HIGHLIGHTS

GKC FY2024

- Earnings: Diluted Earnings Per Share 8.2% higher, from TT$0.340 to TT$0.368

- Performance Drivers:

- Revenue Growth

- Improving Margins

- Outlook:

- Acquisition Integration Efforts

- Rating: Maintained at MARKETWEIGHT

PHL FY2024

- Earnings: Earnings Per Share increased 18.3% to $1.06 from $0.90

- Performance Drivers:

- Revenue and Earnings Growth

- Lower Finance Costs

- Higher Margins

- Outlook:

- New Restaurant Openings / Regional Expansion

- Rating: Maintained at OVERWEIGHT

This week, we at Bourse review the financial performance of GraceKennedy Limited (GKC) and Prestige Holdings Limited (PHL) for its fiscal year ended December 31st, 2024, and November 30th, 2024 (FY2024) respectively. GKC and PHL delivered improved performance driven by increased revenue growth and higher profitability margins. Can both companies continue to improve results in the upcoming months ahead? We discuss below.

GraceKennedy Limited (GKC)

GraceKennedy Limited (GKC) reported Diluted Earnings per Share (EPS) of TT$0.368 for the fiscal full year ended December 31st, 2024, 8.2% higher than the TT$0.340 reported in FY2023.

Revenue from Products and Services increased by 7.6%, moving from TT$6.5B to TT$7.0B, Similarly, Interest Revenue improved by 11.6% to TT$291.4M, resulting in 7.8% expansion in Total Revenue, from TT$6.8B in FY2023 to TT$7.3B in FY2024. Direct and Operating Expenses rose to TT$6.9B, while Impairment Losses on Financial Assets fell 7.3% year on year to TT$22.0M, contributing to a 7.9% increase in Expenses to TT$6.93B in the current period. GKC’s Profit from Operations expanded by 7.7%, increasing from TT$507.4M to TT$546.3M in FY2024. Interest Income from Non-Financial Services surged by 26.6% year-on-year (YoY), while Interest Expense from Non-Financial Services rose by 13.0%, from TT$75.2M in FY2023 to TT$84.9M in FY2024. Share of Results from Associates and Joint Ventures advanced by 16.3%, to TT$39.2M compared to the previous year. Profit Before Tax (PBT) amounted to TT$538.2M, reflecting an 8.6% increase from TT$495.7M in FY2023. Resultantly, Net Profit improved by 5.8% to TT$386.5M, resulting in 8.1% increase in GKC’s Net Profit Attributable to Equity Owners, from TT$339.2M to TT$366.9M in the current period.

Food Trading Segment Improves

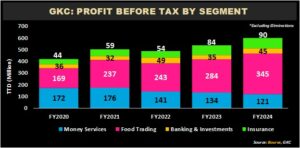

For the fiscal full year 2024, GKC’s Profit before Tax rose 11.8% (excluding eliminations), continuing its positive momentum for the past five reporting period.

Food Trading, the largest contributor to PBT (57.5% excluding eliminations) expanded by 21.6% year on year, from TT$284M in FY2023 to TT$345M in FY2024, positively impacted by target promotions and customer engagement from both World Brands Services and Consumer Brands Limited, with recent acquisition, Unibev Limited, surpassing company benchmarks, according to the Group. Continuing its acquisition strategy, on January 29th, 2025, the Group announced the acquisition of the remaining 30% stake in Catherine’s Peak Bottling Company Limited, leading to 100% ownership of the company, subject to regulatory conditions.

GraceKennedy Money Services (GKMS), accounted for 20.1% of PBT (excluding eliminations) fell 10% to TT$121M from TT$134M in the prior comparable period, due to reduced transaction volumes and remittances in key markets – particularly, Guyana.

The Group’s Insurance Segment represented 15% of PBT (excluding eliminations) advanced 7.9% to TT$90M, led by positive results from the Group’s strategic partnerships, notably, GK General Insurance Company Limited, Canopy Insurance Limited and Scotia General Insurance Agency Limited.

Banking & Investments, accounted for 7.4% of PBT (excluding eliminations) grew significantly by 25.7% from TT$35M in the prior reporting period, driven by significant growth in the Group’s loan portfolio, increased investment income, as well as gains in its equity trading portfolio.

