 45.6%. PHL’s effective tax rate fell from 33.7% to 31.1% for the current period under review. Overall, PHL reported a Profit After Tax of $35.2M (↑51.3%), relative to $23.3M in the previous year.

Increased Revenue

Revenue improved 8.0% from $655M to $707M in HY2025, continuing its upward trajectory.

Additionally, the company commenced construction of their second TGI Fridays restaurant in Portmore, Jamaica with plans to open in Q4 2025. The company also has plans to open three new Starbucks cafes- two in Trinidad and one in Guyana, together with one new Pizza Hut restaurant also in the fourth quarter. On August 26th 2025, PHL’s Board of Directors approved the execution of a Development Incentive Agreement. Under this agreement, PHL agreed to the development and operation of outlets within Panama for the Pizza Hut brand, which opens the potential to expand geographically and into a foreign currency generating jurisdiction.

Margins Higher

Over the past five periods, PHL’s profitability margins have been steadily improving. Gross Profit Margin was relatively stable at 33.6%. Operating Profit Margin grew from 6.8% to 8.4% in HY2025 while Profit Before Tax margin, expanded to 7.2%, compared to a prior 5.4%. Net Profit Margin increased by 140 basis points (bps) to 5.0% in HY2025 from 3.6% in HY2024.

The Bourse View

PHL is currently priced at $13.50, up 19.5% Year-to-Date. The stock trades at a price-to-earnings ratio of 10.8 times, below the trading sector’s average of 21.9 times. Pending the approval of all regulatory requirements for the Agostini takeover, the company announced a special dividend of $0.50 per common share to be paid on November 14th, 2025 to shareholders on record as of October 17th, 2025. PHL is expected to be delisted from the TTSE following the completion of the acquisition by AGL.

PHL should prove to be a useful addition to AGL on acquisition, on account of its dominant position in the domestic fast-food industry and regional expansion initiatives. On the basis of revenue growth, improved margins, attractive valuations along with a reasonably generous dividend yield, Bourse maintains an OVERWEIGHT rating on PHL. Bourse’s rating coverage of PHL stock will conclude upon its delisting from the TTSE.

This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third-party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”