HIGHLIGHTS

UCL HY2025

- Earnings: Earnings Per Share increased 81.1% from $0.53 to $0.96

- Performance Drivers:

- Revenue Growth

- Margin improvements

- Outlook:

- Increased economic activity

- Rating: Maintained at MARKETWEIGHT

AHL HY2025

- Earnings: Earnings Per Share decreased 3.1% from $0.32 to $0.33

- Performance Drivers

- Higher Revenues

- Margins Lower

- Outlook:

- Cost Management Initiatives

- New Product Offerings

- Rating: Maintained at MARKETWEIGHT

This week, we at Bourse review the performance of Unilever Caribbean Limited (UCL) and Angostura Holdings Limited (AHL) for their respective six months reporting periods ended June 30th, 2025, respectively. UCL benefitted from increased revenues and earnings amid the transition of its business model. AHL, while recording higher revenues and expanding its product offerings, faced pressure on profitability margins. We discuss below.

Unilever Caribbean Limited (UCL)

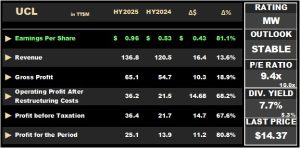

For the six months ended June 30, 2025 (HY2025), Unilever Caribbean Limited (UCL) reported Earnings Per Share (EPS) of $0.96, an 81.1% increase over the $0.53 reported in the prior comparable period.

Revenue amounted to $136.8M in the current period, 13.6% up relative to the $120.5M earned in HY2024. Cost of Sales fell 9.2%, from $65.7M in HY2024 relative to $71.8M in the current period. Gross Profit advanced 18.9% to $65.1M. Selling and Distribution Costs fell 20.5% to $20.4M, while Administrative Expenses grew 5.6%. Impairment reversal on trade receivables declined 85.1%, resulting in a 70.2% increase in Operating Profit before restructuring costs from $21.5M in HY2024 to $36.6M in HY2025. Profit Before Taxation amounted to $36.4M, a 67.6% gain from a prior $21.7M. Profit from Continuing Operations stood at $25.0M (+79.9%). Overall, UCL’s Profit for the Period amounted to $25.1M, 80.8% higher than $13.9M reported in the prior period.

Revenue Grows

UCL’s Revenue grew 13.6% year-on-year, moving from $120.5M in HY2024 to $136.8M in HY2025. According to the Group, the uplift in revenue was associated with a significant one-off transaction; the implementation of a new local distribution model which involved the sale of warehouse stock. However, for UCL’s second quarter (April – June) 2Q2025, Revenue declined 11.0% quarter-on-quarter to $56.4M.

Margins Improve

UCL’s profit margins improved overall when compared to the prior period. Gross Profit Margin grew from 45.4% in HY2024 to 47.6% in HY2025. Profit Before Tax Margin increased to 26.6% from a prior 18.0%. UCL’s Operating Profit Margin advanced to 26.5% in HY2025 from a prior 17.9%, primarily attributable to cost efficiencies of the new local distribution model. With the impact of the migration to a new distribution model on margins unlikely to recur, there may be some moderation in profitability margins in subsequent reporting periods.

The Bourse View

At a current price of $14.37, UCL trades at a trailing P/E of 9.4 times, below the Manufacturing Sector average of 10.0 times. The Group declared their second interim dividend of $0.15 per share payable on September 15th, 2025, to shareholders on record by September 2nd, 2025. The stock offers investors a trailing dividend yield of 7.7%, above the sector average of 5.3%.

UCL benefitted from effective cost management alongside revenue growth, leading to margin expansion and improved earnings. As part of its global streamlining strategy, the Group divested its ice-cream business in July 2025 and closed its local manufacturing and warehousing operations. UCL now operates mainly as a distributor of products made at other Unilever facilities. UCL disclosed in late August the adoption of a ‘more comprehensive Dividend Policy’ which aims to pay dividends more frequently after evaluating a plethora of factors including cashflow, financial performance, conditions affecting the business and other considerations.

Looking ahead, investors will be monitoring adjusted revenue trends in upcoming periods to assess the stock’s trajectory. Accordingly, Bourse maintains a MARKETWEIGHT rating on UCL.

Angostura Holdings Limited

Angostura Holdings Limited (AHL), for the six-month period ended June 30th, 2025, posted an Earnings per share (EPS) figure of $0.33, a 3.1% improvement from $0.32 in HY2024.

Revenue increased by 6.3% moving from $458.7M in HY2024 to $487.6 in HY2025 largely attributed to an increase in sales from both international branded rum as well as Bitters. Cost of goods sold saw an increase of 4.6% year-on-year (YoY) moving from $233.6M in HY2024 to 244.5M in HY2025. Gross Profit grew $18.0M or 8.0% to $243.1M.

Selling and marketing expenses rose 12.7%, climbing from $95.0M in HY2024 to $107.1M in HY2025. Administrative expenses increased by $6.0M, from $45.9M to $51.9M in HY2025, an increase of 13%. The company recognized an expected credit loss of $1.3M (+25.2%). Other Income fell by 90.7% or $2.4M. This led to results from operating activities declining 3.2% YoY to $83.1M. Finance income increased to $15.4M, representing a growth of 54.3%. Profit Before Tax (PBT) benefited directly from this, advancing 2.9% to $96.7M in HY2025. Taxation expense rose 4.8% to $29.2M with an effective tax rate of approximately 30%. Resultantly, AHL recorded Profit for the period of $67.5M, a 2.1% increase from $66.2M in HY2024.

Revenue Improves

Over the past five periods, AHL revenue trajectory has been generally positive. AHL’s five-year compounded revenue growth rate was 6.3%, with an average growth rate of 6.7% when looking at prior comparable periods. In HY2025, Total Revenue experienced a growth of 6.3%, from $458.73M to $487.6M. According to AHL, this was mainly driven by a 16% gain in sales from international branded rum, together with a 4% increase in Bitters sales from the U.S. market. Additionally, in April 2025 AHL launched the new Angostura 420 premium ready-to-drink brand, which is expected to boost the company’s earnings going into the second half of 2025.

Margins Lower

AHL’s profitability margins have been relatively rangebound. Gross Profit margin moved from 49.1% to 49.9%, driven mainly by the hefty increase in Gross Profit. Operating Profit margin fell from 18.7% in HY2025 to 17% in the current period, likely due to the group increasing marketing investments. Similarly, Profit After Tax margin dropped to 13.8% compared to 14.4% in HY2024 and is currently at the lower end of the 5-year trailing range.

The Bourse View

At a current price of $12.90, down 13.1% year-to-date, AHL trades at a relatively elevated trailing P/E ratio of 18.2 times, above the Manufacturing Sector I & II average of 10.0 times. The company declared an interim dividend of $0.10 per share with the record date being October 10th, 2025, and payment date on October 31st, 2025. The stock offers investors a trailing dividend yield of 3.0%, below the sector average of 5.3%.

On the basis of increased revenue, tempered by lower margins and elevated valuations, Bourse maintains a MARKETWEIGHT rating on AHL.

DISCLAIMER: “This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase, or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives, or agents, accepts any liability whatsoever for any direct, indirect, or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third-party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”