HIGHLIGHTS

GKC Q12024

- Earnings: Diluted Earnings Per Share 2.4% higher, from TT$0.094 to TT$0.091

- Performance Drivers:

- Revenue Growth

- Lower Margins

- Outlook:

- Acquisition Integration Efforts

- Rating: Maintained at OVERWEIGHT

MASSY HY2024

- Earnings: Earnings Per Share 15.6% lower

Continuing Operations: EPS 14.5% lower, from $0.167 to $0.143

- Performance Drivers:

- Revenue Growth

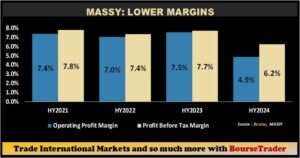

- Lower Margins

- Outlook:

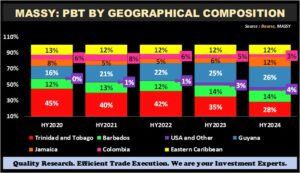

- Geographical Diversification

- Acquisition Integration Efforts

- Rating: Maintained at OVERWEIGHT

This week, we at Bourse review the performance of two members of the Conglomerate sector on the Trinidad & Tobago Stock Exchange (TTSE), Grace Kennedy Limited (GKC) and Massy Holdings Limited (MASSY) for their three-months (Q12024) and six-months period (HY2024) ended March 31st, 2024, respectively. GKC delivered improved performance driven by increased revenues, while MASSY would have reported decline in earnings. Can GKC continue its positive earnings momentum? Will MASSY’s performance improve in the latter part of the year? We discuss below.

GraceKennedy Limited (GKC)

GKC reported a Diluted Earnings per Share (EPS) of TT$0.094 for the three months concluded on March 31st, 2024 (Q12024), an increase of 2.4% over the corresponding period in Q12023.

Revenue from Product and Services improved 7.9% from TT$1.8B to TT$1.6B, while Interest Revenue advanced 21.0% to TT$72.1M. Notably, Total Revenue advanced 8.3% to TT$1.8B in Q12024 from $1.7B in Q12023. Direct and Operating Expenses grew 8.8% to TT$1.7B, in contrast, Net Impairment Losses on Financial Assets increased to TT$5.5M. As a result, Total Expenses expanded by 9.0%. GKC’s Profit from Operations increased 3.8% from TT$124.7M (Q12023) to TT$129.5M (Q12024). Share of Results of Associates and Joint Ventures increased 11.4% to $19.3M compared to the previous comparable period. Profit Before Taxation (PBT) grew to $136.2M, up 1.7% from $133.9M in Q12023. Taxation expense moved from TT$36.2M to TT$36.8M. Resultantly, Net Profit for the period improved from TT$97.8M to TT$99.5M in the current review period. In comparison to TT$91.7M recorded in the prior period, Net Profit Attributable to Owners of GKC steadily increased by 2.0% to TT$93.5M.

Food Trading Segments Declines

Food Trading, the largest contributor to PBT (64.0% excluding adjustments) declined 1.2% from TT$101M in Q12023 to TT$99M in Q12024. According to GKC, its food operations remained focused on increasing operating efficiencies and expanding production and distribution capabilities.

GraceKennedy Money Services (GKMS), the second largest contributor to PBT (19.8% excluding adjustments) fell 8.7% to TT$31M from TT$34M in the prior comparable period, attributable to competitive and inflationary pressures.

The Banking and Investments segment increased 28.5%, reporting growth in both consumer loans and deposits. First Global Bank Limited (FGB) provided the Group with additional digital products, including as automated loan applications and approvals, as well as digital customer onboarding.

The Group’s Insurance Segment, which accounted for 10.5% of PBT, significantly advanced 116.4% to TT$16M. GK General Insurance Limited (GKGI) and Key Insurance Company both displayed improved performance Q12024, with higher sales and PBT. In February, GKGI expanded its coverage offers through its existing agreement with Scotiabank Jamaica.

Margins Reduced

GKC margins narrowed in Q12024 relative to the prior comparable period. Operating Profit Margin fell from 7.4% in Q12023 to 7.1% in Q12024, while Profit Before Tax Margin dropped from 7.9% (Q12023) to 7.4% in the current period. This could be reflective of persistent inflationary pressures within the economic environment.

The Bourse View

At a current price of $3.86, GKC trades at a P/E ratio of 11.4 times, below the Conglomerate Sector average of 14.2 times. The stock offers investors a trailing dividend yield of 2.5%, below the sector average of 3.1%. The Group announced an interim dividend of TT$0.02, which is to be paid to shareholders on June 14th, 2024.

