HIGHLIGHTS

JMMBGL 9M2024

- Earnings: Earnings Per Share of TT$0.37 vs prior Loss Per Share of TT$0.01

- Performance Drivers:

- Lower Operating Revenue

- Higher Operating Expenses

- Increased Share of Profits from Associates

- Outlook:

- Uncertain Financial Markets

- Elevated Interest Rates

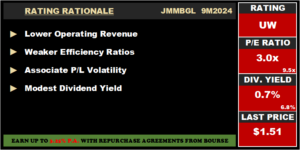

- Rating: Maintained at UNDERWEIGHT

This week, we at Bourse review the performance of JMMB Group Limited (JMMBGL) for its nine-month fiscal period ended December 31st, 2023 (9M2024). JMMBGL was supported by a material one-off gain in its Associated Company, Sagicor Financial Corporation. We also provide a brief update on the allocation details of the National Investment Fund Holding Company’s NIF2 4.5% 2029 bond issue.

JMMB Group Limited (JMMBGL)

JMMB Group Limited (JMMBGL) reported an Earnings Per Share (EPS) of TT$0.37 for its nine months ended December 31st, 2023 (9M2024), compared to a loss per share of TT$0.01 in the prior comparable period.

Net Interest Income fell 24.3% to TT$278.6M from a prior TT$367.9M. Fee and Commission Income contracted 9.9% to TT$169.7M from TT$188.4M in 9M 2023. Gains on Securities Trading advanced 43.4% to TT$218.2M. Subsequently, Operating Revenue fell 6.9% year-on-year (YOY) from TT$824.0M in 9M 2023 to TT$767.3M in 9M 2024. Operating Expenses rose 12.2% to TT$718.3M, reflecting inflationary increases and strategic spending on long-term initiatives while Impairment Loss on Financial Assets expanded from TT$62.7M in 9M 2023 to TT$70.4M in 9M 2024. Consequently, Operating Profit fell 73.4% from TT$183.8M in 9M 2023 to TT$49.0M in 9M 2024. The Group’s earnings were significantly bolstered by its Share of Profit from Associate of TT$708.8M, leading to a Profit Before Tax of TT$689.9M, compared to TT$8.3M in the prior period. Overall, Profit Attributable to Equity Holders stood at TT$728.5M, up 6917.4% compared to a loss of TT$10.7M reported in the previous period.

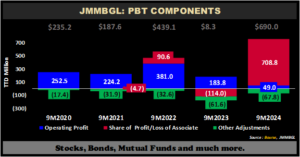

PBT Improves on Associate Share of Profit

JMMBGL’s Profit before Tax (PBT) grew to TT$689.9M from TT$8.3M for the nine months ended December 31st, 2023, supported by significant Share of Profit from its Associate Sagicor Financial Company Limited (SFC). Operating Profit, however, declined 73.4% from TT$183.9M in 9M2023 to TT$49.0M in 9M2024, driven by the challenging financial environment. JMMBGL’s Share of Profit of Associate from amounted to TT$708.8M increasing 722% year-on-year, which was propelled by a material one-off gain of TT$636.6M from SFC’s acquisition of Ivari Holdings on October 3rd, 2023.

This share of profit was a stark change from the share of SFC loss in the prior comparable period, which amounted to TT$114.0M, restated to reflect the adoption of IFRS 17 in April 2023. Excluding the one-off gain, JMMBGL’s PBT amounted to TT$53.4M in the current period.

The market capitalization of JMMB’s 23.3% shareholding in SFC was TT$1.0B as of December 31st, 2023, 54.8% lower than its carrying value of TT$2.2B on December 31st, 2023.

Operating Profits Decline

JMMBGL’s efficiency ratio increased from 77.7% in 9M2023 to 93.6% in 9M2024, reflecting reduced operational efficiency as shown by the drop in Operating Profits to TT$49.0M. It implies that a larger part of the company’s income (net of interest expense) is being consumed by operating expenses (a lower ratio indicates greater efficiency). Operating expenses increased from TT$640.1M to TT$718.3M, reflecting inflationary increases and strategic spending on its longer-term initiatives. It remains to be seen how well the Group will prioritize investments to improve scale and efficiency, ultimately contributing to long-term shareholder value.

