HIGHLIGHTS

Local Market

- FY2025 Projected Performance:

- TTCI: ↑ 6.9%

- ALL T&T: ↑ 9.2%

- CLX: ↓ 0.3%

- Market Drivers:

- Continued Economic Growth ↑

- Subdued Energy Production ↓

- Cooling Inflationary Pressures ↑

- Acquisition Activity ↑

- Geographic Diversification Initiatives↑

International Market

- FY2025 Projected Performance:

- S&P 500 -8.2% to +24.1%, base case 10.5%

- Market Drivers:

- Resilient Economic Growth ↑

- Cooling Inflation ↑

- Expected Interest Rate Cuts ↑

This week, we at Bourse consider the potential direction of local/regional (and international) equity markets in the year ahead. We discuss possible drivers that could shape the investment landscape in 2025 and consider the outlook for various market sectors. Lastly, we share some strategies to help investors navigate uncertainty and optimize their stock portfolios for the evolving market environment.

Local stock market growth forecast

The Trinidad & Tobago Composite Index (TTCI) recorded its third consecutive year of decline in 2024, falling 11.6%, impacted by weak investor sentiment, tepid growth, climbing TTD yields and other factors. With a broad repricing having taken place, Trinidad and Tobago Stock Exchange (TTSE) equities are now forecast to advance in 2025. At the index level, the All T&T Index (ALL T&T), which includes locally-domiciled companies, is forecast to rise by 9.2%, following a 12.7% decline in 2024. Meanwhile, the Cross-Listed Index (CLX), which includes TTSE-listed companies domiciled in Jamaica and Barbados, is projected to remain relatively flat (declining 0.3%), following a 7.7% decrease in 2024. Overall, the T&T Composite Index (TTCI) is forecast to increase by 6.9%, an improvement compared to the 11.6% decline recorded in the previous year.

Local Market Drivers

At the macroeconomic level:

- Modest economic growth should be supportive of corporate financial performance, on account of resilient non-energy sector activity and an uncertain energy sector outlook. The IMF projects GDP in Trinidad and Tobago to expand by 1.6% in 2024 and 2.4% in 2025.

- Subdued Energy Production. Domestic Natural Gas and Crude Oil production remained at relatively stagnant levels in 2024, with the outlook described as ‘challenging’ by energy experts and various state officials. This forecast is unlikely to change materially, with stabilization of production being the priority over the near-term.

- Cooling inflationary pressures. Recently released data from the Central Bank of Trinidad and Tobago suggests softer inflationary trends, despite an uptick in food inflation level (+3.1%).

At the Company-specific level:

- Continued acquisition activity should be supportive of valuation, with several ‘blue-chip’ companies including acquisition as a major part of their growth strategies to expand markets, market share and/or diversify company risk.

- Geographic Diversification Initiatives. Several companies have and are expected to continue pursuing geographic expansion both organically or through acquisition, increasing the degree of “built-in” diversification benefits afforded to investors.

- In terms of new additions to the market, investors will be anticipating the long-awaited cross-listing of Seprod Limited’s AS Brydens & Sons Holdings Limited (ASBH), one of T&T’s largest distributors onto the Trinidad and Tobago Stock Exchange (TTSE).

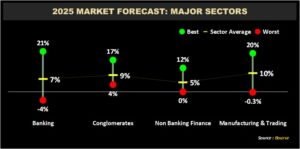

Sector Outlook Improves

Major market sectors are forecast to deliver positive performance in 2025, underpinned by resilient earnings growth and relatively attractive dividend yields.

Banking. The largest sector by market capitalization, (56% of the overall market value), the Banking sector is forecast to advance 7.0% in 2025. Although stock-specific drivers may vary, industry-level drivers include (i) moderate revenue growth, (ii) resilient economic activity both locally/regionally and (iii) stable profitability margins. Bourse’s estimates for earnings growth, relatively attractive valuation multiples and dividend yields produced a forecast for banking stock price movements ranging between -4% to +21%. Within the sector, 2 stocks are rated ‘Overweight’ (OW), and 3 stocks are rated Marketweight (MW).

Conglomerates: Accounting for roughly 22% of total market capitalization, the Conglomerate sector is forecast to advance 9% in 2025. Stocks in the sector are forecast to advance between +4% to +17%. Revenue growth driven by continued acquisition activity and diversification benefits are key drivers to the Conglomerate sector outlook. Within the sector, 1 stock is rated ‘Overweight’ (OW) and 2 stocks are rated Marketweight (MW).

Non-Banking Finance: The Non-Banking Finance sector – which represents 10% of market capitalization – is expected to advance 5% in 2025, with individual stock prices fluctuating between 0% and +12%. Within this sector, three stocks are rated Marketweight (MW), while one stock is rated Underweight (UW).

