HIGHLIGHTS

Conservative Investors

- Characteristics

- Risk Aversion

- Income-oriented

- Capital Preservation/ Loss Aversion

- Preference for certainty

- Time Horizon

- Conservative Investment Options:

- Income Funds

- Repurchase Agreements (Repos)

- Fixed Deposits

- Bonds

- Dividend Yielding Equities

This week, we at Bourse begin a series aimed at helping individuals better determine the types of investments they should consider, based on their specific investor profile. Investors – looking through the lens of risk tolerance – may better focus on investment solutions to help achieve their goals without being unduly comfortable in the risks taken. Today, we focus on the Conservative Investor and highlight several traits, suitable investment options and a suggested portfolio mix that should fit the risk tolerance associated with the investor profile.

What’s Your Investor Profile?

Investor profiles broadly describe different types of investors based on their risk tolerance, return requirement, investment time horizon and liquidity needs. Typically, investors can be categorized into three (3) basic profiles: Conservative, Moderate and Aggressive.

The Conservative Investor prioritizes income generation and preserving of capital, with limited focus on capital appreciation. The Conservative Investor usually focuses on loss minimization, as opposed to return maximization.

The Moderate Investor, as the name suggests, is prepared to take on moderate risk in exchange for generating returns through a combination of income generation and capital appreciation. Some losses and/or fluctuations to invested funds are tolerable for this investor.

The Aggressive Investor in order to maximize returns, is prepared to take on greater risk. This investor is typically very focused on growing wealth as quickly as possible, cognizant that his/her investments may fluctuate significantly in value.

Are You a Conservative Investor?

The Conservative Investor tends to display the following traits:

- Risk Aversion. Conservative investors seek little to no volatility (low risk) in their investments, content to accept lower returns in exchange for investment certainty.

- Income-oriented. Generally, these investors prefer financial instruments that provide a steady income stream in the form of coupons, interest and even reliable dividends.

- Capital Preservation/Loss Aversion – Protecting their initial principal/investment is a primary concern for risk-averse investors, with emphasis on avoiding losses.

- Liquidity. This investor values relatively quick access to funds, opting for investments with a high degree of convertibility to cash in a short time with little to no loss in value.

- Time Horizon. Because of this liquidity preference, the Conservative investor tends to have a shorter investment time horizon. Investments are mostly within 1–3-year tenors, with some funds deployed in medium term (5-7 years) instruments.

When Should I Be a Conservative Investor?

Can you be a Conservative Investor at any age? Of course, you can. However, Conservative Investing is usually more often adopted by persons further along the Investor Life Cycle.

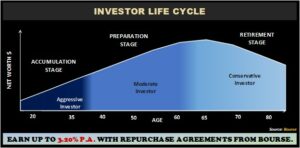

The Investor Life Cycle typically encompasses three basic stages: Accumulation, Preparation and Retirement. Each stage involves different investment strategies tailored to the investor’s age, risk tolerance, investment horizon and financial goals.

Conservative investors are often associated with the Retirement Stage (Age 60+) of the investor life cycle. As individuals approach retirement, risk appetite becomes reduced as their focus shifts from growth to preserving capital and generating income.

Nevertheless, you can be a Conservative Investor at any age based on your own circumstances. For example, an entrepreneur taking considerable risk through business might be more inclined to invest his/her non-business-related wealth conservatively. A conservative investing approach is primarily a function of an individual’s willingness and ability to bear risk.

Investment Options

With the characteristics and preferences of the Conservative Investor in mind, what could be some appropriate investment solutions to satisfy their needs? Conservative solutions are broadly centered around low-risk, fixed-rate, and shorter-term investments such as (i) Income Funds, (ii) Repurchase Agreements, (iii) Fixed Deposits, (iv)Investment Grade Bonds and – to a lesser extent – (v) Dividend-yielding stocks.

Income Funds (specifically Fixed NAV funds) are mutual funds that offer investors a fairly reliable rate of return, with low-to-no risk of capital. They offer good liquidity, with funds readily accessible in a day or two.

Repurchase Agreements (Repos) and Fixed Deposits (FDs)

Repos and FDs are essentially short-term, fixed-return investment solutions. Fixed Deposits are offered by banks (including commercial and merchant banks), while Repos are generally offered by Broker-Dealers and other entities. In the case of an FD, the investment has insurance from the Deposit Insurance Corporation up to a limited amount. With Repurchase Agreements, investments are fully secured by financial instruments such as government bonds. Rates on Repos (and FDs) tend to be more attractive than income funds, given that investors are committing to place their funds for a longer (and fixed) period of time. Repos and FDs investment tenors can range from as little as 90 days to as long as 5 years.

Bonds

A bond is a fixed income instrument in which a lender (investor) loans money to a borrower (bond issuer). In return, the investor receives periodic coupon (interest payments) at fixed and known dates with principal returned on the final maturity date. Bonds issuers include governments, state enterprises and corporations. Bonds tenors typically range from 3 years to 20 years. In extreme cases, some bonds are perpetual, never having a maturity date. Bonds also vary in risk, usually reflected by its credit rating.

For the Conservative Investor, shorter-term (3 to 7 year), higher credit quality bonds may be more appropriate to achieving investment objectives within a desired level of risk. Depending on an investor’s time horizon, risk tolerance (preference for investment grade vs. high yield bonds), and currency availability (TTD or USD), investment grade bonds currently offer yields ranging from 3.5% to 5.0%.

Dividend-Yielding Stocks

While stocks are not ordinarily considered as lower-risk investments, the Conservative Investor may consider equities which exhibit (i) relative price stability and (ii) consistent, predictable dividend payments as part of their overall portfolio. So-called dividend stocks offer the potential for capital appreciation, while generating returns via dividend payments.

Locally, several stocks within each sector of the Trinidad and Tobago Composite Index (TTCI) that have become appealing to investors focused on generating income. Sector average dividend yields currently range from 3.0% to 5.5%. It should be noted, however, that even the most reliable dividend stocks can face fluctuations in their prices.

How Much Can a Conservative Portfolio Earn?

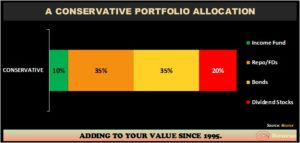

With a better idea of the portfolio building blocks for the Conservative Investor, just how much could such a portfolio earn? A sample Conservative Investor portfolio allocation might comprise 10% in Income Funds, 35% in Repos/FDs, 35% in Government bonds and 20% dividend stocks. When considering prevailing returns on each of these types of investments, the weighted return on the Conservative portfolio would range between 3.5% – 4.0%.

Would this expected return (3.5%-4.0%) achieve the Conservative Investor’s objectives of (i) preserving capital and (ii) preserving purchasing power in a low-risk manner? When compared to the 5-year, average inflation rate in T&T of 2.8%, the answer would be ‘yes’.

In addition to the most appropriate investments from a risk-perspective, ensuring you (i) build a suitably diversified portfolio and (ii) incorporate (if possible) investments in foreign currency are important considerations for any investor. Next week, we take a look at the ‘Moderate’ Investor and his/her investment options in an ever-changing environment.

DISCLAIMER: “This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase, or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives, or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third-party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”