HIGHLIGHTS

UCL Q12024

- Earnings: Earnings Per Share increased 155.6% from $0.09 to $0.23

- Performance Drivers:

- Lower Revenue

- Margin Improvements

- Lower Operating Expenses

- Outlook:

- Increased Economic Activity

- Rating: Maintained at MARKETWEIGHT

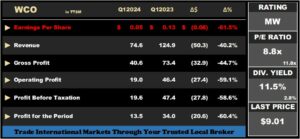

WCO Q12024

- Earnings: Earnings Per Share decrease 61.5% from $0.13 to $0.05

- Performance Drivers:

- Reduced Revenues

- Lower Margins

- Outlook:

- New product offering

- Rating: Downgraded to MARKETWEIGHT

This week, we at Bourse review the performance of Unilever Caribbean Limited (UCL) and The West Indian Tobacco Company Limited (WCO) for the fiscal quarter period ended 31st March 2024. UCL benefitted from improved earnings despite a decline in revenues, while WCO would have been constrained by reduced revenues and lower margins in the first quarter. How will both companies fare in the months ahead? We discuss below.

Unilever Caribbean Limited (UCL)

Unilever Caribbean Limited (UCL) reported Earnings Per Share (EPS) of $0.23 for the fiscal quarter ending March 31st, 2024 (Q12024), a 155.6% increase from $0.09 in the prior comparable period.

Revenue amounted to $57.0M, down 18.6% from a prior $70.1M in Q12023. Cost of Sales was 29.4% lower, from $44.5M in Q12023 to $31.4M in the current period. Gross Profit remained consistent in comparison to a year earlier, from $25.5M to $25.6M, up 0.4%. Selling and distribution costs fell from a prior $16.4M to $12.6M, a decline of 22.9%, likewise, Administrative Expenses decreased 18.1% year-on-year. Impairment reversal on trade receivables incurred an expense of $0.02M compared to a credit of $0.3M a year earlier, resulting in Operating Profit for the period at $9.4M, up 83.5%. UCL reported nil Restructuring Costs over the period compared to $2.21M in the prior period. Finance income fell by 30.9% to $0.47M, in contrast, Finance expense advanced 35.3% to $0.65M (Q12023: $0.48M). UCL’s Profit Before Taxation for the period expanded by 129%, from $4.05M to $9.26M. Taxation expense grew by 101.5% to $3.24M, with the effective tax rate moving from 39.8% in Q12023 to 35% in Q12024. Overall, UCL’s Profit for the Period stood at $6.02M, 147.2% higher than $2.44M reported in the prior period.

Revenue Lower

UCL’s Total Revenue contracted by 18.6%, from a prior $70.1M to $57.0M in Q12024. The Company disclosed that the higher comparator in the prior year was predominantly related to “close-out promotions of COVID-related products”, which accounted for increased revenue in the prior period. UCL reiterated its focus on strategic objectives, with the Beauty and Personal Care category contributing 49.3% of total revenue, up from 45.2% a year earlier. Home Care accounted for 39.3% of revenue whilst, Food & Refreshments generated 11.4%. Investors will be closely monitoring revenue data for signs of stabilization/growth, following several years of transformation-related and economic driven revenue volatility.

Margins Improve

Notwithstanding lower revenue, UCL’s profit margins showed signs of recovery relative to the prior period. Gross Profit Margin climbed from 36.4% in Q12023 to 44.9% in Q12024. According to UCL, cost management and cash flow optimization initiatives – which resulted in lower selling and distribution costs- aided a recovery in Operating Profit. Operating Profit Margin improved from 7.3% to 16.6%. UCL’s Profit Before Tax Margin advanced to 16.2% in Q12024 from 5.8% the previous year.

The Bourse View

At a current price of $12.00, UCL trades at a trailing P/E of 15.2 times, above the combined Manufacturing I & II Sector average of 11.8 times. The stock offers investors a trailing dividend yield of 4.7%, above the sector average of 2.8%.

UCL remains focus on driving profitability for long-term growth through its brand portfolio. Additionally, the Company continues to benefit from the implementation of cost management and cash-flow initiatives, which have resulted in margin improvement and bottom-line growth. On the basis of improved profitability margins and above-sector average dividend yield, tempered by revenue contraction, Bourse maintains a MARKETWEIGHT rating on UCL.