The Group is expected to continue enhancing organic growth with acquisition activity. On the basis of increased revenue, relatively attractive valuations and acquisition activity Bourse maintains an OVERWEIGHT rating on GKC.

Massy Holdings Limited (MASSY)

Massy Holdings Limited (MASSY) reported Earnings per Share (EPS) of $0.142 for the six-month period ended March 31st, 2024 (HY2024), 15.6% lower than an EPS of $0.168 reported in HY2023. EPS from Continuing Operations slipped 14.5% from $0.167 to $0.143 per share.

Revenue from Continuing Operations grew 15.3% YoY, from $6.78B in HY2023 to $7.82B in HY2024. Operating Profit after Finance Costs contracted 25.7% to $379.9M, while Operating margin declined from 7.5% to 4.9%. Share of Results of Associates and Joint Ventures climbed 860.7% to $107.8M (HY2023: $11.2M). Profit Before Tax (PBT) fell 6.7% to $487.7M. Income Tax Expense rose to $177.2M (HY2023: $166.4M, or 6.5% higher). Profit for the period from continuing operations amounted to $310.5M, 12.9% lower compared to $356.4M in the prior period. MASSY reported a loss on discontinued operations of $1.4M versus a profit of $2.52M in HY2023. Consequently, Profit for the period fell 13.8% to $309.2M compared to $358.9M from the prior period. Overall, Profit Attributable to Owners of the Parent stood at $281.4M, 15.5% lower than the $333.1M reported in the previous period.

Segment Performance Resilient

Integrated Retail, the largest contributor to PBT (64.9%), marginally increased by 2.6%, from $308M in HY2023 to $316M in HY2024. According to the Group, growth in MASSY’s core retail markets was offset by increased operational costs and logistical challenges.

Gas Products, the second-largest contribution to PBT (28.7%), increased 13.2% from $123M to $140M, attributable to its strategic acquisitions in Jamaica and improved operations in Guyana.

Notably, Motor & Machines (18.8% of PBT) fell 10.9% to $92M from $103M in HY2024, owing to logistical challenges in Colombia and Guyana. Financial Services (8.9% of PBT) fell 3.4% in HY2024 to $43M, relative to $45M in the prior period.

Margins Decline

Despite a 15% increase in Revenue, MASSY’s profit margins were relatively lower when compared to the past three (3) historical reporting periods. Operating Profit Margin fell from 7.5% in HY2023 to 4.9% in HY2024. Profit Before Tax Margin dipped to 6.2% in HY2024 from 7.7% the previous year. MASSY would have highlighted certain one-off adjustments in HY2024, which would have adversely impacted its financial results and margins. According to the Group, its PBT would have been broadly consistent with the prior period’s performance when excluding these one-off items.

Geographic Diversification Trends

With acquisitions around the Caribbean, Latin America, and the US, MASSY’s geographic PBT contribution reflects its ongoing regional and global diversification activities. Trinidad & Tobago, while remaining as the largest geographic contributor to PBT (28%), fell 17% YoY from $202.3M to $167.5M. Guyana’s share of PBT (26%) grew from $145.9M in HY2023 to $153.8M in the current reporting period, becoming an increasingly important geographical PBT contributor to the Group. Barbados (14% of PBT) advanced 4% to $84.3M, relative to $81.1M reported in the previous comparable period. Jamaica’s contribution to PBT grew to 12% buoyed by recent acquisitions, from $34.2M for HY2023 to $71.1M in the current reporting period. Notably, the Eastern Caribbean operations (12% of PBT) remained relatively in line with the prior year and amounted to $70.2M. PBT from U.S.A. (4%) operations climbed 28% from $19.1M to $24.5M, primarily driven by new and existing acquisitions. Colombia’s operations contributed the least to PBT (3%) and recorded a drop in performance by 26%.

The Bourse View

At a current price of $4.18, MASSY trades at a trailing P/E of 11.6 times, below the Conglomerate sector average of 14.2 times. MASSY offers investors a trailing dividend yield of 3.8%, above the sector average of 3.1%. The Group declared an interim dividend payment of $0.0315 per share payable on June 17th, 2024, to shareholders on record by June 3rd, 2024.

On the basis of continued revenue growth, accretive acquisition activity and relatively attractive valuations when compared to the sector, Bourse maintains an OVERWEIGHT rating on MASSY.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase, or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives, or agents, accepts any liability whatsoever for any direct, indirect, or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third-party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”