HIGHLIGHTS

Local Markets

- Inflation Moderates

- Headline Inflation (May): 0.9%

- Yields Inch Higher

- 1-year: 3.05%

- 10-year: 5.32%

International Markets

- Inflation Eases

- CPI (May): 3.30%

- PCE (June): 2.60%

- Yields Remain Elevated

- 2-year: 4.77%

- 10-year: 4.48%

Investor Considerations:

- Preservation of Purchasing Power

- Preservation of Principal

- Steady Investment Income

This week, we at Bourse review the evolving Fixed Income environment, considering the changing conditions and opportunities – if any – are available for investors. With investors increasingly seeking greater certainty in preserving purchasing power and inflation cooling – yet still elevated, could fixed income solutions offer safe harbour? We discuss below.

Local Markets

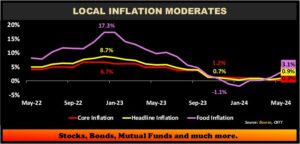

Local Inflation Steadies

Local inflation moderated in Q2 2024, as evidenced by data retrieved from the Central Bank of Trinidad and Tobago (CBTT), with headline inflation inching up to 0.9% (year-on-year) in May 2024 from 0.5% in the previous month. Food inflation advanced to 3.1% in May, from 1.1% in April, underpinned by price increases for several locally produced and imported food items. According to the Economic Survey published by the CBTT, inflation is anticipated to remain low in 2024. However, the momentum of price movements would depend on changes in domestic utility or tax rates, the intensity of any adverse weather conditions and global commodity prices.

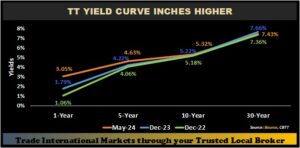

TTD Yields Up

With domestic prices stabilizing but remaining elevated, TTD interest rates – as illustrated by the Government of the Republic of T&T (GORTT) yield curve – have moved higher. The movement, however, has not been a parallel shift across the curve. Shorter term bond yields have displayed the greatest change, with the 1Y GORTT yield climbing 126 basis points from 1.79% in December 2023 to 3.05% in May 2024. Meanwhile, the 5-year and 10-year yields increased a more measured 41 bps and 10 bps respectively from the comparable period. Meanwhile, 30-year rates, declined 23 bps to 7.43% in May 2024 from 7.66% in December 2023. One likely contributing factor to the change in yields could be the wider-than-anticipated fiscal deficit (outlined in the recent mid-year review to be in the order of TT$9B versus an initially projected TT$5B), which has led to a more active pipeline of GORTT private bond placements.

Investment Rates Edge Higher

The knock-on effect of higher GORTT yields has been a general uptick in investment rates across most fixed income investment solutions. With respect to very short-term offerings, Fixed Net Asset Value (Fixed NAV) mutual fund rates have moved broadly higher. As an example, the TTD Savinvest Structured Investment Fund (TTSIF), managed by Bourse, increased its distribution rate to 2.00% p.a. Increases have also been implemented by other Fixed NAV mutual Fund providers.

For investors seeking 1 to 3 year investments, TTD Repurchase Agreement (Repo) rates have also moved higher. 1-Year rates on these fully secured, fixed-term investments currently range between 3.00% to 3.35% p.a.

Despite increased bond issuances by GORTT and other issuers, accessibility remains an issue for non-institutional investors given the preference for private placements by issuers to maximize convenience and speed to market. Individual or ‘retail’ investors do, however, have opportunities to participate in fixed income opportunities via several exchange-traded bond listings including various GORTT bonds, the National Investment Fund’s (NIF) Series B and Series C bonds and the most recently issued ‘NIF2’ bond.

International Markets

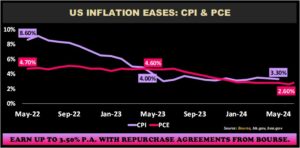

US Inflation Lower

US inflation data, measured using the Consumer Price Index (CPI), has remained relatively range-bound since May 2023, hovering between 3-4%. In May 2024 inflation stood at 3.30%. The US Federal Reserve’s (Fed) preferred measure of inflation, the Personal Consumption Expenditures (PCE) index, displayed fewer jerky movements and settled within the range of 2-3%.

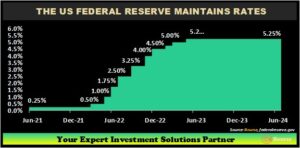

Despite the moderation in inflation, the US Federal Reserve has kept interest rates steady at 5.00% – 5.25% for the time being since ramping rates sharply upward in 2022. More surprisingly, the US Treasury Yield curve has remained inverted, allowing investors to participate in more attractive yields by investing in shorter-term securities. 2-year US treasuries increased from 4.23% in December 2023 to 4.77% in July 2024. Meanwhile, the 10-year yield increased 60 bps over the same period. The gap between the 2-year yield and the 10-year yield decreased 6 bps since December 2023.

Market indicators are now suggesting a greater than 50% probability that the first interest rate cut since the onset of Covid-19 in March 2020, is expected in September 2024. US Policymakers have signalled potentially one rate cut this year, with a further four cuts in 2025 depending on economic data. Interest rates have an inverse relationship with bond prices; all else being equal a reduction in benchmark yields should result in higher bond prices.

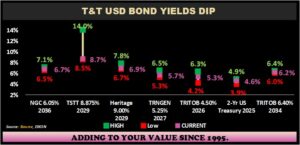

T&T-related USD Bond yields trend lower

T&T-related USD-denominated bond yields are currently trading at the lower end of their 52-week ranges. For example, Trinidad Generation Unlimited (TRNGEN) 5.25% 2027 bonds are trading at a 5.7% yield, 40 bps above its 12-month low. With lower benchmark rates anticipated to pull market yields generally lower, bond investors may wish to consider locking in longer-term, attractive yields before they decline.

On June 14th, 2024, Credit Rating Agency Moody’s changed the outlook on T&T’s ratings from positive to stable and affirmed its ‘Ba2’ ratings. While domestic investors tend to have some degree of ‘home bias’, diversification remains a useful and executable strategy to mitigate risk when investing in international bonds. Investors can consider non-T&T related, investment grade bonds as a means to diversify risk while still benefitting from comparable returns.

Is Now the Right Time for Fixed Income?

As is usually the case, the ‘right time’ for any investment depends on an investor’s specific circumstances and objectives.

For those focused on domestic investments, local equity markets have not inspired confidence with multi-year declines and broadly lower equity valuations. While this may be viewed by more risk-tolerant, longer-term investors as an attractive entry point into stocks, less risk-tolerant investors with shorter investment time horizons may find fixed income investment solutions more appealing. In particular, solutions such as Fixed NAV mutual funds, Repurchase Agreements (Repos) and even fixed deposits may offer a better balance of principal and purchasing power preservation to the lower-risk investor. This may be increasingly the case as TTD returns on such investments edge upward. TTD bond options, though somewhat more limited in availability, offer longer-term fixed income opportunities.

For investors with the ability to invest internationally, fixed income offers useful diversification to any investment portfolio. Whether investing in USD income funds, repos, US Treasuries and/or GORTT or other USD Bonds, the investment menu on offer should satisfy almost any investor preference. With USD rates expected to decline in the coming months, it may be a rewarding time to consider picking up USD fixed income assets in the current higher interest rate environment.

As always, it makes good sense to consult an experienced advisor, like Bourse, to make more informed investment decisions for your portfolio.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”