HIGHLIGHTS

GHL HY2025

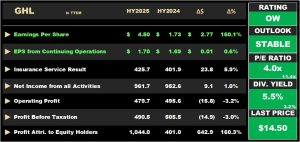

- Earnings Per Share (EPS):

- EPS climbed 160.1% from $1.73 to $4.50

- EPS from Continuing Operations grew marginally 0.6% from $1.69 to $1.70

- Performance Drivers:

- Disposal of discontinued operations

- Higher Operating Expenses

- Outlook:

- Cost Management Initiatives

- Rating: Maintained at OVERWEIGHT.

NCBFG 9M2025

- Earnings: EPS advanced 56.6% from TT$0.22 to TT$0.34

- Performance Drivers:

- Gain on sale of subsidiary

- Increased Insurance service result

- Higher Net Operating Income

- Outlook:

- Increased growth opportunities

- Rating: Maintained at MARKETWEIGHT.

This week, we at Bourse review the performance of Guardian Holdings Limited (GHL) and NCB Financial Group Limited (NCBFG) for its six months (HY2025) and nine months (9M2025) ended June 30th, 2025, respectively. GHL and NCBFG both benefitted from divestment activity. We discuss below.

Guardian Holdings Limited (GHL)

Guardian Holdings Limited (GHL) reported Earnings per Share (EPS) of $4.50 for their half year ended June 30th, 2025, up 160.1% from $1.73 when compared to the previous year. Incorporated into HY2025’s result was a significant $651M gain recognized from the sale of Thoma Exploitatie B.V. on January 24th, 2025.EPS from continuing operations amounted to $1.70 per share, a modest 0.6% increase from $1.69 in HY2024.

Insurance Service Result improved 5.9% moving from $401.9M to $425.7M in HY2025, supported by a 5.0% increase in Insurance Revenue but slightly offset by a 14.8% increase in Insurance Service expenses. Net Income from Investing Activities grew 5.8% to $990.0M, largely attributable to an increase in net realized gains but lightly impacted by increased impairment losses on financial assets. Net insurance finance expenses increased 17.1% to $489.5M in HY2025. As a result, Net Insurance and Investment Result amounted to $926.1M, a marginal 0.7% improvement from $919.9M in HY2024. Fee and commission income from brokerage activities improved to 35.6M, up 8.8% Year on Year (YOY).

Net Income from all activities grew a modest 1.0% to $961.6M. Other operating expenses rose 6.3% YoY from $363.9M to $386.8M. Operating Profit was reduced by 3.2% from $495.6M to $479.4M in HY2025. Consequently, Profit Before Taxation dropped to $490.5M, 3.0% lower than the $505.5M reported for the prior comparable period. Profit from discontinued operations after taxation was $649.0M (prior period: $8.2M), mainly driven by a significant gain realized from the sale of Thoma Group in the previous quarter. As a result, Profit for the Period stood at $1.0B, improving to 158.5% from $404.9M. Overall, Profit Attributable to Equity Holders of the Company grew to $1.0B, 160.3% higher than $401.9M for HY2024.

Property and Casualty Improves

Operating Profit, excluding adjustments for the period came in at $623.8M during the six–month period, 3.1% lower than the prior comparable period.

Life, Health and Pension (LHP), the largest contributor, which contributes 66.8% to total operating profit (excluding adjustments) declined 10.1% YoY from $463.2M to $416.5M, primarily due to higher insurance finance expenses, despite an improvement in revenue. It should be noted that on July 11th, 2025, GHL’s board of directors approved the acquisition of NCB Insurance Agency and Fund Management Limited’s pension fund portfolio by Guardian Life Limited, its Life, Health and Pension business based in Jamaica, subject to regulatory approval.

The Property and Casualty Segment experienced the most growth of 36.4% moving from $129.7M to $174.7M in HY2025, driven by higher insurance revenue across T&T, Dutch Caribbean and Netherlands markets.

Insurance Brokerage slipped to $17.3M, declining by 9.8% from $19.2M due to a sharp increase in the company’s other operating expenses. Asset Management saw the largest decline, slipping 51.8% from $31.6M in HY2024 to $15.2M in HY2025 due to lower net income from investing activities, while other operating expenses remaining relatively flat.

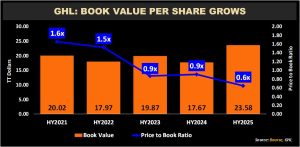

From a value perspective, GHL’s book value per share advanced from $17.67 in HY2024 to $23.58 in the current period under review. GHL’s price to book ratio moved from a high of 1.6 times in HY2021 to a low of 0.6 times in HY2025 (below its five-year average of 1.1 times). This implies that investors are currently paying less on a per-share basis to own net assets of the company, often interpreted as an indicator of value.