The West Indian Tobacco Company Limited (WCO)

The West Indian Tobacco Company Limited (WCO) reported Earnings Per Share of $0.05 for the fiscal quarter ended March 31, 2024 (Q12024), a 61.5% decline from $0.13 in the prior comparable period (Q12023).

Revenue fell a substantial 40.2% Year on Year (YoY) from $124.9M to $74.6M. Cost of Sales was considerably lower by 33.8% year on year to $34.1M from $51.5M in Q12023. This resulted in a drop in Gross Profit by 44.7% to $40.6M from $73.4M (Q12023). Distribution costs declined by 13.0% to $1.5M compared to the prior period, while administrative expenses increased by 6.6% from $16.6M (Q12023) to $17.7M in Q12024. Other Operating Expenses declined year on year (YoY) to $2.4M in Q12024 from $8.7M. Operating Profit fell 59.1% from $46.4M in Q12023 to $19.0M in Q12024. Finance Income contracted by 29.8% in Q1 2024. Finance Costs increased 3.6% year over year. Profit Before Taxation decreased 58.6% from $47.4M to $19.6M in Q1 2024. Taxation dropped by 53.9% to $6.2M for the period under review, from $13.4M. Profit for the Period fell 60.4%, from $34.0M to $13.5M in Q12024.

Revenue Struggle Persists

WCO’s revenue continue to decline in Q12024, after a sharp drop in the previous year on year quarter, impacted by inventory management in Guyana, Colombia, and Jamaica. Q12024 Total Revenue contracted 40.2% from $125M to $75M.

WCO’s domestic revenue fell 38.4% year-on-year to $58.5M in Q12024, down from $94.9M reported for the comparative period last year. Additionally, revenue from Caricom and non-Caricom markets decreased 46.0% to $16.2M in the current period under review.

The sharp decline in Q12024 would have come as a surprise to investors, given the recent quarterly revenue stabilization in the latter half of 2023, combined with an overall increase in WCO’s revenue for its FY2023 when compared to FY2022.

WCO continues to take initiatives to arrest the decline of its revenue, with the launch of its new vaping product, ‘Vuse’. The new offering is intended to cater to customer demand of the alternative smoking segment, which should be supportive of revenue in the coming quarters.

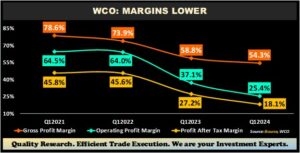

Margins Decline

WCO’s profitability margins continued to decline relative to prior Q1 periods. WCO’s Gross Profit Margin declined in the current period to 54.3% from 58.8% in Q12023, following the decrease in revenue due to challenges in the local market. Operating Margin saw the largest deterioration as administrative expenses increased, moving from 37.1% to 25.4% in the current period. Consequently, Profit After Tax Margin fell to 18.1% in Q12024 relative to a prior 27.2%.

The Bourse View

At a current price of $9.01, WCO trades at a P/E of 8.8 times, below the combined Manufacturing sector average of 11.8 times. The stock offers investors a trailing dividend yield of 11.5%, well above the sector average of 2.8%.

WCO’s Q12024 performance could best be described as unexpected, particularly in the context of positive financial results in FY2023 and 4Q2023 which rejuvenated investors’ confidence in the stock. The price rally which accompanied its strong FY2023 results (WCO rallied as much as 75.6% in 2024) has since fizzled, with WCO’s price advancing 1.2% year-to-date. Investors will again be looking for signs of revenue and margin stabilization in the coming quarters, seeking indications of successes stemming from WCO’s new revenue streams and new product initiatives. For the time being, WCO’s revenue volatility and lower margins in Q1 will weigh on investor sentiment, while prolonged challenges could ultimately weigh on earnings and dividend distributions. While still trading at relatively attractive valuations, on the basis of near-term underperformance, Bourse downgrades its rating on WCO to MARKETWEIGHT.

DISCLAIMER: “This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase, or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives, or agents, accepts any liability whatsoever for any direct, indirect, or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third-party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”