Manufacturing and Trading – produced mixed results in 2024, impacted by the volatility of commodity prices and earnings stability. For 2025, Overall, the combined Manufacturing and Trading sector constituents are forecast to vary widely in terms of target stock price movements, estimated to range from -0.3% to +20.0% in 2025. Within the sectors, 2 stocks are rated Overweight (OW), and 8 stocks are rated Marketweight (MW).

Energy: Lone energy sector member, Trinidad and Tobago NGL Limited (TTNGL) experienced a price decline of 56.6% in 2024. TTNGL would have recorded improved performance from its associate company, PPGPL driven by favourable Mont Belvieu natural gas liquids (NGL) prices, increased NGL production and greater sales volume. Despite a recovery in earnings, regulatory requirements limited TTNGL’s ability to pay dividends to shareholders, resulting in its downward stock price direction. In the absence of dividend payments, TTNGL’s stock price is expected to remain relatively rangebound at current levels. With a resumption of dividend payments, TTNGL’s stock price could materially increase.

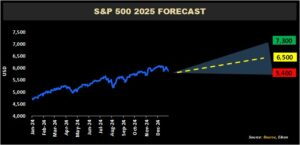

US stocks poised for gains?

The S&P 500 advanced 23.3% in 2024, marking its second consecutive year of >20% double-digit gains, propelled bullish sentiment on Artificial Intelligence (AI), falling interest rates and clarity on the US presidential outcome. Looking ahead to 2025, key drivers shaping U.S market sentiment and direction include:

- Resilient economic growth – According to the International Monetary Fund (IMF), U.S economic growth is expected to ease from an estimated 2.8% in 2024 to 2.7% in 2025, positively boosted by strong consumer spending, offset by the influence of upcoming economic policy measures. Overall, global growth is expected to hold steady at 3.3% in 2025 and 2026.

- Cooling Inflation – The latest December 2024 consumer price index (CPI) report revealed that core inflation which strips out volatile food and energy prices slowed to 3.2%, providing some reassurance about the U.S Federal Reserve’s (FED) optimism about the path for inflation. Although inflation has been slowing, it has remained moderately above the Federal Reserve’s 2% target on an annual basis.

- Interest rate cuts – The Fed began cutting interest rates in September 2024, bringing the federal funds rate down to 4.25 – 4.5% in December 2024. Estimates now forecast two rate cuts in 2025.

- Policy Uncertainty and Geopolitical shifts – The incoming Trump administration is widely expected to pursue economic policies, including import tariffs that will modestly boost inflation and further influence the path of Fed’s rate cuts. Also, any escalation in issues such as US-China relations and the ongoing conflicts in Europe or instability in the Middle East could potentially disrupt global trade, supply chains and significantly influence global markets.

Consensus estimates give the S&P 500 a median 12-month price forecast of 6,500, implying a 10.5% upside from its December 2024 closing level of 5,882. The highest 2025 target by US analysts is currently 7,300 (up 24.1%), with the most conservative forecast a level of 5,400 (or 8.2% lower).

Investor Considerations

Locally, companies stand to benefit from easing inflation and a modest improvement in economic growth. The International Monetary Fund (IMF) projects Trinidad and Tobago’s economy to grow by 2.4% in 2025, driven by robust growth in the non-energy sector. This positive economic backdrop, coupled with acquisitions and geographic expansion initiatives may be supportive to stock market performance. Risks to forecast market performance are largely at the macroeconomic level, with energy production declines, a deterioration in foreign exchange market conditions and import-driven inflation all being factors that could adversely affect company financial performance. Cognizant of these risks, investors with a longer-term view and willing/able to hold their stock positions are being attractively compensated – from both a value and cash-flow perspective – to invest in the local equity market. Investors should prioritize stocks that (i) offer appealing valuations through lower price-to-earnings (P/E) ratios, (ii) demonstrate robust company fundamentals, (iii) provide above-average dividend yields, and (iv) offer a partial hedge against the TTD through USD-based earnings or dividends.

Internationally, the US market has defied expectations with its back-to-back +20% market advances. Analysts’ outlooks for global markets remains optimistic, with modest economic growth predicted, despite the risk of geopolitical tensions creating volatility from time to time. A time-tested investment strategy is diversification. To gain market exposure and benefit from investments with built-in diversification, less active investors may consider allocating their resources to broad-market instruments such as Mutual funds or Exchange Traded Funds (ETFs).

As always, investors are encouraged to consult a trusted investment adviser such as Bourse to make the most informed investment decisions.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third-party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”