The Bourse View

GHL is currently priced at $14.50, down 3.0% year-to-date. GHL trades at a price to earnings ratio of 4.0 times, significantly below the Non-Banking Financial Sector average of 11.4 times. Following the Group’s move from bi-annual to quarterly dividend payments, the second quarterly dividend has been declared at $0.22 cents per share, payable to shareholders on September 5th, 2025. The stock currently offers investors a trailing dividend yield of 5.5%, above the sector average of 3.1%. On the basis of relatively attractive valuation multiples, a reasonably generous dividend yield and stable results from continuing operations, Bourse maintains its rating on GHL as OVERWEIGHT.

NCB Financial Group Limited (NCBFG)

NCB Financial Group Limited (NCBFG) recorded an Earnings Per Share (EPS) of TT$0.34 for the nine months ended 30th June 2025 (9M2025), advancing 56.6% from TT$0.22 in the prior comparable period (9M2024).

Net Interest Income rose 8.2%, driven by higher yields on interest-earning assets and a larger investment portfolio, while net fee and commission income dipped marginally by 0.3%. Net Income from Banking and Investment Activities increased 21.7%, rising from TT$4.05B in 9M2024 to TT$4.93B in the current period, boosted by a TT$662.2M gain on the sale of a subsidiary. The Insurance Service Result gained 8.0% to TT$670.8M, reflecting an elevated property and casualty (P&C) insurance portfolio. Overall, Net Operating Income climbed 21.3% to TT$4.83B in 9M2025.

Operating expenses grew 7.5% to TT$3.25B, while Operating Profit jumped 64.6% to TT$1.58B, compared to TT$957.3M in 9M2024. Share of Profit from Associates advanced 51.5% to TT$25.0M. Profit Before Tax rose 64.4% to TT$1.60B, compared to TT$973.8M, while taxation increased 47.2% to TT$266.8M. Consequently, Net Profit increased 68.3% to TT$1.33B. However, excluding the one-off gain from the sale of subsidiary, adjusted Net Profit stood at TT$671.6M, down 15.2% from TT$792.4M in 9M2024. Net Profit Attributable to Shareholders increased by 60.4% to TT$830.6M.

Operating Profit by Activity

NCBFG’s Operating Profit increased 43.2% year-over-year (excluding adjustments), driven by stronger performance in six out of its seven segments.

Life and Health Insurance & Pension Fund Management (LHP) generated TT$1.35B in 9M2025, up 69.5% from TT$796M in the prior period, with the increase reflecting the gain from the Thoma Group subsidiary disposal. Excluding this one-off, the segment declined 13.7% YoY to TT$688M. Wealth, Asset Management and Investment Banking delivered TT$196M in operating profit, up 86.6% from the prior period. General Insurance increased 47.4% to TT$358M. Treasury and Correspondent Banking rose 3.9% from TT$424M to TT$440M in the current period. Payment Services advanced 71.0% to TT$144M versus TT$84M in 9M2024. Consumer and SME Banking Wealth grew from TT$46M to TT$47M, resulting in a 2.6% increase in operating income. Meanwhile, Corporate and Commercial Banking contracted 11.7% to TT$167M in 9M2025.

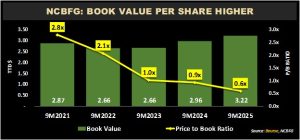

NCBFG’s Book Value Per Share (BVPS) rose from $2.96 in 9M2024 to $3.22 in 9M2025, supported by higher retained earnings. Growth in BVPS, coupled with a weakening share price, resulted in a relatively more attractive price-to-book (P/B) ratio of 0.6x, below its five-year average of 1.5x.

The Bourse View

NCBFG currently trades at a price of $1.91 at a trailing P/E ratio of 5.0 times, relative to the Banking Sector average of 9.8 times. The Group declared an interim dividend of TT$0.022 per share which is payable on September 5th, 2025, on record as at August 22nd, 2025. The stock offers a dividend yield of 3.3%, below the sector average of 4.9%.

Without the Group’s one-off gain from the sale of its subsidiary, growth in adjusted net operating income would have been outweighed by higher operating expenses. Even so, the Group’s price-to-book (P/B) multiple remains the most attractive among its publicly-listed banking peers. On this basis, Bourse maintains a MARKETWEIGHT rating on NCBFG.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third-party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”