Margins Relatively Stable

GKC’s profitability margins remained relatively stable in comparison to the prior reporting period. The Operating Profit margin was consistent with the prior year’s performance and remained at 7.5%, likely owing to the successful implementation of cost-effective management initiatives, while Profit Before Tax margin grew marginally from 7.3% to 7.4%.

The Bourse View

At a current price of $3.69, GKC trades at a P/E ratio of 10.1 times, below the Conglomerate Sector average of 12.9 times. The stock offers investors a trailing dividend yield of 2.8%, below the sector average of 3.4%. The Group announced an interim dividend of TT$0.0236, payable to shareholders on April 7th, 2025. The Group’s share buyback programme, which concluded in November 2024, facilitated the repurchase of approximately TT$276.9K (J$6.4M) of the Company’s outstanding shares. In FY2024, the Group continued to prioritize its growth strategy, through the integration of existing acquisitions and the implementation of cost-efficient processes within its operations. On the basis of revenue growth, continued acquisition activity and fair valuations, Bourse assigns a MARKETWEIGHT rating on GKC.

Prestige Holdings Limited (PHL)

Prestige Holdings Limited (PHL) reported Diluted Earnings per Share (EPS) of $1.06 for the financial year ended November 30th, 2024 (FY2024), a 18.3% increase from $0.90 recorded in FY2023.

Revenue increased 1.6% from a previous $1.33B in FY2023 to $1.35B in FY2024. Cost of Sales increased 0.5%, while Gross Profit rose 3.8% from the prior period to $436.0M. Other operating expenses increased 2.8% while administrative expenses dropped 6.5% year-on-year from $105.7M to $98.8M in FY2024. Other income declined 20.5% to $0.7M. Resultantly, PHL reported Operating Profit of $118.6M in contrast to $101.8M in FY2023. Finance Costs marginally fell 0.3% to $18.2M. The Group recorded a Profit Before Tax (PBT) of $100.5M, relative to $83.6M recorded in FY2023. Overall, PHL reported Profit Attributable to Owners of the Parent Company of $66.4M, comparative to $56.0M in the prior comparable period (+18.6%).

Modest Revenue Growth

PHL’s total revenue grew by $21.0M to $1.35B, continuing an upward trend since the Group’s most heavily COVID-affected period. Revenue growth was 1.6% in FY2024, driven by a combination of (i) new and existing store sales and (ii) the remodeling and relocation of existing stores. The Group noted that its restaurant locations increased to 137, inclusive of 2 new locations introduced in FY2024 (1 Starbucks location in T&T and another in Guyana).

Looking ahead, the restaurant management company disclosed its intent to continue with its investments to expand and/or enhance its physical footprint through new store introductions and existing store remodels. The Group reported plans to introduce a second TGI Friday’s restaurant in Jamaica as well as additional Starbucks cafes for Guyana during 2025.

Margins Higher

For the fiscal year 2024, PHL’s profitability margins generally improved, with Gross Profit Margin expanding from 32.8% in FY2023 to 33.5% in FY2024, reflecting astute input cost management. Operating Profit Margin grew from 7.7% to 8.8% in FY2024, due to a notable drop in administrative expenses, which more than offset the modest increase in operating expenses. Profit Before Tax (PBT) margin, widened to 7.4%, compared to a prior 6.3%.

The Group reaffirmed its commitment to improving efficiencies and managing input costs, with its Pizza Hut and Subway brands emerging as standout performers among its franchises.

The Bourse View

PHL is currently priced at a market price of $11.30 and the stock trades at a price-to-earnings ratio of 10.7 times, below the trading sector’s average of 15.0 times.

The Group announced a final dividend of $0.36 per share to be paid on May 9th, 2025, to shareholders on record as of April 9th, 2025. Cumulatively, PHL is paying a total dividend of $0.52 for FY2024, 15.6% higher than the $0.45 paid in FY2023. The stock offers investors a trailing dividend yield of 4.6%, below the sector average of 5.6%. PHL remains well positioned in the restaurant industry, both locally and regionally, backed by a diverse and resilient brand portfolio and opportunities for market expansion. On the basis of modest revenue growth, improved margins and attractive valuations, Bourse maintains an OVERWEIGHT rating on PHL.

This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third-party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”