HIGHLIGHTS

NFM HY2025

- Earnings: Earnings Per Share increased 11.2% from $0.17 to $0.19

- Performance Drivers:

- Modest Revenue Growth

- Margin Improvements

- New Product Offerings

- Outlook:

- Increased Economic Activity

- Rating: Maintained at MARKETWEIGHT

WCO HY2025

- Earnings: Earnings Per Share declined 56.3% from $0.32 to $0.14

- Performance Drivers:

- Revenue Challenges

- Lower Margins

- Outlook:

- Continued Route-to-Market Optimization

- Rating: Revised to MARKETWEIGHT

This week, we at Bourse review the performance of The West Indian Tobacco Company Limited (WCO) and National Flour Mills Limited (NFM) for their half-year ended 30th June, 2025 (HY2025). NFM’s modest revenue growth and improved margins led to greater earnings, while WCO’s persistent revenue and margin challenges resulted in weaker financial results. Can NFM continue to deliver upward earnings momentum? Will WCO be able to stabilize earnings following several periods of decline? We discuss below.

National Flour Mills (NFM)

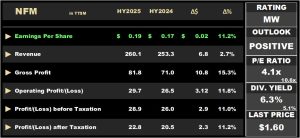

For the Half Year ended June 30th, 2025 (HY2025) National Flour Mills Ltd produced an Earnings Per Share (EPS) of $0.19, an 11.2% increase from the same period in HY2024.

Revenue of $260.1M was recorded, up 2.7% from last year’s $253M. Gross Profit rose 15.3% from $71M, on account of increased revenue and lower Cost of Sales. Selling and Marketing Expenses increased 22.5%, from $21.5M to $26.3M in HY2025. Administrative expenses experienced a $2.6M, or a 9.8% increase from $26.2M to $28.7M. NFM managed to produce an Operating Profit of $29M, an 11.8% increase from $26.5M for the same comparable period. Finance costs increased 49.1%, from $0.51M in HY2024 to $0.75M in HY2025. Taxation amounted to $6.1M, up 10.3% with the effective tax rate maintained at 21.0%. Profit Before Taxation grew to $28.9M in HY2025 from $26.0M, an 11% increase Year on Year. Profit after Taxation was $22.8M, up 11.2% from $20.5M in HY2024.

Revenues Trend Higher

Revenue grew by 2.7%, a $6.8M improvement relative to the prior comparable period in HY2024. Revenue growth was achieved even after the Company’s conscious decision to lower product prices to consumers during the course in 2024. NFM also noted its relaunched Ibis brand and introduced ‘Ibis Bakers Flour’, expanding its product offerings and positioning the business for further revenue growth.

Margins Higher

NFM operating efficiency improvements would have compounded the impact of higher revenue on earnings. The Company managed to improve all three major profitability margins: Gross Profit Margin (GPM), Operating Profit Margin (OPM) and Profit Before Tax Margin (PBTM). GPM grew to 31.5%, the highest level in seven (7) prior comparable periods. The same can also be said about OPM and PBTM which grew to 11.4% (previous 10.5%) and 11.1% (10.3%) respectively. NFM efficiency initiatives extended to its transition to a new Enterprise Resource Planning software, which is expected to enhance profitability in subsequent periods.

The Bourse View

At a current price $1.60, NFM trades at a trailing P/E multiple of 4.1 times, below the combined Manufacturing Sector average of 10.6 times. The stock offers investors a trailing dividend yield of 6.3%, above the Manufacturing Sector average of 5.1%. According to NFM, company remains focused on sourcing quality raw materials (grain) in an effective manner while balancing cost efficiency. On the basis of increased revenue and improved profitability margins but tempered ongoing global uncertainty, Bourse maintains a MARKETWEIGHT rating on NFM.

The West Indian Tobacco Company Limited (WCO)

The West Indian Tobacco Company Limited (WCO) reported Earnings Per Share of $0.14 for the fiscal quarter ended June 30, 2025 (HY2025), contracting 56.3% from $0.32 in the prior comparable period (HY2024).

Revenue fell 25.3% year-on-year (YoY) from $255.4M to $190.7M in HY2025. Cost of Sales marginally declined by 0.9% YoY to $92.5M from $93.3M in HY2024. Gross Profit amounted to $98.2M, down $63.9M or 39.4%. Selling and Distribution costs fell 17.9% to $15.3M from $18.6M in the prior period, while Administrative Expenses decreased 16.0% from $35.2M in HY2024 to $29.5M in HY2025. The company reported Other Operating Expenses of $8.4M in the current period, compared to $1.8M in HY2024. Operating Profit declined 57.8%, from $106.6M to $45.0M in HY2025. Finance Income and Finance Cost contracted 43.7% and 11.9%, respectively. Profit Before Taxation fell 57.6% from $108.2M to $45.9M in HY2025. Taxation declined 59.6% to $11.5M from $28.5M, with the effective tax rate moving from 26.4% to 25.1%. Overall, Profit for the Period dropped 56.9%, from $79.7M to $34.4M in HY2025.

Revenue Down

WCO’s half-year 2025 results marked its fifth consecutive period of declines, with Revenue falling 25.3% year-on-year from $255M to $191M. Stabilization of revenue levels has proven elusive, with the Company continuing to confront a potent combination of illicit tobacco products, tobacco alternatives and perhaps evolving consumer preferences. Domestic revenue contracted sharply by 37.6%, reflecting ongoing market challenges, while Caricom markets provided some relief with a strong 34.0% year-on-year increase. Despite regional gains, the uplift was not enough to offset the broader downturn, highlighting the Group’s need to further diversify and strengthen its export footprint.

Margins Lower

WCO’s profitability margins continued to decline in HY2025. The Group’s Gross Profit Margin contracted to 51.5% from 63.5%, reflecting increased cost pressures. Operating Profit Margin also fell sharply from 41.7% to 23.6%, compounding by lower revenue relative to stickier overhead costs. As a result, Profit After Tax Margin declined to 18.0% from 31.2% in the prior comparable period.

Once one of the most reliable and robust producers of dividends, WCO has experienced a consistent decline in dividend payouts over the past five years. Total dividends fell from $1.54 per share in FY2020 to $0.67 per share in FY2024, reflecting ongoing profitability headwinds. The Company declared a first interim dividend of $0.10 per share for HY2025, half of the $0.20 paid in the same period last year. Should the current earnings trajectory persist, shareholders may have to accept a possible lower overall dividend as the Company repositions itself in the evolving environment.

The Bourse View

WCO’s operating headwinds have been largely reflected in its stock price, which is down 22.9% year-to-date and down 89.9% since its peak price of $42.96 in December 2019.

At a current price $4.32, WCO trades at a P/E of 8.3 times, below the combined manufacturing sector average of 10.6 times. The company announced an interim dividend of TT$0.10 which was paid on September 5th, 2025 to shareholders on record on August 19th, 2025. The stock offers investors a trailing dividend yield of 13.2%, above the sector average of 5.1%. This yield could be lower in subsequent periods, with the declaration of more modest dividends.

Investors remain watchful for clear evidence of stabilizing revenue and operating performance, cognizant of the headwinds faced by the Company. On the basis of continued revenue and margin pressures, Bourse revises its rating on WCO to MARKETWEIGHT with a WATCH Outlook.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third-party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”