JMMBGL’S financial leverage (measured as Total Assets divided by Total Shareholder Equity) stood at 10.2 times in its latest period, marking an improvement from the 13.7x level in 9M2023. Notably, Shareholder Equity advanced 52.1% to TT$3.1B in 9M2024 from TT$2.0B in 9M2023.

The Bourse View

JMMBGL currently trades at a market price of $1.51 and trades at a P/E ratio of 3.0 times, below the sector average of 9.5 times. It should be noted that its low P/E ratio includes the impact of the material one-off gain from Associate SFC’s acquisition of Ivari – excluding the one-off gain, the P/E ratio is 7.8 times. The stock offers investors trailing dividend yield of 0.7%, below the Non-Banking Finance sector average of 6.8%.

The Group’s financial performance, at its core operating level, continues to be impacted by the challenging economic conditions, characterized by the still-elevated interest rate environment, inflationary pressures and weaker trading activity across regional markets. Weaker operating performance has been overshadowed by strong results from its Associate SFC. On the basis of reduced revenues, lower operational efficiency and uncertain financial markets which could weigh on investment securities, Bourse maintains an UNDERWEIGHT rating on JMMBGL.

More on Sagicor Financial Company Limited (SFC)

Sagicor Financial Company Limited (SFC) reported a Fully Diluted Earnings Per Share in 9M2023 of US$0.32 (119.6% higher) relative to a Loss Per Share of US$1.65 in 9M2022.

Net insurance and investment result expanded 674.5% to US$342.6M in 9M2023 from a loss of US$59.6M in 9M2022. Fees and other income dipped 18.6% from US$111.4M in 9M2022 to US$90.7M in the current reporting period. Share of income of associates and joint ventures reported a 35.0% drop in performance, from US$6.95M to US$4.51M. Income Before Taxes swung from a loss of US$234.7M, up 151.3% to US$120.5M in 9M2023. Notably, Income taxes grew to US$39.8M from US$1.81M in the prior period. Overall, Net Income for the period stood at US$80.7M, climbing 134.1% from a net loss in 9M2022 of US$236.5M. This resulted in 119.8% increase in Net Income attributable to Shareholders of the Company to US$46.7M, compared to a loss of US$236.3M in the same period last year.

SFC Stock Price Recovers

From a low of C$4.26 on August 24th, 2023, SFC’s has been on a recovery path in 2024, currently trading at C$6.72. The price is, however, still down 33.1% relative to its initial listing price on the Toronto Stock Exchange (TSX) of C$10.04.

SFC announced the completion of its acquisition of Ivari in October 2023. According to the Group President, the Canadian market, with which the Caribbean has many ties, is a natural one for Sagicor to grow into. Ivari is expected to be ‘considerably accretive’ to SFC’s book value per share and earnings per share.

NIF2 Oversubscribed

The National Investment Fund Holding Company disclosed that its recent NIF2 Bond Offer of $400M was oversubscribed by 267%, with the total number of applications received totalling 3,861 at an aggregate subscription value of $1.066M. Individual subscriptions amounted to $735.5M, while Credit Unions / Pension Plan interest totalled $302.6M. Small Business/ Entities subscriptions in total were a more modest $28.2M.

Consistent with the Offer’s allocation policy, individuals received priority and ultimately 100% of the bond’s allocation. Non-Individual investors received no allocation of bonds.

Individual investors who submitted applications for up to $20,000 received 100% of their subscription. Individuals subscribing for more than $20,000 would receive their first $20,000, with the remaining amount allocated on a pro rata basis. As previously declared, all refunds were made to investors on March 12th, 2024, via electronic transfer. The NIF2 bond (NIF2090229) was officially listed on the T&T Stock Exchange on March 13th, 2024, at a listing price of $100 and with a maturity date of February 9th, 2029.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase, or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives, or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third-party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”